Swing trading is a popular style of speculating on financial markets. Discover which swing trading strategies and indicators you should be using.

What is a swing trading strategy?

A swing trading strategy is a methodology for entering and exiting trades to capture short- to medium-term gains in a market.

The swing trading style is based on only trading the bulk of a price ‘swing’ from low to high or high to low, rather than finding the start of a new trend.

Swing trading strategies take place over much shorter timeframes. Instead of targeting profits over months or years as investors would, swing traders are looking at days or sometimes weeks.

Some swing traders will keep their timeframes even shorter, looking at price action within minutes, hours or days. But unlike day trading, there’s nothing to say a swing trader can’t hold their position open overnight.

The best swing trading strategy for you will therefore depend on how much time you can dedicate to finding set-ups. If you’re able to be more active and find opportunities throughout the day, you could consider day swing trading, but if you’re looking for lower-maintenance systems that are more similar to a buy-and-hold strategy, you can focus on strategies that can be checked periodically.

The drawback of holding positions open overnight is that you could face gap risk. This is when the price of a market moves dramatically while closed, resulting in a ‘gap’ between the previous close and the market open price. You’ll also incur an overnight funding fee to cover the cost of maintaining a leveraged position overnight.

Beginner swing trading strategy

As a beginner, swing trading might seem overwhelming as there are so many different strategies you can use. Whether they’re based on technical analysis, fundamental analysis or a combination of the two.

Ultimately, every swing trading strategy has just one aim at its core: to identify swing lows at which to buy (go long) and swing highs where you could sell (go short).

Let’s take a look at a popular few swing trading strategies to get you started.

RSI swing trading strategy

The relative strength index (RSI) is commonly used as the base of a swing trading strategy as it helps detect oversold and overbought conditions.

The indicator oscillates from 0 to 100. When the RSI moves over 70, the market is considered overbought. When the RSI moves under 30 it is generally considered oversold. Swing traders use it to buy at oversold levels, ready for the swing up, and sell at overbought levels, ready for a swing low.

Whenever you’re trading with indicators, it’s important to remember that they can give off false signals. This makes it important to confirm your decisions with other tools and indicators.

You can adjust the RSI to suit your analysis, but the default RSI setting of 14 periods is usually adequate for swing trading strategies.

Fibonacci retracements swing trading strategy

Fibonacci retracements are an extremely common base for a swing trading strategy because they help identify levels of support and resistance.

The drawing tool is comprised of a series of ratios or percentages that are derived from the famous Fibonacci sequence. The theory goes that at these key points, the market is likely to rebound.

You’d look to see where the market has previously hit a support level as a ‘swing low’, ready to take a long position, and where it’s hit a resistance level or ‘swing high’ for a short position.

Fibonacci retracements are popular as they not only provide entry insights, but the levels create guides for take-profits and stop-loss orders too. But as with any technical strategy, you’ll want to confirm that your predicted price action is underway before you make any decision.

Price action swing trading

Price action trading is purely focused on what is on the price chart – no indicators, just chart patterns.

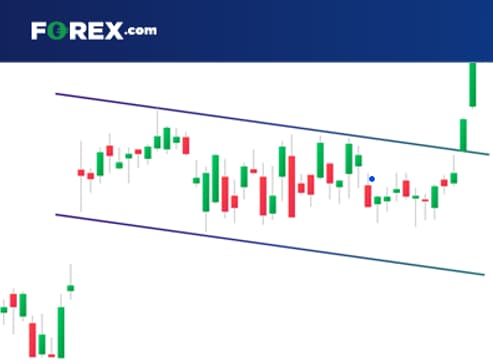

A popular price action strategy for swing trading is a bull flag, which is a pullback set-up. It indicates the previous trend will continue. These retracements or ‘swing lows’ are what can provide a great entry for a swing trade.

The strategy behind price action continuation trades is to wait for the pattern to form and trade in the direction of the existing trend.

A bull flag pattern is made up of the original uptrend which is the flagpole, followed by the consolidation or the flag.

Swing traders would wait for the breakout to be confirmed by a couple of candles before entering the trade to avoid a false signal. A stop loss could then be placed at the lowest point of the flag.

Algo swing trading strategy

Algorithmic trading is a more advanced swing trading strategy that involves making decisions based on a set of rules that are then programmed into a computer to automate trades. The positions are executed as soon as the conditions are met.

It’s popular – especially among more active swing traders who want to trade over smaller timeframes – as automating the trades can cut out the need to monitor markets waiting for the right set-up to take place.

Swing trading exit strategy

Knowing how you’ll be exiting a swing trade is just as important as knowing when to enter one.

Swing trading strategies tend to target relatively modest profits – instead of a 20% aim, you might just try for 10% or 5% profit. This means your take-profit orders will be a lot tighter to your entry orders than in other longer-term styles.

And due to the much smaller profit targets, losses have to be managed extremely closely or they’ll eat into any portfolio growth you might have achieved. To do this, most swing traders will form a stop-loss strategy.

What is a swing trading stop loss strategy?

A stop-loss strategy is a key component of risk management. Attaching stop-loss orders automates your exit by closing a trade if the market moves against you by a pre-set amount.

We’ve touched on where stop-loss placement is recommended for different strategies but on the whole, it all comes down to your risk tolerance.

For example, instead of a 2:1 profit-to-loss ratio – for every £2 of profit, you’re willing to accept £1 of loss – you might aim for a 3:1 profit-to-loss ratio for your system.

So, while your take profit might be £30 away from the current market price, your stop loss is just £10 away.