US Dollar Index technical outlook: DXY short-term trade levels

- US Dollar Index breaks April opening-range- plunges more than 4.7% off yearly highs

- USD five-week sell-off now threatening break below yearly low

- DXY resistance 101.73/91, ~102.20s, 102.95/99– support 100.82, 100, 99.67

The US Dollar Index is attempting to mark a fifth-consecutive weekly decline with DXY down more than 4.7% from the yearly highs to test the January yearly lows. While a break of the monthly opening-range does keep the focus lower, we’re looking for possible inflection into this zone with a close below to threaten the next major leg lower in the Dollar. These are the updated targets and invalidation levels that matter on the DXY short-term technical charts.

Discuss this USD setup and more in the Weekly Strategy Webinars on Monday’s at 8:30am EST.

US Dollar Index Price Chart – DXY Daily

Chart Prepared by Michael Boutros, Sr. Technical Strategist; DXY on TradingView

Technical Outlook: In last month’s US Dollar Index short-term outlook, we noted that DXY was, “testing a key support zone at 101.73/90- a region defined by the 2023 low-day close and the 78.6% Fibonacci retracement of the yearly range. Looking for a reaction into this zone for guidance with the immediate decline vulnerable while above.” Price rallied more than 1.4% off those lows before faltering just ahead of the objective yearly open at 103.49.

Since then, the index has plunged more than 2.3% with a break of the monthly opening-range lows today taking the DXY into the yearly lows at 100.82- a close below this threshold is needed to keep the immediate decline viable.

US Dollar Index Price Chart – DXY 240min

Chart Prepared b/y Michael Boutros, Sr. Technical Strategist; DXY on TradingView

Notes: A closer look at USD price action shows DXY continuing to trade within the confines of the descending pitchfork formation highlighted last month with a break of the weekly opening-range yesterday fueling a sell-off into the lows- looking for possible price inflection here.

Initial resistance now eye back at the February low-day close / March low at 101.73/91 and is backed by upper parallel (currently ~102.20s). Ultimately a close above the 2016 high-close / 2020 high at 102.95/99 is needed to suggest a more significant low is in place / a larger reversal is underway.

A break lower from here exposes the psychological 100 barrier backed closely by the 2019 high at 99.67, the February 2020 high-week close at 99.34 and the 61.8% Fibonacci retracement of the 2021 advance at 98.97- look for a larger reaction there IF reached.

Bottom line: A break of the weekly / monthly opening-ranges in US Dollar Index takes DXY into the yearly lows- looking for a reaction here. From a trading standpoint, a good zone to reduce portions of short-exposure / lower protective stops – rallies should be limited to 102 IF price is heading lower here with a break threatening another leg lower in the index towards 100 and beyond. Review my latest US Dollar weekly technical forecast for a longer-term look at the DXY trade levels.

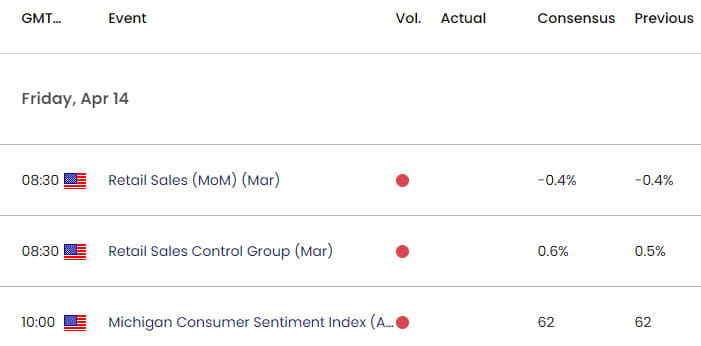

Key Economic Data Releases

Economic Calendar - latest economic developments and upcoming event risk.

Active Short-term Technical Charts

- Gold short-term price outlook: XAU/USD bulls run out of breath

- Australian Dollar short-term outlook: AUD/USD stalls at resistance

- Japanese Yen short-term outlook: USD/JPY searches support into April open

- Canadian Dollar short-term outlook: USD/CAD teases the break

- Euro short-term outlook: EUR/USD support test at prior resistance

--- Written by Michael Boutros, Sr Technical Strategist with FOREX.com

Follow Michael on Twitter @MBForex