EUR/JPY, GBP/JPY Key Points

- The massive “yen carry trade” unwind was technically- and sentiment-driven, and could absolutely run further after pausing for a few weeks.

- EUR/JPY traders will only grow more constructive on the pair if it can regain the 200-day MA at 164.00.

- A GBP/JPY break below the bearish flag could expose the early-month lows near 184.00, if not the 1-year lows at 179.00, in time.

After the “shock” unwind of the now-infamous yen carry trade to start the month, the key question traders have been asking for the last few weeks has been, “Is it over yet?”

Fundamentally speaking, the picture hasn’t changed much over the past few weeks – the Bank of Japan is still expected to incrementally raise interest rates in the coming months while other central banks cut their own target rates – but the driving factor behind the massive cross-markets moves we saw earlier this month were never fundamentally-driven in the first place.

Instead, they were more technically- and sentiment-driven in nature: As the yen broke certain resistance levels, it convinced more traders that the years-long carry trade may be unwinding, prompting them to unwind their carry trades, leading the yen to break more resistance levels and more traders to reconsider their positions in a vicious cycle.

This (perhaps too long) preamble serves to remind us that we could absolutely see another leg higher in the yen after nearly a half-decade downtrend following COVID. Below, we outline the technical setups to watch on two yen “crosses,” EUR/JPY and GBP/JPY.

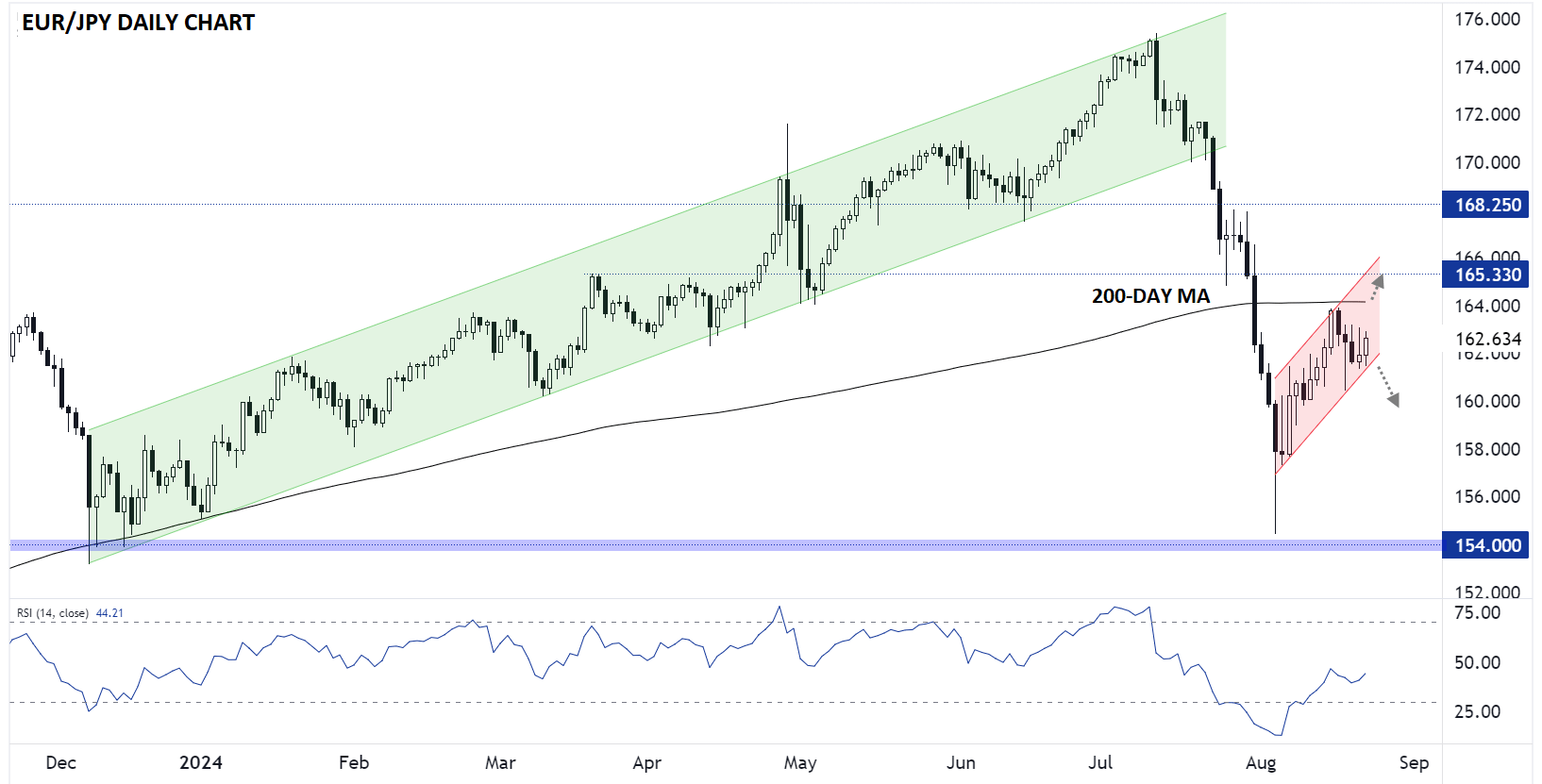

Japanese Yen Analysis – EUR/JPY Daily Chart

Source: TradingView, StoneX

Looking at EUR/JPY first, the cross nearly fell to its 1-year low near the 154.00 handle in the peak of the panic on August 5th, but the exchange rate has since recovered more than 1200 pips to trade back in the 162.00s as of writing.

However, EUR/JPY’s recovery has been far more tepid and gradual than the initial selloff, creating a possible “bearish flag” pattern on the daily chart. As the name suggests, the pattern has bearish implications if the pair breaks below the near-term rising channel (“flag”), and longer-term traders will only grow more constructive on the pair if it can regain the 200-day MA at 164.00. Until then, bulls may want to exercise caution in establishing new positions.

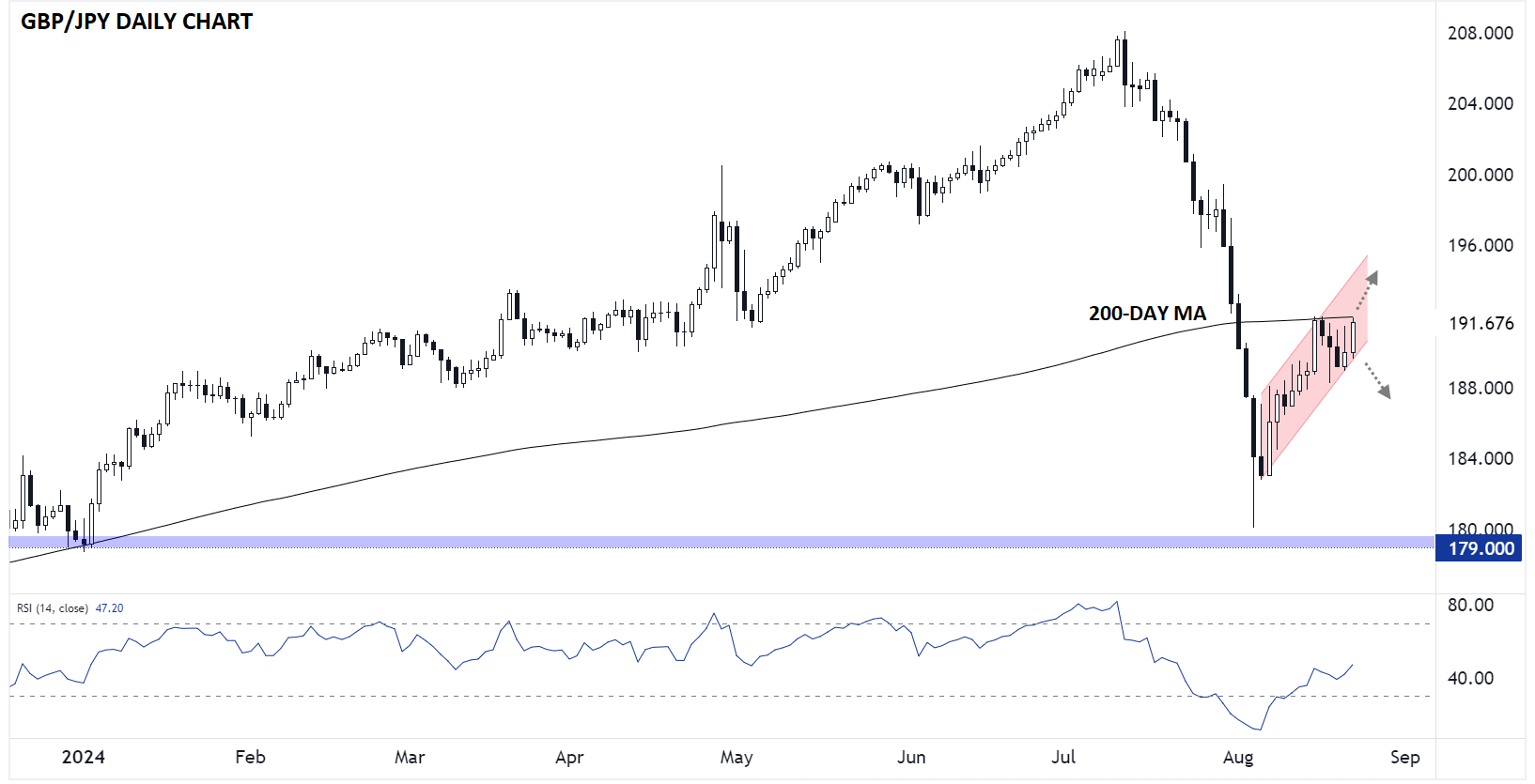

Japanese Yen Analysis – GBP/JPY Daily Chart

Source: TradingView, StoneX

Turning our attention to GBP/JPY, we can see a similar setup: The pair saw a massive selloff through late July and early August, culminating in a brief test of the 1-year lows (in this case at 179.00) before forming a gradual recovery/bearish flag setup below the 200-day MA.

Moving forward, bulls will want to see if GBP/JPY can break durably above its 200-day MA at 192.00 or whether the last 3 weeks represent a mere counter-trend correction against the strong bearish momentum. In that scenario, a break below the bearish flag could expose the early-month lows near 184.00, if not the 1-year lows at 179.00, in time.

-- Written by Matt Weller, Global Head of Research

Check out Matt’s Daily Market Update videos on YouTube and be sure to follow Matt on Twitter: @MWellerFX