US Dollar Outlook: USD/CAD

USD/CAD falls to a fresh weekly low (1.4303) as the US Consumer Price Index (CPI) shows an unexpected downtick in the core rate of inflation, and the exchange rate may threaten the positive slope in the 50-Day SMA (1.4175) if it fails to defend the monthly low (1.4280).

US Dollar Forecast: USD/CAD Susceptible to Test of Monthly Low

USD/CAD extends the series of lower highs and lows from the start of the week even though the headline CPI climbs to 2.9% in December from 2.7% the month prior as the core rate prints at 3.2% versus forecasts for a 3.3% reading.

Join David Song for the Weekly Fundamental Market Outlook webinar.

David provides a market overview and takes questions in real-time. Register Here

It remains to be seen if the development will sway the Federal Reserve as the ‘median participant projects that the appropriate level of the federal funds rate will be 3.9 percent’ at the end of 2025, but signs of a robust economy may push the central bank to further combat inflation as the US Retail Sales report is anticipated to show another rise in household spending.

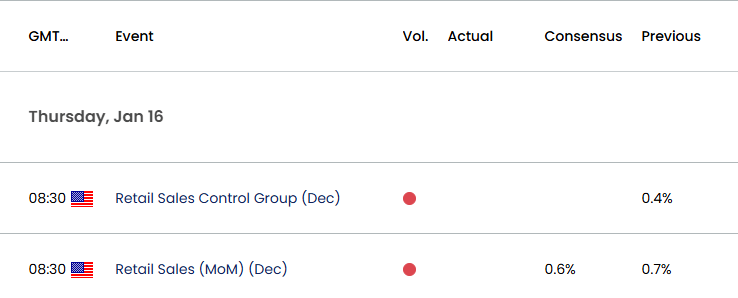

US Economic Calendar

Retail spending is expected to increase 0.6% in December following the 0.7% expansion the month prior, and the Federal Open Market Committee (FOMC) may come under pressure to pause its rate-cutting cycle as the economy shows little signs of a recession.

In turn, a positive development may spur a bullish reaction in the US Dollar as it boosts the outlook for growth, but a weaker-than-expected US Retail Sales report may drag on the Greenback as it fuels expectations for lower interest rates.

With that said, USD/CAD may struggle to retain the advance from the December low (1.3991) if the bearish price series persists, but the exchange rate may continue to track sideways should it defend the monthly low (1.4280).

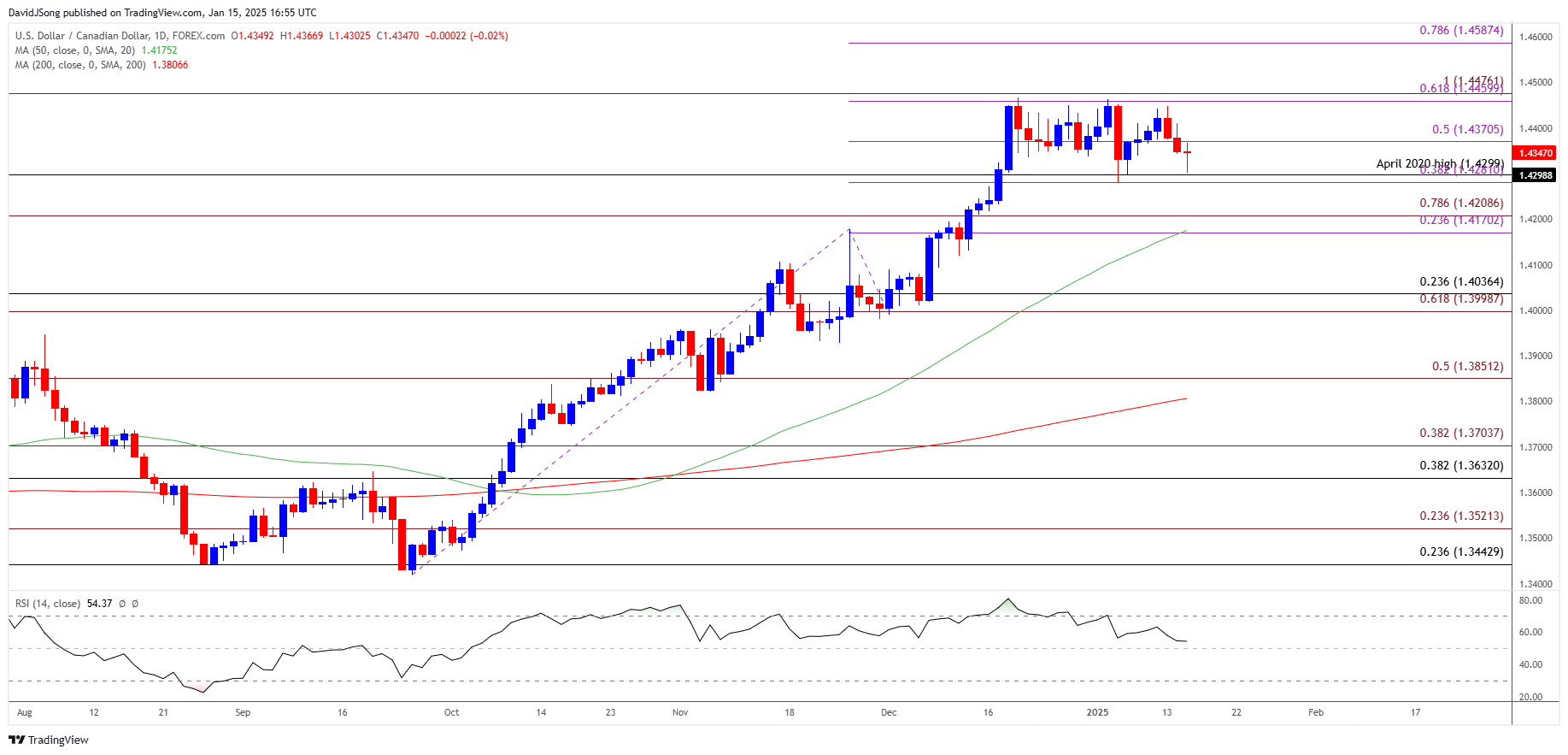

USD/CAD Price Chart – Daily

Chart Prepared by David Song, Senior Strategist; USD/CAD Price on TradingView

- The three-day selloff in USD/CAD continues to move the Relative Strength Index (RSI) away from overbought territory, with the oscillator currently sitting at its lowest level since October.

- A break/close below the 1.4280 (38.2% Fibonacci extension) to 1.4299 (April 2020 high) zone, may push USD/CAD towards the 1.4170 (23.6% Fibonacci extension) to 1.4210 (78.6% Fibonacci extension) region, and the exchange rate may no longer track the positive slope in the 50-Day SMA (1.4175) should it push below the moving average.

- Next area of interest comes in around 1.4000 (61.8% Fibonacci extension) to 1.4040 (23.6% Fibonacci retracement), but USD/CAD may face range-bound conditions if it defends the monthly low (1.4280).

- Need a break/close above the 1.4460 (61.8% Fibonacci extension) to 1.4480 (100% Fibonacci extension) area to open up 1.4590 (78.6% Fibonacci extension), with the next region of interest coming in around 1.4750 (100% Fibonacci extension).

Additional Market Outlooks

Gold Price Recovery Stalls Ahead of December High

EUR/USD Vulnerable Amid Push Below January Opening Range

Australian Dollar Forecast: AUD/USD Halts Four-Day Selloff

USD/JPY Pulls Back to Keep RSI Below Overbought Zone

--- Written by David Song, Senior Strategist

Follow on Twitter at @DavidJSong