US Dollar Index technical forecast: DXY weekly trade levels

- US Dollar plunge halted at 2020 May lows for fifth consecutive week

- USD testing yearly opening-range lows- risk for inflection / downside exhaustion

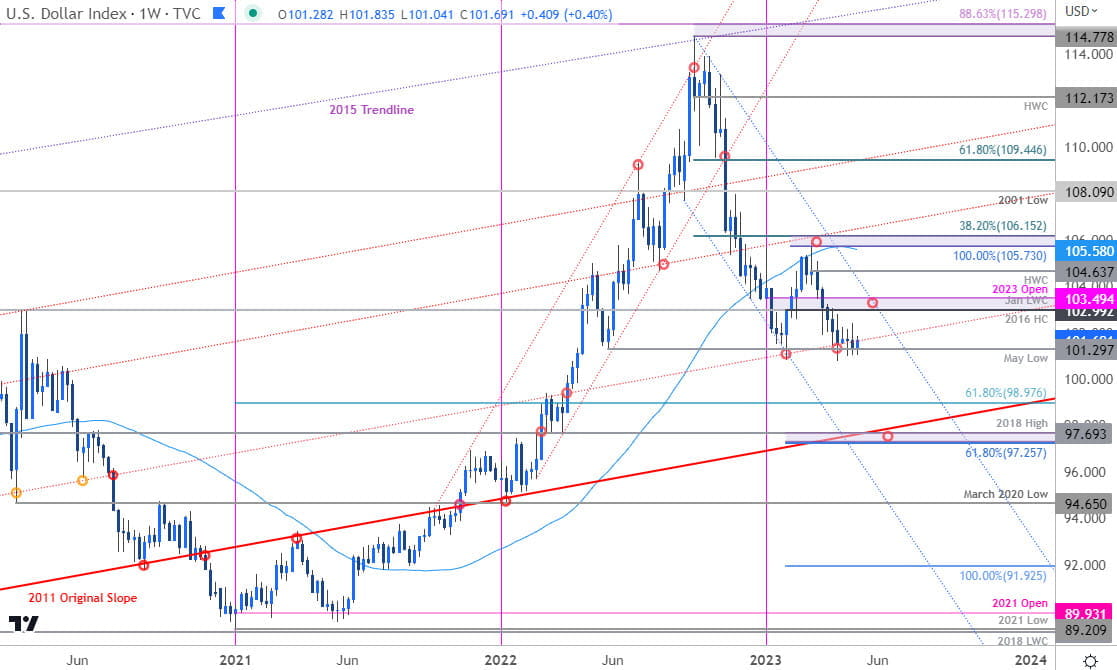

- DXY resistance 102.99-103.49, 104.63, 105.58/73– support 101.30, 100, 98.97

The US Dollar continues to coil just above key support near the yearly range lows and while the broader outlook remains tilted to the downside, the bears may be vulnerable near-term while above 101. These are the updated targets and invalidation levels that matter on the DXY weekly technical chart.

Discuss this USD setup and more in the Weekly Strategy Webinars on Monday’s at 8:30am EST.

US Dollar Index Price Chart – DXY Weekly

Chart Prepared by Michael Boutros, Sr. Technical Strategist; DXY on TradingView

Technical Outlook: In last month’s US Dollar Index technical forecast we noted that the DXY was, “is threatening a fifth consecutive weekly decline into a key support pivot with the April opening-range taking shape just above. From a trading standpoint, a good zone to reduce short-exposure / lower protective stops.” Nearly five-weeks later, and the index continues to hold just above the objective May 2022 swing low at 101.30- we looking for possible inflection off this mark.

Key weekly resistance is eyed at 102.99-103.49- a region defined by the 2016 high-close, the January low-week reversal close, and the objective 2023 yearly open. A breach / weekly close above the 2022 slope resistance (blue) is ultimately needed to validate a breakout / suggest a larger reversal is underway in the Dollar.

A break / close below this support zone would threaten resumption of the 2022 downtrend towards the 100-psychological barrier and the 61.8% Fibonacci retracement of the 2021 rally at 98.98. Critical support rests with the 61.8% extension / 2018 high at 97.25/69- look for a larger reaction there IF reached.

Bottom line: The US Dollar has been resting on support for the past five weeks and the focus is on a breakout of this near-term range. From a trading standpoint, the broader bearish outlook remains vulnerable while above 101.30- bears on notice. Rallies would need to be capped by 103 IF price is heading lower on this stretch. I’ll publish an updated US Dollar short-term outlook once we get further clarity on the near-term DXY technical trade levels.

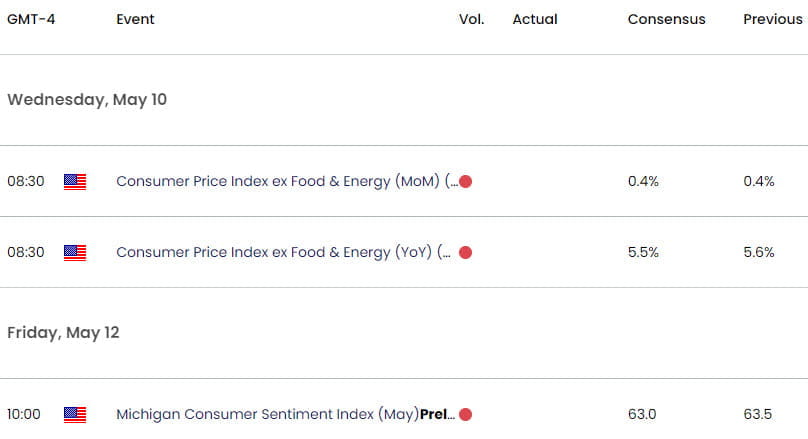

Key Economic Data Releases

Economic Calendar - latest economic developments and upcoming event risk.

Active Weekly Technical Charts

- Gold (XAU/USD)

- British Pound (GBP/USD)

- Crude Oil (WTI)

- Euro (EUR/USD)

- Canadian Dollar (USD/CAD)

- Japanese Yen (USD/JPY)

- Australian Dollar (AUD/USD)

--- Written by Michael Boutros, Sr Technical Strategist with FOREX.com