US CPI, FOMC, BOE, ECB and SNB on tap: The Week Ahead

The US inflation report and FOMC meeting are the standout events next week. The odds fully back or the Fed to hold, but with CPI released on the eve of the Fed’s rate decision it could be seen as a proxy for how hawkish or dovish the meeting is perceived to be. However, we are yet to see key reports this week from the US including Friday’s nonfarm payroll report and the University of Michigan consumer survey. But if they come in softer than consensus estimates alongside lower inflation expectations, it could take the sting out of next week US inflation report and FOMC meeting – and see markets price in with more conviction rate cuts for 2024.

The week that was:

- Gold ran out the gates a little too fast at the week’s open, rallying $75 to a new all-time high before reversing spectacularly.

- Oil prices continued to plunge which saw crude oil fall below $70, on weak demand concerns and disappointment with OPEC’s latest production cuts

- US ISM services PMI picked up, new orders and business activity beat expectations and prices paid remained elevated, which makes it difficult to argue that services inflation is falling – which is what the Fed actually want to see.

- However, weak Q4 GDP at 0.2% q/q adds to the case that rates may have peaked, even if the RBA will feel inclined to maintain a hawkish bias at each meeting in Q1.

- The BOC held rates at 5%, and whilst they retained a hawkish bias they admitted that domestic demand was cooling

- The RBA held rates at 4.35% and their statement was interpreted as dovish (again).

- US employment data was softer heading into Friday’s nonfarm payroll report with job openings slowed to a 2.5-year low and ADP jobs below expectations

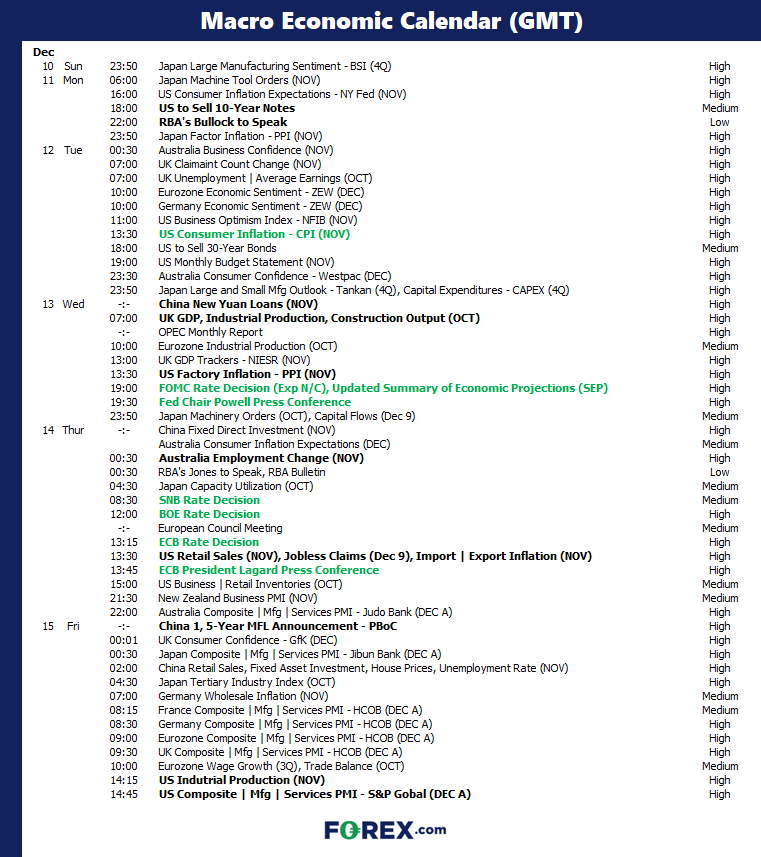

The week ahead (calendar):

The week ahead (key events and themes):

- FOMC meeting

- US inflation (CPI, PPI)

- BOE, ECB and SNB meetings

- UK data dump

- China data (new loans, 1 and 5-year MLF)

US inflation (CPI, PPI)

With the Fed expected to hold rates at next week’s FOMC meeting and inflation data released ahead of it, the inflation report is arguably pips the post as the key event next week. Yet with PCE inflation and headline CPI softening faster than the Fed expected, it could take an uncomfortably hot set of numbers to sway market opinions that the Fed may hike again. In all likelihood, failure for inflation to soften fast enough simply pushes back expectations of the Fed’s anticipated first cut.

However, with CPI flat at 0% in last month’s report and core CPI falling to 0.2% m/m, any further signs of weakness could bolster bets of a Q1 cut and boost appetite for risk, support US indices and weigh on the US dollar (especially if we see a negative print for CPI). Whether the Fed will feel the need to telegraph cuts at next week’s meeting remains debatable, but that I how I would expect markets to react if early signs of deflation appear on the eve of the Fed’s meeting, even if the Fed go on to take a cautious approach the next day.

Trader’s watchlist: EURUSD, USD/JPY, WTI Crude Oil, Gold, S&P 500, Nasdaq 100, Dow Jones

FOMC meeting

It is the Fed's final meeting of the year next week, where they will present staff projections, the dot plot, the usual statement and then a press conference with Jerome Powell himself.

Fed Fund futures currently imply a 99% chance of the Fed holding rates, and it may as well be 100%. The more interesting development in recent days is to see expectations of the Fed’s first cut shift from May 2024 to March, with pricing currently implying a 54% chance of one. With markets being forward looking and some parts of the US economy weakening (such as employment), it is not completely illogical to expect cuts next year.

But will they really cut rates in the first quarter? I’m not so sure. Oil prices are continuing to plunge which itself is deflationary, but it will take time for that to make its way through the supply chain to consumer prices. And whilst it is true that the economy is weakening, the Fed likely don’t have the appetite to signal so soon that they’ll be cutting rates in Q1 at next week’s meeting. Besides, this is the central bank that dragged its heels over hiking in the first place as inflation was “transitory”, only to eventually hike rates higher than markets has originally anticipated. So why would it be different this time around?

Because for the Fed to be aggressive with rate cuts, we likely need to see the wheels fall off the US economy faster than they currently are.

Traders will want to see any (or a combination of) the following to justify their dovish pricing; lower inflation forecasts, dovish comments in the statement or press conference, or a lower median Fed funds rate in the dot plot. Failure for them to do so could result in a disappointing Santa’s rally, if not a deep pullback for appetite for risk in general.

Trader’s watchlist: EURUSD, USD/JPY, WTI Crude Oil, Gold, S&P 500, Nasdaq 100, Dow Jones

BOE, ECB and SNB meetings

Three central banks across Europe will almost certainly result in no changes to policy what so ever. The BOE have telegraphed they expect the current rate remain on hold for some time, and the ECB have only recently entered pause mode while markets have removed any expectations of another hike.

However, a slew of weak economic data helped the DAX reach a record high as traders are now ricing in a cut for the ECB. And as with the Fed, we likely need to hear the ECB strike a slightly dovish tone to justify the repricing of cuts. And I very much doubt the ECB will make any such signal next week. So, we may find that it supports the euro and weighs on the DAX to a degree if the ECB steer clear of any dovish tones.

Bets are also on the SBB to cuts rates around the middle of 2024, but again we need to ask if the central bank wants to confirm this next week at the risk of undoing some of their previous tightening.

Trader’s watchlist: EUR/USD, GBP/USD, USD/CHF, EUR/CHF, EUR/GBP, GBP/CHF, FTSE 100, DAX

UK data dump

With the BOE outlining that rates are to remain at the current level for some time, it does take some sting out of next week’s data dump. Unless of course the wheels fall off and traders become the more convinced that the BOE will indeed become the first major central bank to cut rates in 2024. And that could weigh further on GBP pairs and support the FTSE, unless the data is outright dire.

Trader’s watchlist: GBP/USD, GBP/JPY, EUR/GBP, FTSE 100

As for the rest…

Beijing will want to see a pickup of new loans to show that they may be inching closer towards the domestically-driven demand they are aiming for. They may decide to cut their 1 and 5-year MLF (medium term lending facility) if loans are down to help boost the economy.

RBA governor Bullock and assistant governor of finance Jones speak next week, and traders may want to hear if their comments back up the latest dovish statement. There is some slight confusion over the communications, in that their prior three statements have been dovish only to be followed by the release of two hawkish minutes. Yet with GDP coming in weak at 0.2%, will this be enough to sway RBA members to sound more dovish than they have in recent appearance?

Trader’s watchlist: AUD/USD, NZD/USD, AUD/NZD, NZD/JPY, AUD/JPY, ASX 200, USD/CNY, China A50

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

Visit Matt's profile on our news and analysis page of our website