Weekly technical trade levels on USD Majors, Commodities & Stocks

- Technical setups we/re tracking into the weekly open

- Next Weekly Strategy Webinar: Monday, May 22 at 8:30am EST

- Review the latest Weekly Strategy Webinars on my YouTube playlist.

In this webinar we take an in-depth look at the technical trade levels for US Dollar (DXY), Euro (EUR/USD), Japanese Yen (USD/JPY), Australian Dollar (AUD/USD), British Pound (GBP/USD), Canadian Dollar (USD/CAD), Gold (XAU/USD), Silver (XAG/USD), Crude Oil (WTI), S&P 500 (SPX500), Nasdaq (NDX) and the Dow Jones Industrial Average (DJI). These are the levels that matter this heading into the weekly open.

US Dollar Index Price Chart – DXY Weekly

Chart Prepared by Michael Boutros, Sr. Technical Strategist; DXY on TradingView

For weeks we’ve been tracking a technical support zone near the objective yearly range lows in the US Dollar Index around 101.29. Last week marked a massive reversal-candle that nearly encompassed the last four-weeks range. The rebound off key support is now approaching a key pivot zone at 102.99-103.49- a region defined by the 2016 high-close, the January low-week close, and the objective 2023 yearly open. Look for a larger reaction there IF reached with key near-term support now raised to the yearly low-day close at 101.58. Review my latest US Dollar technical forecast.

Gold Price Chart – XAU/USD Daily

Chart Prepared by Michael Boutros, Sr. Technical Strategist; XAU/USD on TradingView

The threat remains for a larger correction in gold while below key resistance at 2040/50- a region defined by the April high-day close, the yearly (record) high-day close and the 2022 high-day close. Initial support rests with the April 14th reversal close at 2004 and the objective May open at 1995- losses below this threshold would risk a larger correction towards 1950. Review my latest Gold technical forecast.

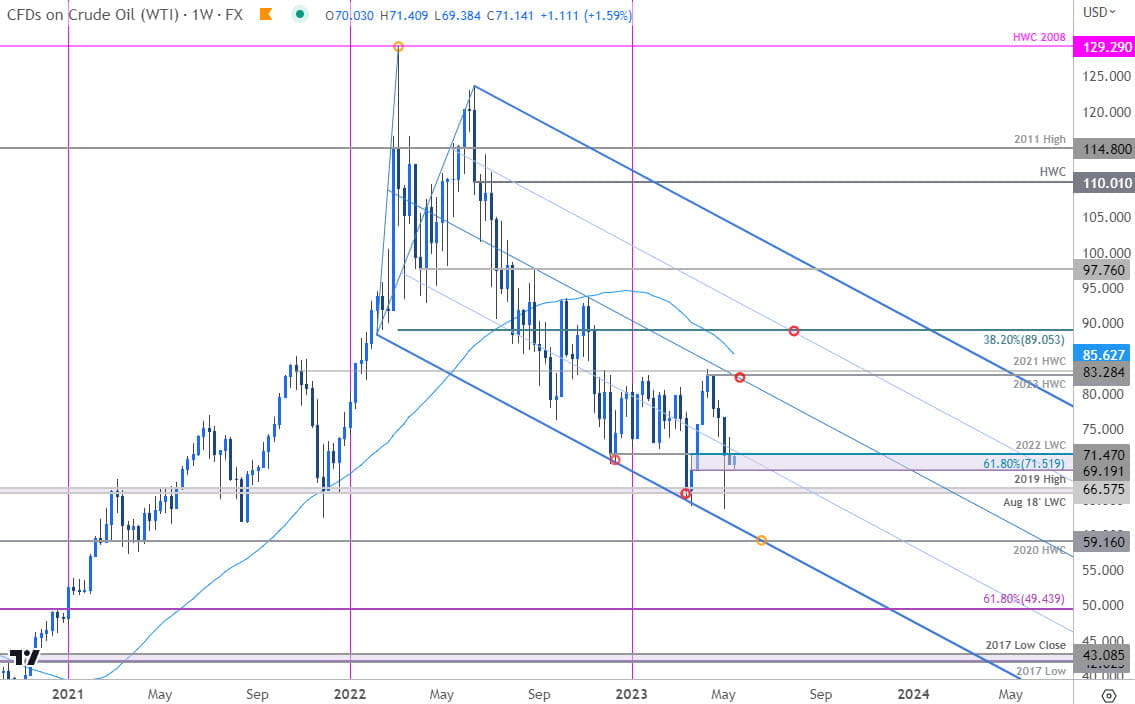

Crude Oil Price Chart – WTI Weekly

Chart Prepared by Michael Boutros, Technical Strategist; WTI on TradingView

Crude oil is testing a critical support zone for the third consecutive week at 69.19-71.52- a region defined by the March low-week close, the 61.8% Fibonacci retracement of the yearly range and the 2022 low-week close. Although a deep intra-week stretch did briefly mark a new yearly low, price has been unable to close below this region. Look for possible price inflection off this mark in the days ahead. Review my latest Crude Oil technical forecast.

--- Written by Michael Boutros, Sr Technical Strategist with FOREX.com

Follow Michael on Twitter @MBForex