- US dollar index (DXY) breaks below 50-day moving average following soft payrolls report

- Unless we see an abrupt reversal today, that points to further dollar downside

- GBP/USD has broken above 1.2800, a level it struggled at earlier this year

- A retest of the March highs may be on the cards

Overview

In the absence of an unexpected reacceleration in US inflationary pressures or unlikely hawkish pivot from Jerome Powell when he appears before lawmakers on Capitol Hill on Tuesday, it’s questionable whether the US dollar can reverse the bearish move seen last week. With Fed rate cut expectations swelling as US data continues to soften, the path of least resistance looks lower in the near-term for DXY.

GBP/USD is one pair that may be able to capitalise on dollar weakness, putting a potential retest of the March highs in play.

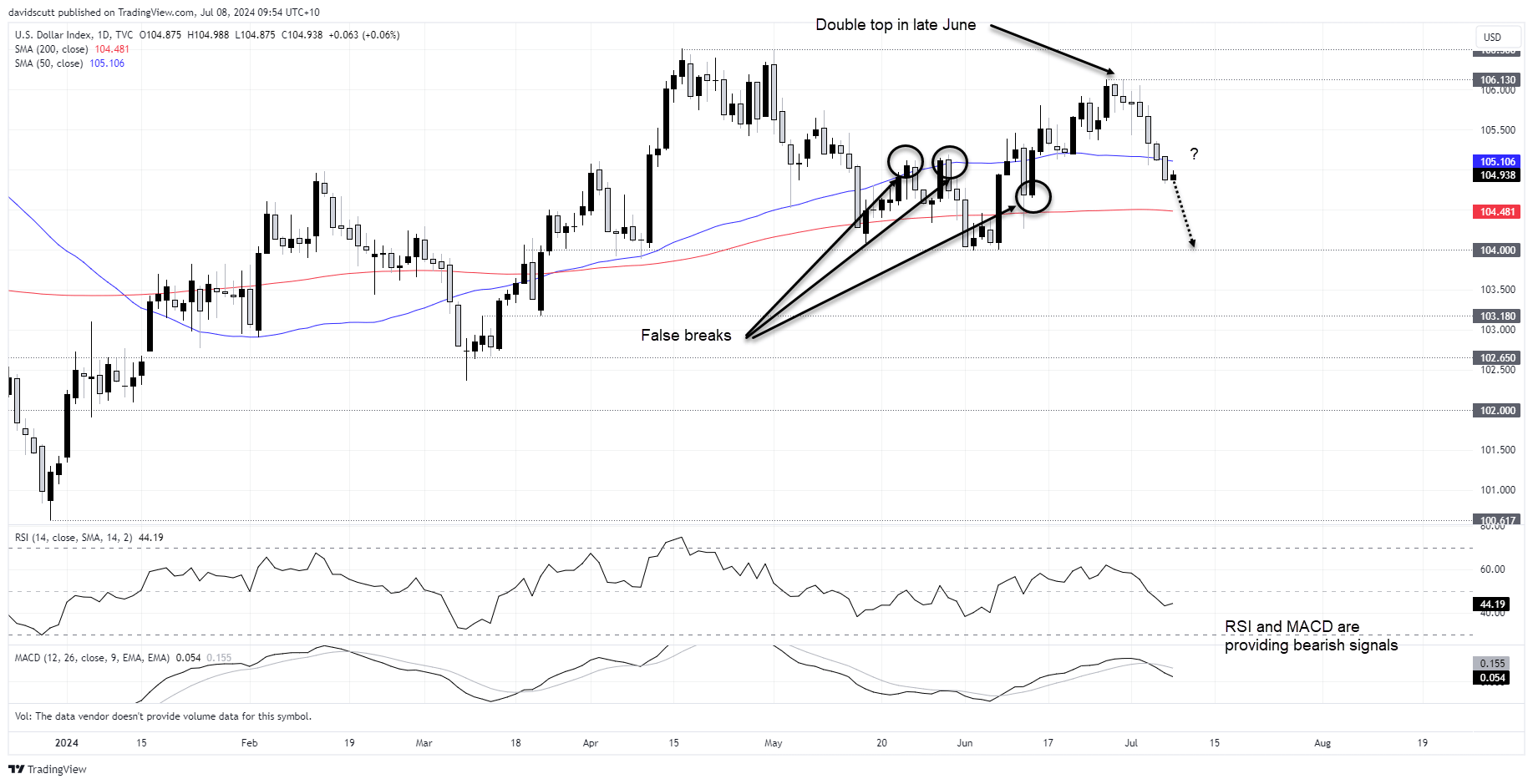

Droopy DXY points to downside risks

Looking at the US dollar index daily first, you can see how quickly DXY rolled over after printing the double top of 106.13 in late June, seeing it slice below the 50-day moving average on Friday following seven consecutive daily declines.

This break looks important, should it stick.

There have been plenty of occasions recently where it has closed through it only to reverse the next day, making the price action on Monday important. Because when we haven’t seen an immediate reversal, the DXY has tended to spend a considerable period on the side to which it crossed. On this occasion, that means lower given the moving average is starting to rollover.

If the move sticks, the 200-day moving average will be in focus. However, relative to how respected the 50-day equivalent has been recently, its record is checkered at best, meaning the first meaningful downside target may be 104 where the DXY found support in March, April and June.

When you zoom out to a weekly timeframe for DXY, an obvious evening star pattern is evident, adding to the case for potential dollar downside. I discussed that late last week prior to the soft payrolls report received on Friday.

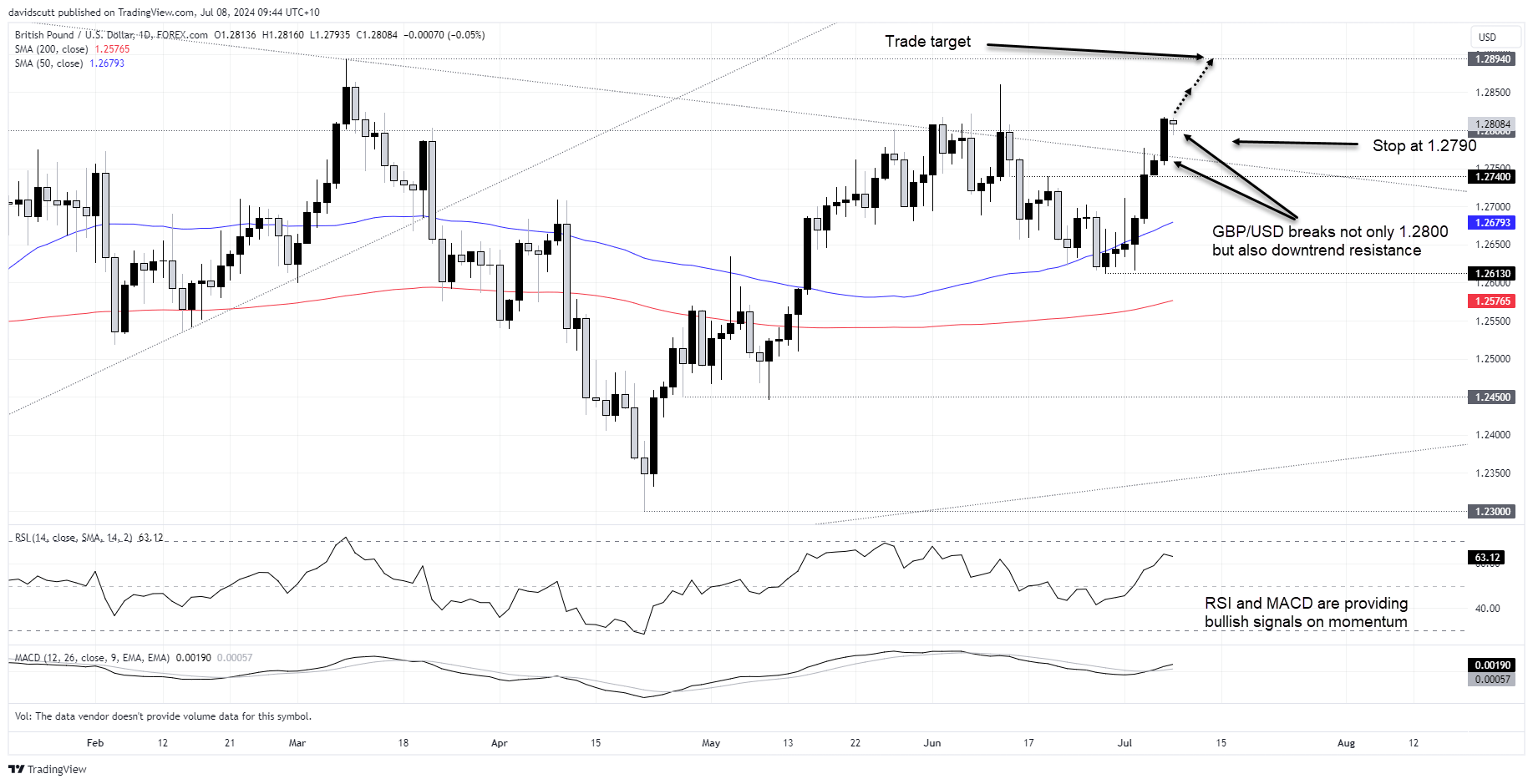

GBP/USD looks good after bullish break

Should the dollar continue to soften, GBP/USD is one pair that looks constructive on the charts.

Having broken above 1.2800 and closed there Friday, and successfully back tested the level in early Asian trade today following the French election results, it looks a decent long setup.

Buying near these levels targeting the May high of 1.2894 is a potential trade, allowing for a stop loss to be placed at 1.2790 for protection. You’re risking around 15 pips to make around 90, depending on entry level. Resistance may be found around 1.2860, the high struck in June. Should GBP/USD fail to clear that level, consider taking profits.

While GBP/USD has not had a great track record above 1.2800, this bullish break comes with the USD on the backfoot and follows a successful break of downtrend resistance that thwarted other bullish moves earlier this year. With it out of the way and momentum indicators like MACD and RSI providing bullish signals, upside looks easier than downside in the near-term.

Event risk

On the data front, this note looking at USD/JPY produced over the weekend looks at the key risk events to watch from the USD side of the ledger. As for the UK, we have speeches from BoE members Benford, Truran and Pill over the coming days. Other than that, the calendar has little top-tier data with monthly GDP and industrial production figures on Thursday the only releases of note.

-- Written by David Scutt

Follow David on Twitter @scutty