AUD/USD recovers after weak Chinese inflation data

AUD/USD rises after earlier losses following mixed Chinese inflation data. Chinese PPI fell for the first time since December 2020, dropping -1.3% YoY in October after rising 0.9% in September. Meanwhile, CPI cooled from a 29-month high of 2.8%, to a weaker-than-expected 2.1%.

The weaker inflation underscores the softening demand that China faces amid COVID lockdowns and slowing global growth.

With COVID cases at multi-month highs and restrictions widening in the Guangzhou district, optimism that China is looking to exit the zero-COVIDA strategy are fading.

Meanwhile, the USD is falling for a fourth straight session, driven by the midterm elections in an otherwise quiet day on the economic calendar. Whilst the race is tighter than expected a gridlock Washington could keep Democrats spending in check, cooling the inflation outlook.

Looking ahead, Australian inflation expectations are set to point to inflation rising further in November to 5.7%, up from 5.4%. The data comes as the RBA slows its pace of hikes.

Where next for AUD/USD?

AUDUSD has risen above the 20 sma and is attempting to retake the 50 sma along with 0.6500. The RSI supports further upside.

Buyers could look for a move over 0.6550, the weekly high to bring 0.6680, the July low into focus, negating the near-term downtrend.

Support can be seen at 0.6365 the 20 sma, and falling trendline support. Below here 0.6285, the November low comes into focus. A break below here creates a lower low.

FTSE wobbles as results come in

FTSE is edging lower as investors digest weaker-than-expected Chinese inflation data, wait for the US midterm election results, and assess corporate earnings from the likes of Marks and Spence and Taylor Wimpey.

The results are looking closer than expected, which is certainly creating some nerves in the market. The gridlock optimism trade that we have seen in recent sessions appears to be running out of steam.

The focus could quickly shift to US inflation data and UK GDP data later in the week.

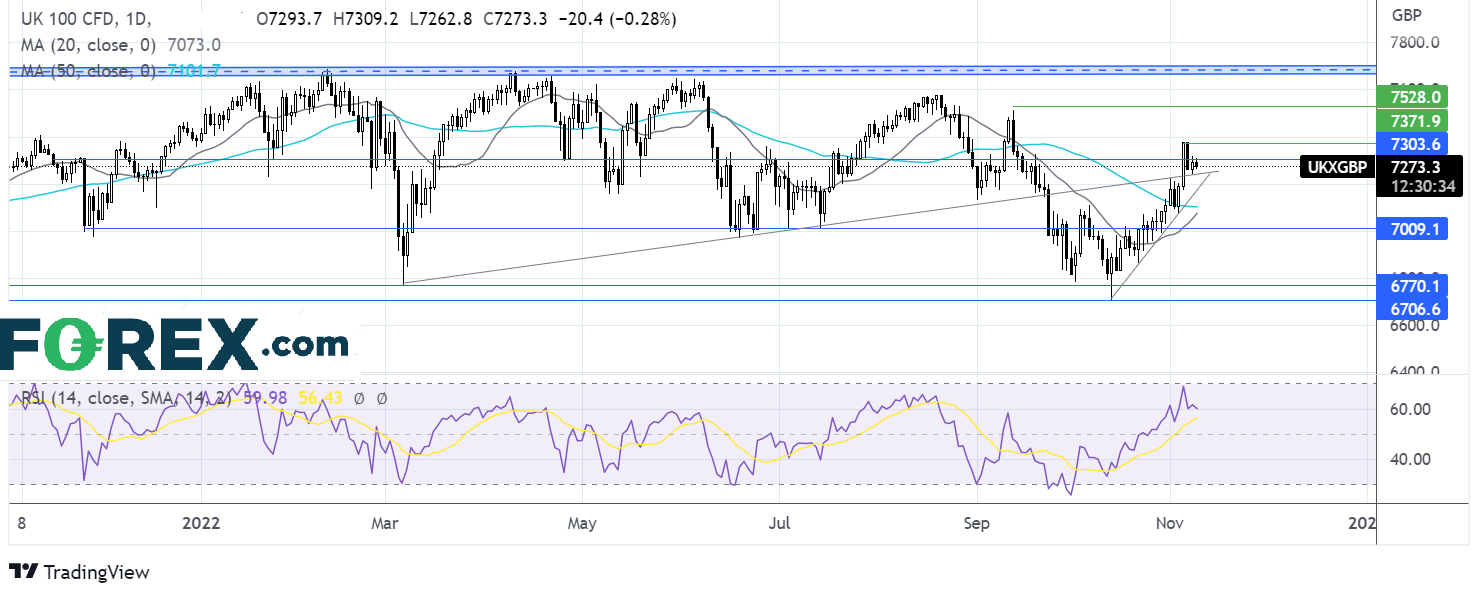

Where next for FTSE index?

The FTSE has pushed back above the multi-month rising trendline, which along with the bullish RSI keeps buyers hopeful of further gains. The fall could be considered a buying opportunity, while the trendline resistance turned support holds at 7235.

A move below the 50 sma at 7110 could negate the near-term uptrend and open the door to 7000.

Buyers could look for a move over 7300 round number to 7377, yesterday’s high to extend the bullish trend.