US Dollar Index technical outlook: DXY short-term trade levels

- US Dollar Index breaks March opening-range- plunges more than 3.7% off highs

- USD sell-off now approaching downtrend support- bears vulnerable while above

- DXY resistance 102.95/99, 103.49, 103.86– support 101.74/90 (key), 101.15, 100.82

The US Dollar Index is attempting to mark a sixth-consecutive daily decline with DXY off by more than 1.6% this week. The decline is now approaching a key pivot zone and while a break of the monthly opening-range keeps the focus lower, the decline may be vulnerable as price approaches near-term downtrend support. These are the updated targets and invalidation levels that matter on the DXY short-term technical charts.

Discuss this USD setup and more in the Weekly Strategy Webinars on Monday’s at 8:30am EST.

US Dollar Index Price Chart – DXY Daily

Chart Prepared by Michael Boutros, Sr. Technical Strategist; DXY on TradingView

Technical Outlook: In my last US Dollar Index short-term outlook, we noted that DXY had, “broken short-term trend support – we’re looking for evidence of an exhaustion low in the days ahead with a breach / close above 106.15 needed to fuel the next leg higher in price” The index registered a high at 105.88 just days later before reversing sharply with a break below the March opening-range plunging more than 3.7% off the highs.

The decline is now testing a key support zone at 101.73/90- a region defined by the 2023 low-day close and the 78.6% Fibonacci retracement of the yearly range. Looking for a reaction into this zone for guidance with the immediate decline vulnerable while above.

US Dollar Index Price Chart – DXY 240min

Chart Prepared by Michael Boutros, Sr. Technical Strategist; DXY on TradingView

Notes: A closer look at USD price action shows DXY trading within the confines of a descending pitchfork formation with the lower parallel further highlighting near-term support at 101.73/90. Initial resistance now eyed at 102.99 and is backed by the objective yearly-open at 103.49 and the weekly-open at 103.86. Ultimately a breach / close above 104.36 is needed to suggest a more significant low was registered this week.

A break / close below this threshold exposes subsequent support objectives at the 1.618% extension of the monthly decline at 101.15, the yearly low at 100.82 and the 2019 swing high at 99.66.

Bottom line: The US Dollar breakdown may be vulnerable to exhaustion heading into the first major support hurdle. From a trading standpoint, a good zone to reduce portions of short-exposure / lower protective stops – rallies should be limited to the weekly open IF price is heading lower. Review my latest US Dollar weekly technical forecast for a longer-term look at the DXY trade levels.

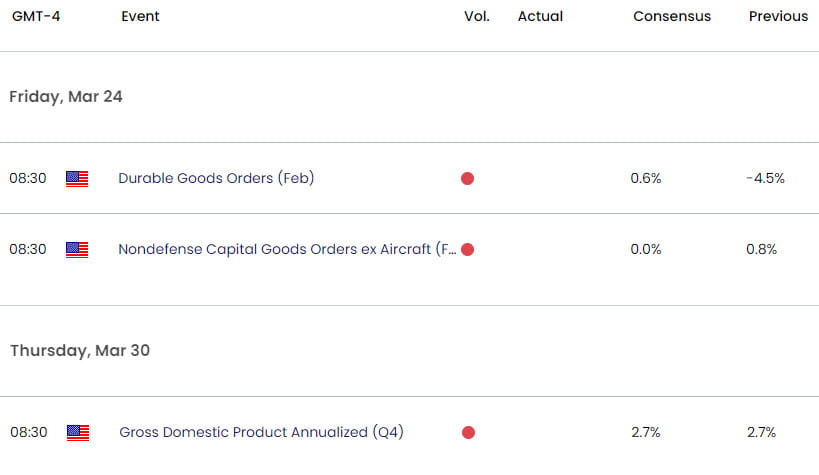

Key Economic Data Releases

Economic Calendar - latest economic developments and upcoming event risk.

Active Short-term Technical Charts

- Japanese Yen short-term price outlook: USD/JPY bears look to reassert

- Equities short-term outlook: S&P 500, Nasdaq, Dow breakdown levels

- Gold short-term price outlook: XAU/USD reversal gathers pace

- Canadian Dollar short-term outlook: USD/CAD breakout levels

- Euro short-term technical outlook: EUR/USD breakdown underway

--- Written by Michael Boutros, Sr Technical Strategist with FOREX.com

Follow Michael on Twitter @MBForex