- Today’s top-tier US data painted a mixed picture: The May ADP Employment report printed at just +27k, well below expectations of 185k and the lowest reading since 2010. On the other hand, the ISM Non-Manufacturing PMI rose to 56.9, above 55.4 expected. The widely watched employment component of the report rose to 58.1 from 53.7 last month.

- The market is becoming increasingly convinced that the US will NOT impose tariffs on Mexico, a sentiment recently echoed by Republican Senator (and head of the Senate Finance Committee) Grassley. Negotiations kick off tomorrow ahead of Monday’s deadline.

- Both the US dollar and 2-year treasury yields recovered sharply off their morning lows – could this mark a near-term bottom? Traders are looking ahead to tomorrow’s ECB meeting and Friday’s NFP report for guidance.

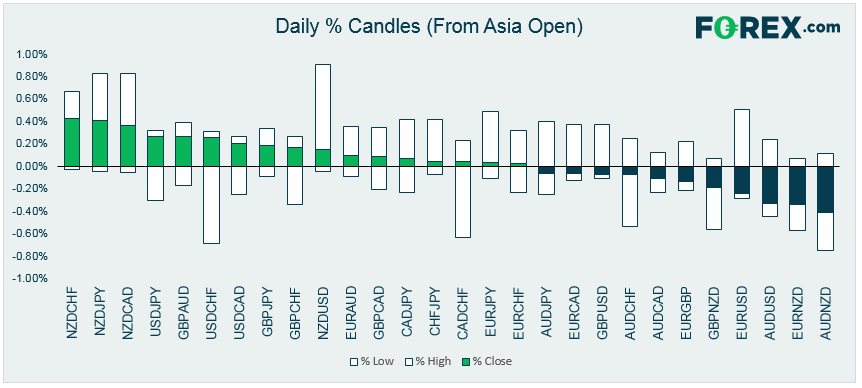

- In an unusual development, the New Zealand dollar was today’s strongest major currency, while its neighbor the aussie was the weakest major.

- Oil prices continued their collapse, with WTI shedding another 3% after a big unexpected buildup in inventories.

Latest market news

Today 04:00 PM

Today 09:11 AM