Trade talks in Washington are set to resume today and it could be a binary outcome for global sentiment.

As Matt Weller pointed out, the US-China trading relationship (or lack of) will have dramatic impact on global markets and, with a general lack of news-flow beyond the RBNZ meeting shortly, this is the only game in town. Premier Liu has reinstated his visit to the high-stake talks, although headlines generated from both camps suggest they’re still playing hard-ball tactics in a last-minute bid to get ahead.

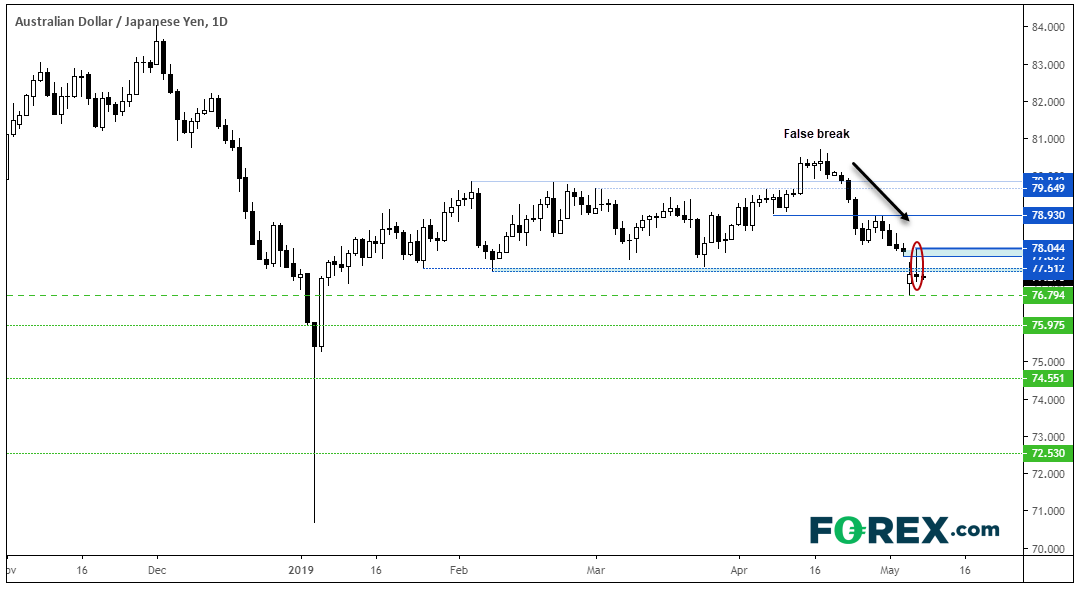

Still, it was a clear risk-off session at the close with JPY attracting safe-haven flows and US stocks sliding, although the Aussie remained quite resilient after bears wrong footed by RBA holding rates. This has slightly blunted AUD/JPY’s usefulness as a barometer of risk over the near-term, although we note a bearish pinbar has formed near our resistance zone and the gap is now closed. From here, a break below 76.94 could be game-on for bears whereas a move above Tuesday’s high above 78 assumes talks are back on track and a positive sentiment has been revived.

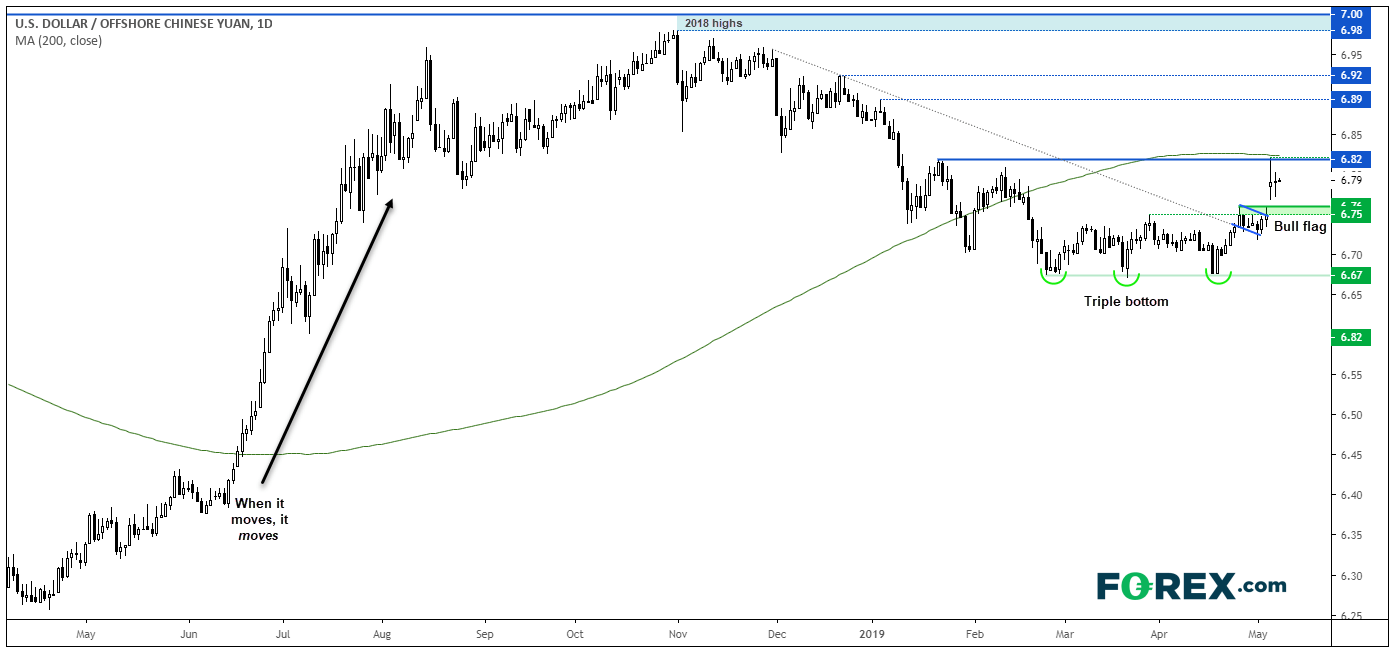

However, with the focus very much on trade talks and the relationship between US and China going forward, USD/CNH could be the purer way to trade around the theme. If Beijing let’s the Renminbi slide in a cold response to talks, it will have huge ramification for global markets. China’s trade partners would want their currencies lower which would then have a wider impact on emerging markets, in the face of a stronger USD.

On Monday, USD/CNH gapped higher from a bullish flag and breaks it convincingly out of a triple bottom reversal pattern to suggest the correction from the 2018 highs may have completed. 200-day average and 6.82 high has capped as resistance, but a clear break of 6.82 could assume trend continuation and bring the 2018 highs into focus, with 5.98 and 6.92 acting as interim resistance levels.

Further out, whilst $7.00 has been seen a magical barrier that Beijing won’t allow to be broken, they may be forced to if Washington go ahead and sustain 25% tariffs on China’s imports. One thing that that can be said for the currency is that, when the Renminbi it moves, it moves and escalated tensions could be the perfect catalyst.

A break back below 6.7560 would take it back within range, below the 100-day MA and assumes trade talks were now back on track.