With the US out celebrating Independence Day holiday, it should be a quieter day in the markets. With that in mind, this edition of Technical Tuesday is going to be a light one. We will get technical on the gold outlook and provide analysis on the FTSE and DAX.

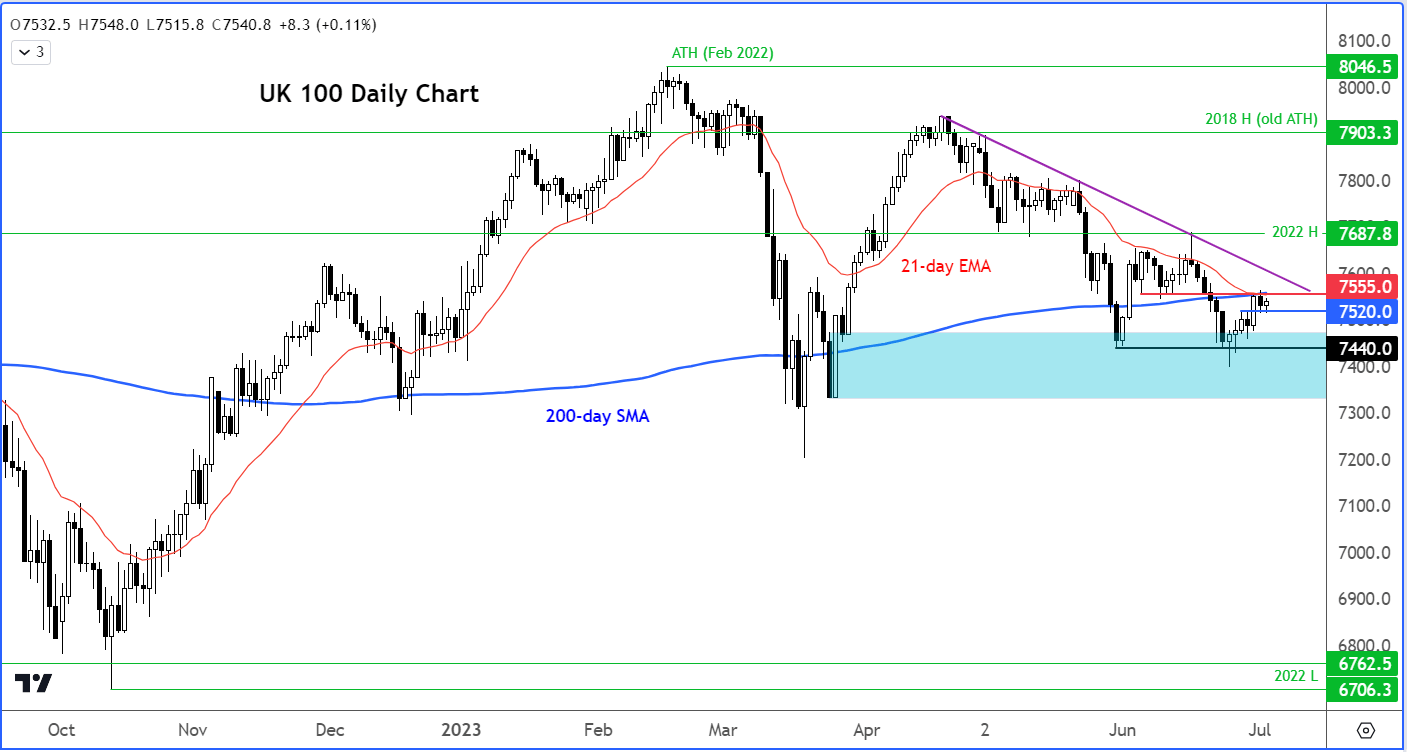

FTSE outlook: UK index needs to reclaim 200-day

The FTSE has stabilised in the last few sessions, finding good support around 7400-7500 range, where it had previously staged a breakout from at the end of March. Back then, the bears were trying to hold the index below the 200-day average, but it was a bit like keeping a ball in water. As soon as it was released, it shot higher. Now, we are in a similar situation again with the 200-day, now at 7550ish, is trying to hold the index down. If it gives way, then expect the FTSE to rally sharply.

Source: TradingView.com

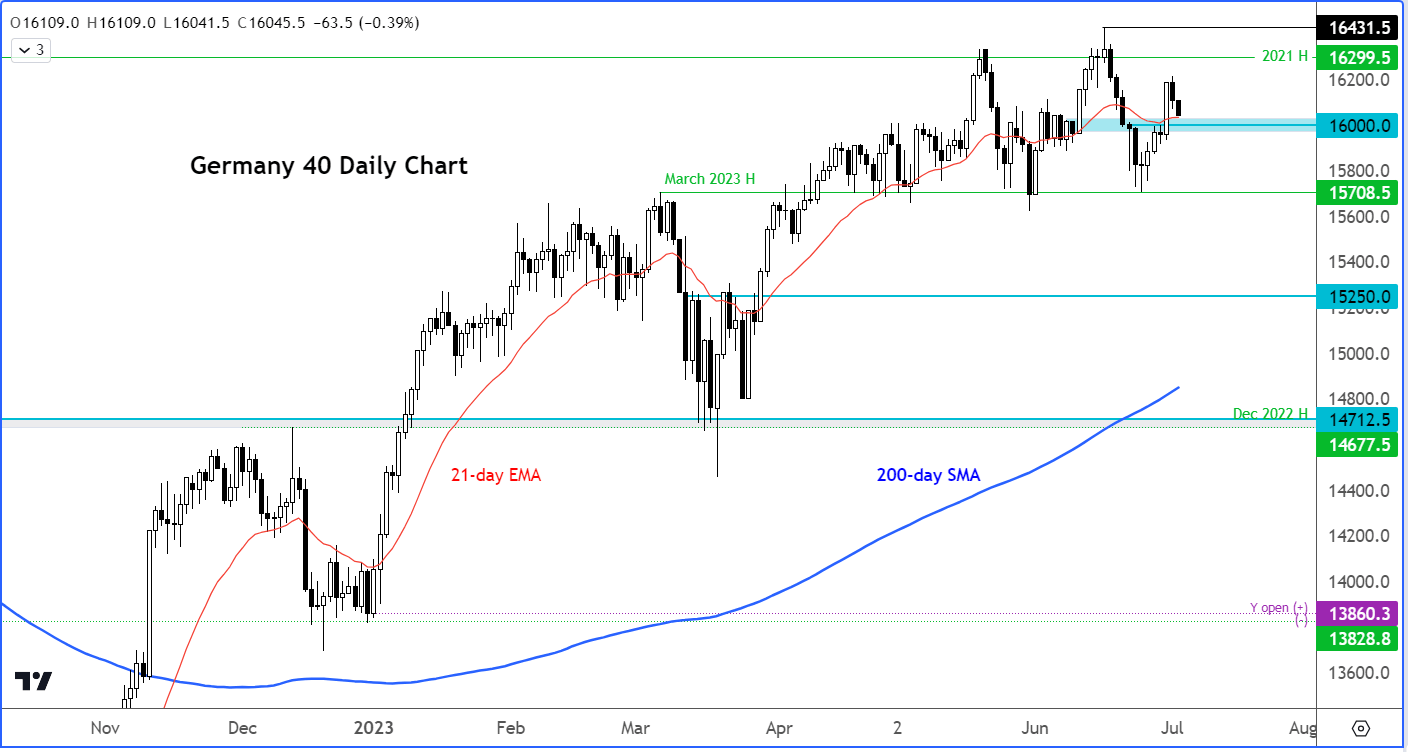

DAX outlook: German index testing key support

Despite all the economic uncertainty across the Eurozone, the German index has had a great year, reaching a fresh all-time high in mid-June. But since then, it has turned a bit more volatile, initially staging a sharp sell-off and then rebounding strongly, before falling again at the start of this week. All told, there’s little technical evidence to suggest the bullish trend is over just yet. So, we will look for support levels to hold and resistances to break. One such support level is around 16000 (give or take 20 points), the base of Friday’s breakout. Once resistance, this area could turn into support and trigger another wave of buying pressure. We will only entertain the bearish case should this level give way decisively on a closing basis.

Source: TradingView.com

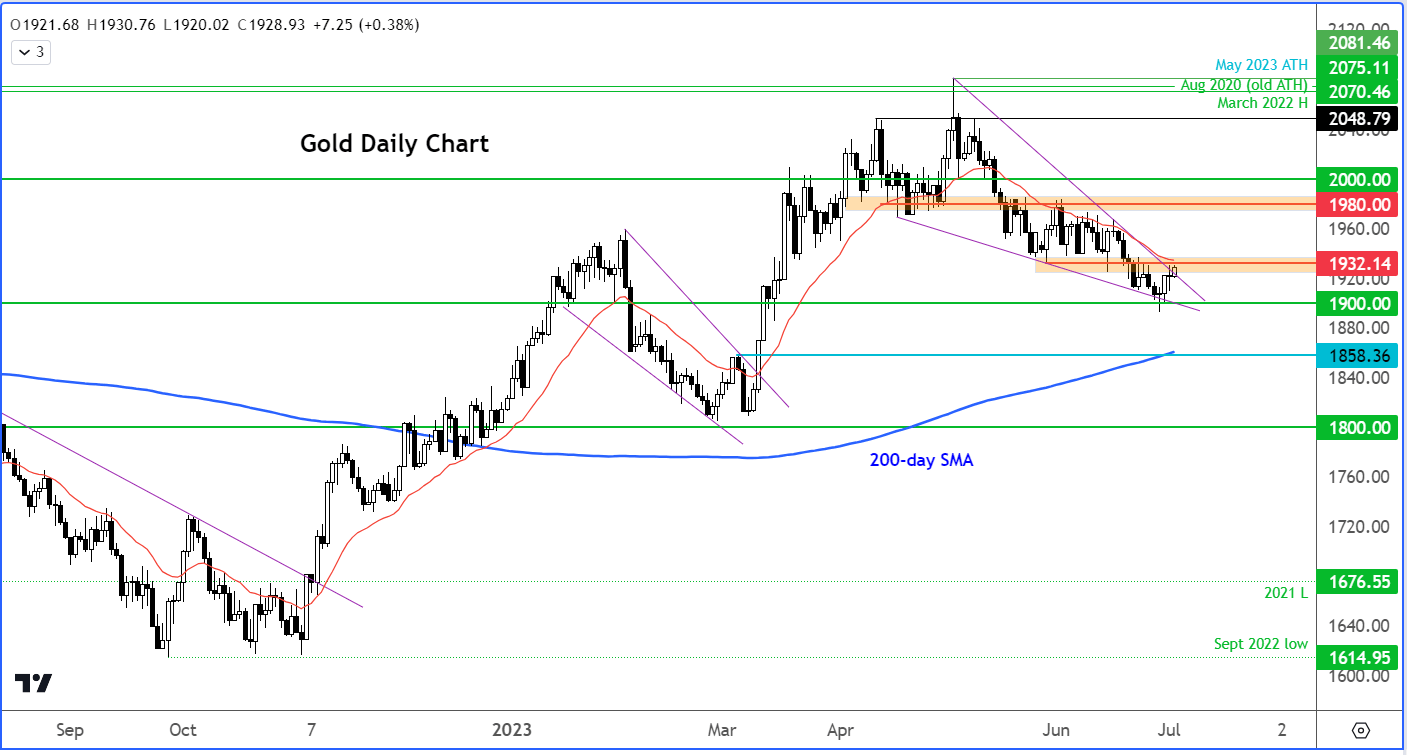

Gold outlook: Can metal break out of wedge?

Gold has been trending lower inside a falling wedge pattern ever since its breakout to a new all-time high in May failed to hold. The bulls have been disappointed with the lack of upside follow-through, thanks to rising bond yields amid renewed push by major central banks to tame stubborn inflation.

The bullish trend ended in May when the breakout above the August 2020 record high of $2075 immediately failed. Subsequently, gold went on to break below its 21-day moving average, which is a popular short-term trend indicator. This MA has consistently provided resistance to any gold advance during June. We are now very close to testing it again, with the metal also approaching $1932 resistance level.

Conservative gold traders will now want to see if the buyers will show up and push the price of gold through the above resistance area and therefore the trend resistance of the falling wedge pattern, or we simply resume lower again.

For now, the short-term gold outlook remains bearish as price continues to break down short-term support levels and gets offered on any bounces. Will that change later this week? Well, a lot will now depend on incoming data and we have plenty of that starting Wednesday, when US investors are also back in town.

Key support levels such as $2000, $1980 and now $1932ish have broken down. The latter is now the most important short-term level to watch as price tests it from underneath. For as long as gold holds below this $1932 level, the path of least resistance would remain to the downside towards $1900. Below $1900, the next big level is around $1850/55 area, which marks the base of the breakout in March and the 200-day average.

Source: TradingView.com

Technical analysis FAQs

What is technical analysis?

Technical analysis is a method used to evaluate financial markets using historical price data to identify trends and patterns. The theory is that previous trading activity can give insight into future price movements.

Learn more about technical analysis

How do I get the latest USD/JPY news?

You can get the latest USD/JPY news and price movements from our in-house team of experts.

Head to our news and analysis section for the most recent updates. Alternatively, you can access a live Reuters newsfeed on our trading platform.

How do you analyse DXY?

You analyse the US dollar index (DXY) in the same way you would a currency pair or stock index. The key difference is it’s not just one currency against another, but the dollar against six others. So, if the dollar is expected to decline against one – but not all – of the currencies, the DXY may not move.

Learn more about the dollar index

What does it mean if DXY goes up?

If the US dollar index (DXY) goes up, it means that the US dollar is gaining in value compared to a basket of other global currencies. Alternatively, if the DXY falls, it means the dollar has lost strength in comparison to other currencies.

See our guide to the US dollar

What is the best indicator for GBP/USD?

Technical analysis of the British pound against the US dollar (GBP/USD) is commonly based on indicators such as moving averages and oscillators. These give traders insights into the direction and strength of trends and areas of support and resistance.

Discover the most popular technical indicators