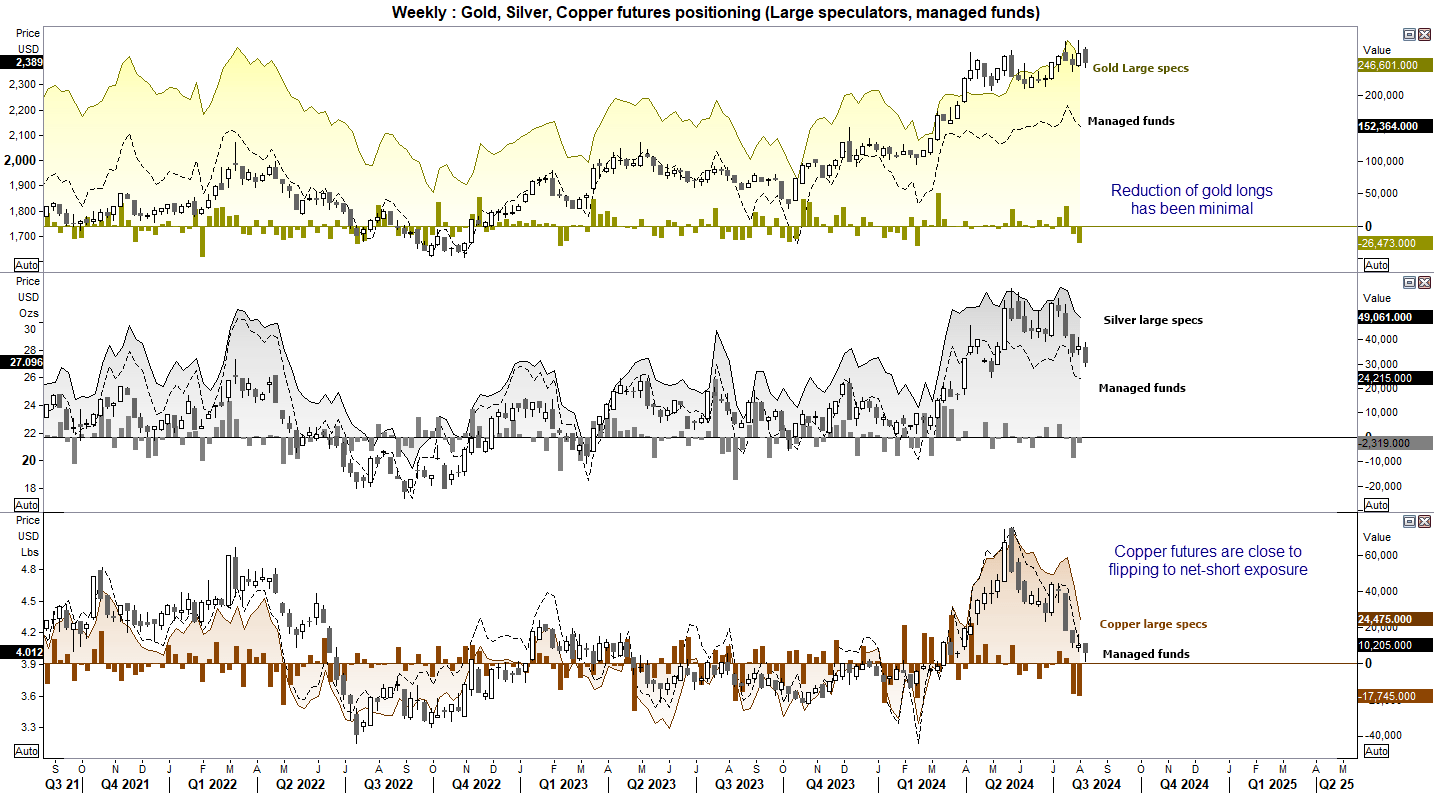

Gold, silver, copper futures positioning – COT report:

The general theme for the last couple of weeks has been to see net-long exposure to key metals decline. This comes as no surprise with the broad pullback on commodities and risk-off tone in general. But on a relative basis, net-long exposure to gold futures is holding firm, copper is being thrown overboard and silver sits somewhere in between.

This fits in nicely with my expectation for gold to hit a new record high in the coming weeks or months, but hold within a choppy trading range not too far from its record highs in due course. Silver is the more volatile little brother of gold, and its lower levels of liquidity make it more prone to deeper corrections (or stronger rallies). Copper prices could have fallen further than they already have, but headlines of Chinese buying seem credible – which has helped copper futures remain above $4 for now.

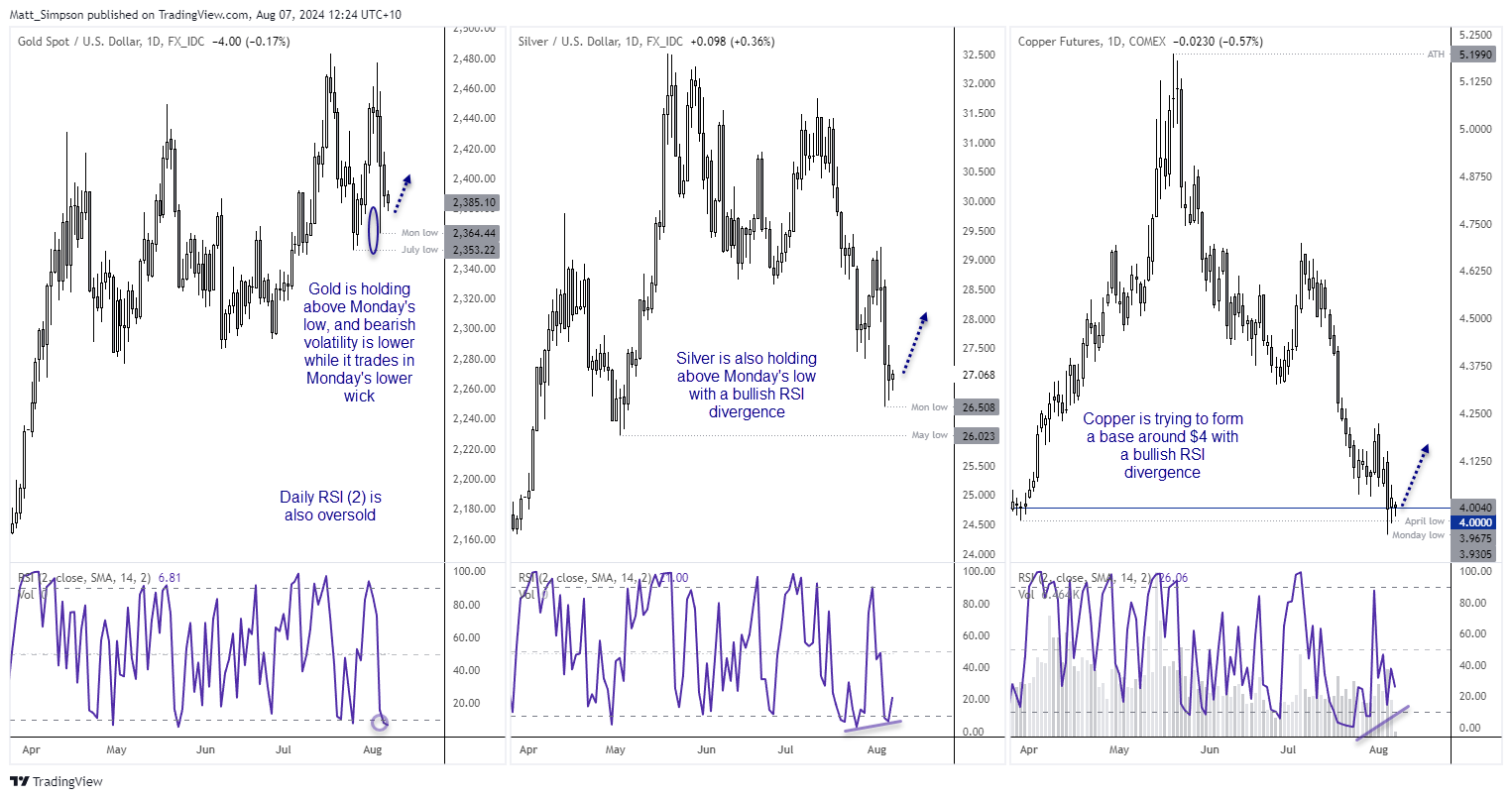

Gold, silver prices stabilising, copper golds above $4.00

Looking across the daily charts, I find it hard to believe that some bullish mean reversion is not due. Gold is currently lower for a fourth consecutive day, and bearish momentum is diminishing on gold, silver and copper. I like that Tuesday’s ranges on gold and silver held above Monday’s lows and remained within the lower wick, which to me suggests that the liquidity gaps left on Monday’s sell-off are being filled - and a base is forming. The daily RSI (2) for gold is oversold, and a slight bullish divergence has formed on silver in the overbought zone.

A bullish divergence has formed on copper’s daily chart, which formed a small bullish inside day on Tuesday. Copper also opened and closed above $4, and today’s trade is currently holding above Tuesday’s low. I suspect a bounce is due on all three metals in the near term.

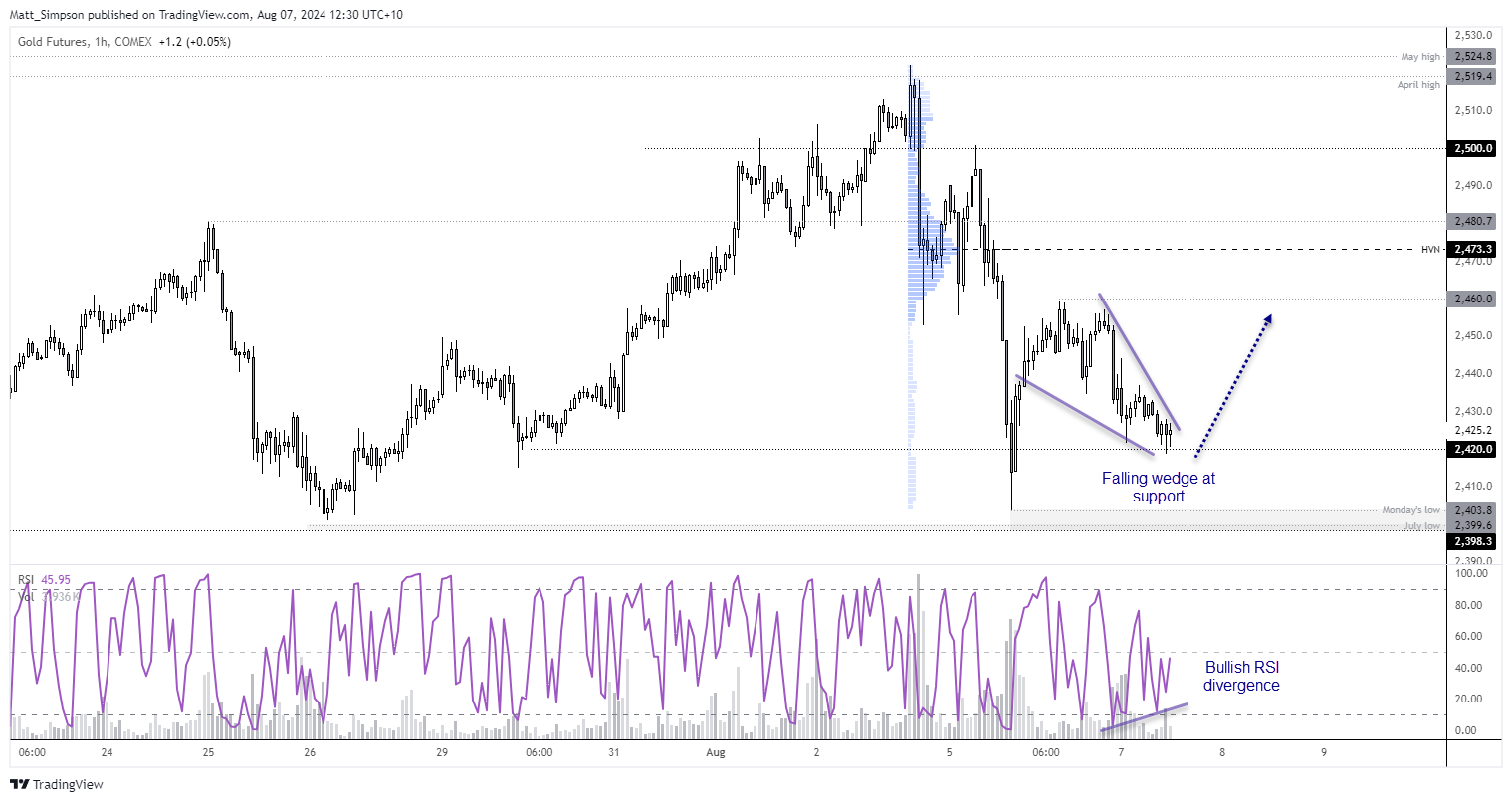

Gold technical analysis:

The 1-hour chart shows that gold futures are retracing lower, yet holding above Monday’s low (which itself held above the July low). Trading volumes are diminishing while prices drift lower to show a lack of bearish enthusiasm, and now trying to hold above $2420. A bullish divergence is also forming on the RSI (2) alongside a falling wedge pattern. Bulls could enter around current levels or seek dips down towards $2410 with a stop below $2398, in hope of prices bouncing higher in line with my bullish bias.

The swing high around $2460 makes a viable interim target, as does the $2470 handle near the high-volume node.

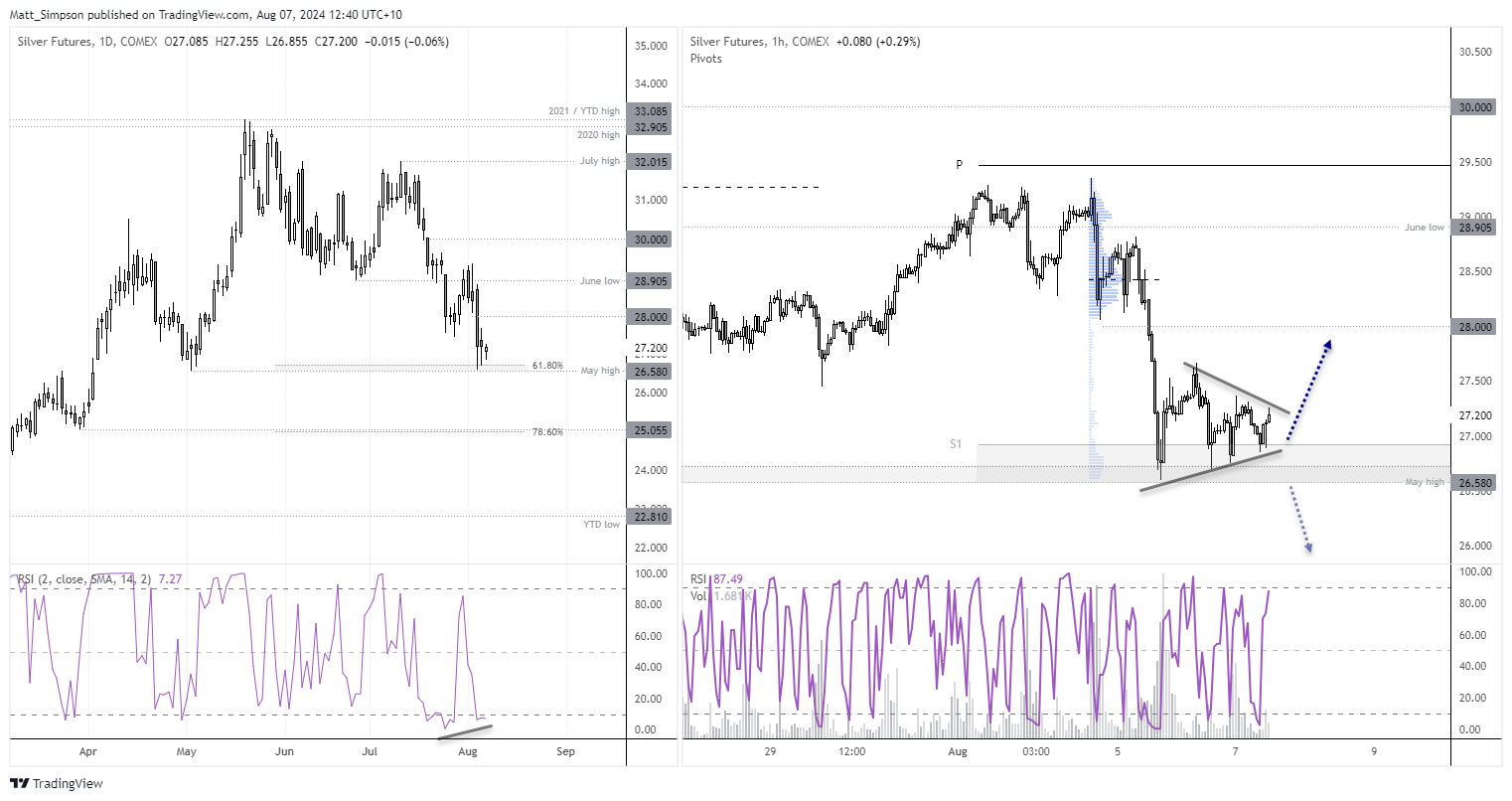

Silver technical analysis:

Prices are holding above the 61.8% Fibonacci level and May low on the daily chart of silver futures. The 1-hour chart shows a potential bearish pennant that would assume a downside break. But analysis of gold, silver and copper on the daily chart has me on guard for an upside break. Of course, if momentum turns sharply lower, the idea becomes invalid with a break below $26.50.

For now, the bias is to seek dips around $27 in anticipation of a countertrend move higher. And I would have more confidence in any such bounce if it were coupled with a rise in gold and ideally copper futures too. And that brings the $27.50 and $28 handles into focus for bulls.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge