- US dollar analysis: weaker NFP and ISM PMI point to peak Fed interest rates

- FX calendar quieter next week

- Will stocks manage to hold onto gain?

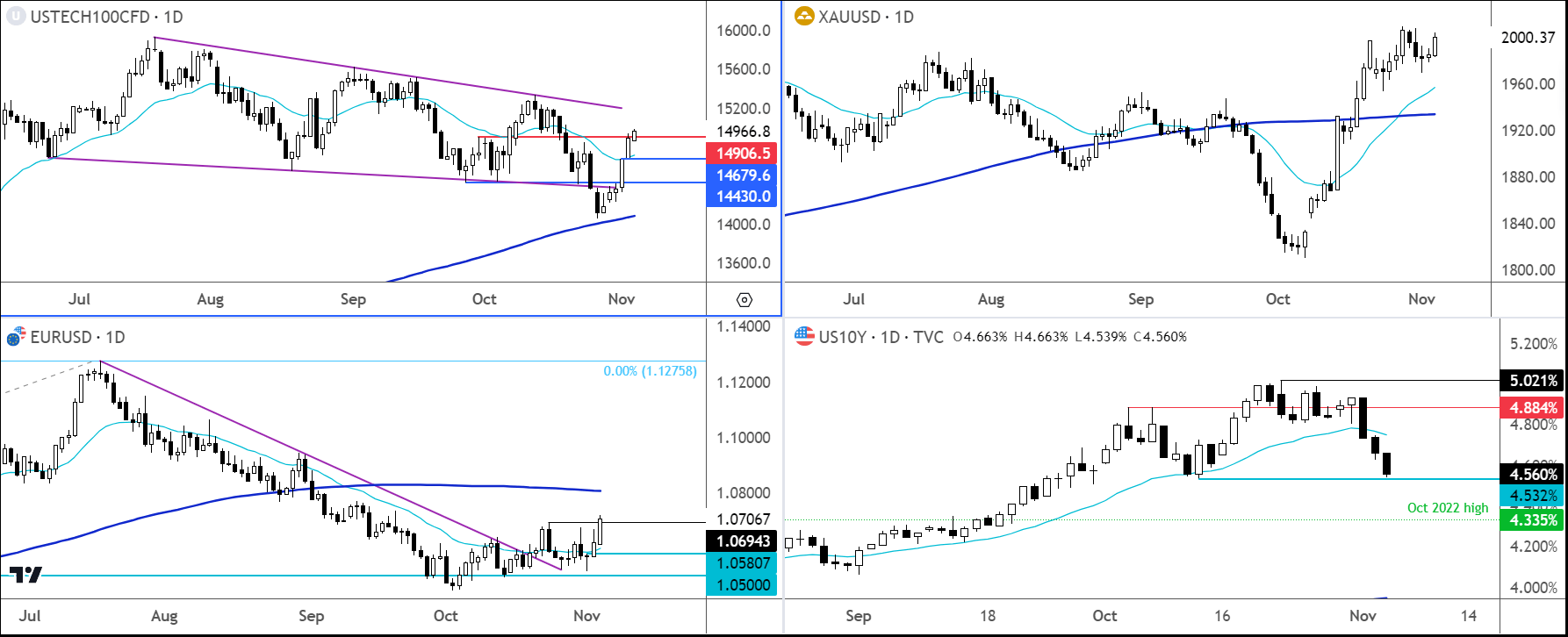

Today’s publication of US jobs report and ISM PMI has further cemented expectations that the Fed has reach peaked interest rates. Bond yields and the dollar have sold off as a result, with indices and gold moving higher. The only hope for the dollar bulls is if we now see stocks come under renewed pressure with Apple not doing so well following its earnings as revenues in China fell short of expectations. Next week is a quieter one for global data, so the FX markets may get direction from the equity markets and ongoing situation in the Middle East, which remains tense.

US dollar analysis: NFP and ISM PMI disappoints expectations

The headline non-farm payrolls report was weaker compared to expectations, printing 150K and there were downward revisions to the prior month’s reading, underscoring the view that jobs growth is weakening as the impact of the Fed’s tightening works through the economy.

Average Hourly Earnings came in weaker on a month-over-month basis at +0.2% vs +0.3% expected. But the YoY rate was 4.1% compared to 4.0% expected. Wages remain high but moving in the right direction as far as the Fed is concerned.

There were -101K net reversion to the prior two months on top of a weaker headline number, while the unemployment rate rose unexpectedly as the household survey proved to be soft. So, it was an overall weak report. The focus will turn to ISM services PMI later. But the jobs report further cements expectations the Fed has reach peaked interest rates.

If you were thinking to finish trading early today, you may wish to hang around a little longer. The closely watched ISM services PMI data also came in weaker at 51.8 vs. 53.0 eyed, which further weighed on USD.

Will stocks manage to hold onto gain?

Following this week’s data dump, the week ahead is going to be quieter for US data. The resilience of the US economy and the potential for inflation to remain high for longer is what drove the dollar to new highs for 2023. But we did see some signs of weakness in data this week and if that turns into a trend then we could possibly see a dollar reversal soon. The NFP and ISM PMI data certainly pointed in that direction, but let’s see if the dollar can now find some unexpected support from a possible bearish reversal in the markets, as the time of rate cuts are not close by any means.

Anyway, here’s how the markets reacted:

Source: TradingView.com

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R