DAX extends its rebound ahead of ZEW sentiment data

The DAX rallied 1.7% yesterday after British Chancellor Hunt ditched most of the min-budget, boosting sentiment across the board.

Hunt scrapped most of the tax cuts and planned to cut spending to reduce concerns over the amount of borrowing needed.

Stronger than expected is banks earnings also boosted Wall Street, which is transferring to an upbeat open in Europe.

Attention now shifts to German ZEW economic sentiment, which is forecast to decline to a record low of -66 in October, down from -61.9 in September and below the 1992 low of -62.

Concerns over the country’s energy supply are expected to increasingly weigh on the outlook for the eurozone’s largest economy.

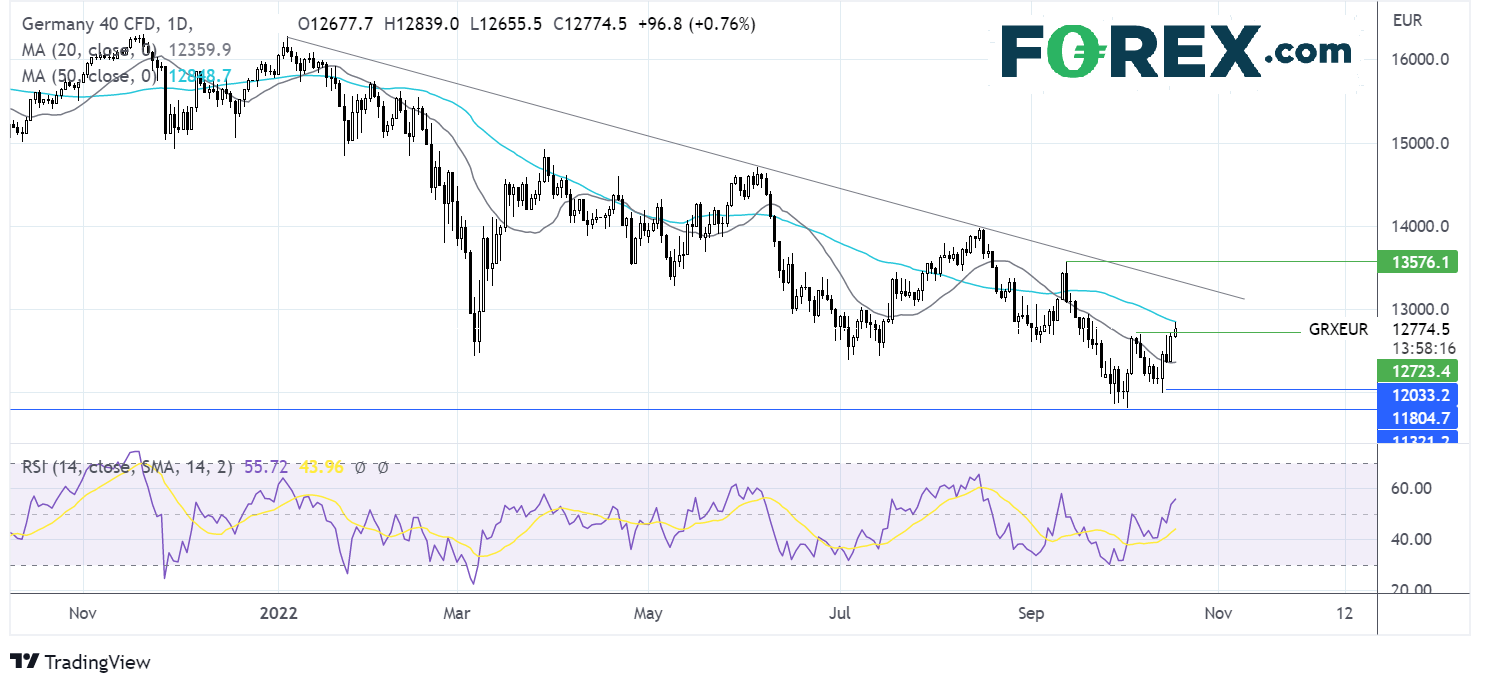

Where next for the DAX?

The DAX has rebounded off the 11810 2022 low, retaking the 20 sma, which along with the bullish RSI, keeps buyers hopeful of further upside.

Buyers will look for a move over 50 sma at 12845, opening the door to 13000, the round number, and September 20 high. Beyond here, investors will look ahead to 13570, the September high.

Should sellers successfully defend the 50 sma, sellers could push the price back towards 12385, the 20 sma, and the July and February low. A break below here opens the door to 12000 and 11800 the 2022 low.

Nasdaq rallies with earnings in focus

The Nasdaq rallied 3.4% yesterday, paring steep losses from Friday, as investors started to position for the start of tech earnings season, which kicks off today with Netflix.

Solid earnings from several key banks have helped to ease immediate recession fears and pessimism over the outlook for the US economy.

Within the Nasdaq, Netflix jumped 6.6% ahead of earnings today, and Tesla rose 7% ahead of earnings on Wednesday.

Despite the move higher in stocks, it’s worth noting that volumes were light and that forecasts for a US recession in the coming 12 months have now hit 100%, according to Bloomberg economics.

There is no high-impacting US data meaning that the focus is likely to remain on earnings.

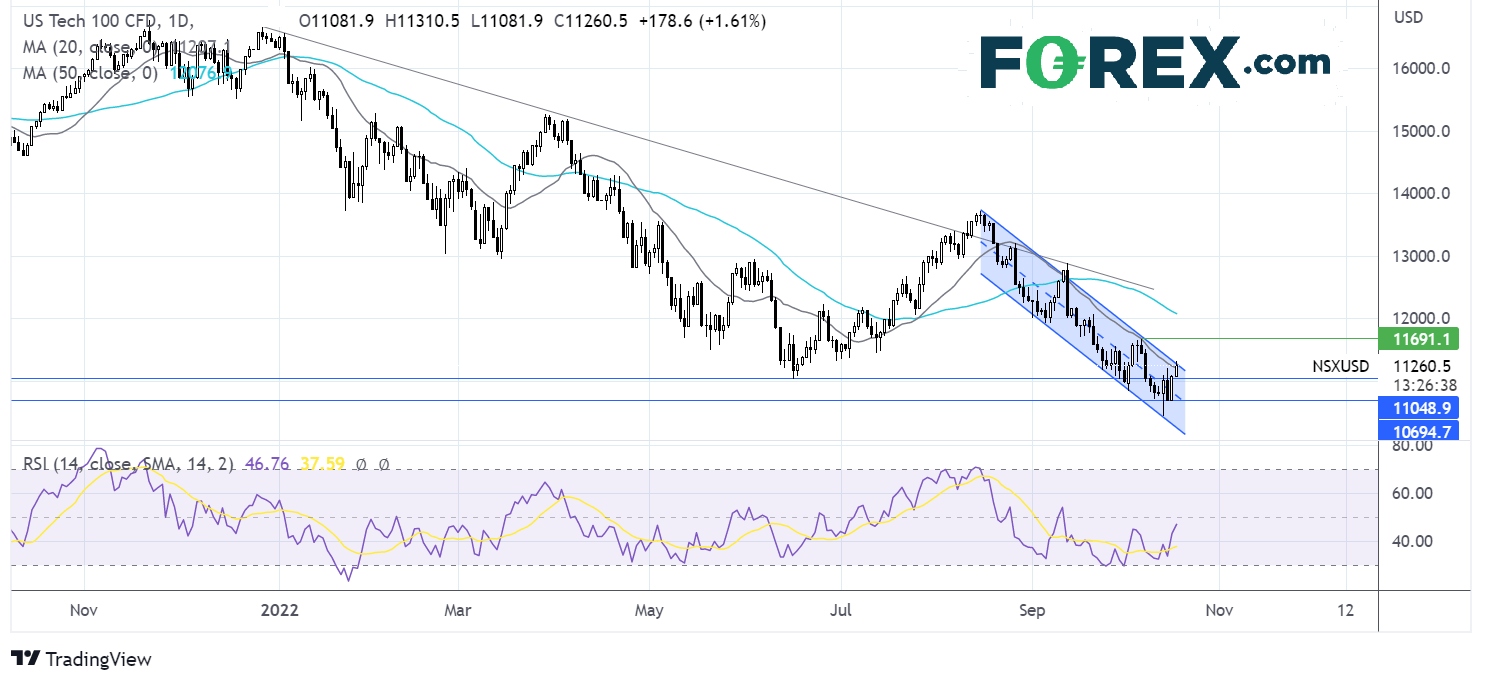

Where next for the Nasdaq?

The Nasdaq had traded in a falling channel since mid-August. The price has rebounded off the 10095 2022 low and is attempting to break out above the 20 sma and the upper band of the falling channel at 11250.

A breakout of the upper band of the channel could open the door 11700 the October high, before exposing the 50 sma at 12075.

On the flip side, failure to break out could see the price test support at 11050 the June low ahead of 10700. A fall below 10430 creates a lower low.