The following report is a guest contribution from Vincent Deluard, CFA. Vincent is the Director of Global Macro Strategy at StoneX Group, and following GAIN Capital’s merger with StoneX last month, we look forward to bringing you more of this deep-dive, institutional-level research in the months to come. If you find this report interesting, please consider subscribing to Vincent’s research directly to receive all of his insights directly and review past reports.

As a final note, this report was originally published on July 14, and we have lightly edited some of the figures to reflect the current state of affairs.

Bottom Line:

- A Democratic victory in the Senate, the House, and the Presidency is the most likely outcome of the 2020 election.

- Stocks fare well after “blue waves”, but they usually experience sharp corrections in the last months before the election.

- Brace for a weaker USD, higher global growth, reflation, and the outperformance of emerging markets, like in 2009-2010.

- Big pharma and hospitals would suffer from a revamp of Obamacare: favor international healthcare stocks.

- Homebuilders and clean energy providers would benefit from a drift to the left of the Biden administration.

Talking about the November election in the U.S. is a bit like mentioning the Dreyfus Affair at a family dinner in France in the early 1900s: emotions run high, opinions are set, and logical arguments quickly give way to screaming matches and general chaos.

I usually avoid the topic as people generally overestimate the importance of the political circus on their daily lives. However, sharp political swings driven by deep underlying generational trends can occasionally bend the arc of history and a blue wave scenario is now the most likely outcome of the November election, a hypothesis that was virtually inconceivable six months ago.

The first part of this report will go over the odds for Democratic victories in the House, Senate, and Presidency, and their impact on the overall market. Stocks have tended to perform well after blue waves, but that is because blue waves have tended to occur after catastrophic market losses. The risk of a double-digit late summer correction is all the stronger as the market would need to price in a significant increase in the corporate income tax rate, the re-regulation of many industries, and restrictions on buybacks.

However, a more cooperative U.S. approach to international relations and continued economic stimulus would likely be positive for global growth and for the macro trades which emerged after the last blue wave in 2009-2010: emerging markets, gold and commodities would benefit from reflation and a weaker U.S. Dollar.

The second part will go over industry and sector implications of a blue wave. Big pharma, private insurers, and hospitals would suffer from the expansion of Medicare and a greater focus on cost control. International healthcare stocks would the best way to bet on my favorite theme for the next decade.

My out-of-consensus view is that a Biden administration will drift to the left due to demographic and generational effects; this should benefit homebuilders and clean energy providers.

Last, investors should remember that Big Tech is becoming the largest donor to Democratic causes and avoid traditionally Republican-leaning industries, such as oil & gas and insurance.

Market Level Implications

Writing objectively about U.S. politics is especially difficult at a time of intense partisan divisions. Hence, I will try to stick to objective sources, such as betting markets odds and poll averages, which fortunately agree in their assessments. The current consensus for the three national elections in November is as follows:

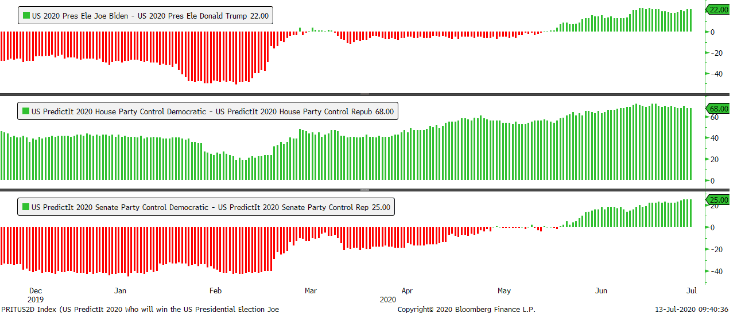

- House: betting odds imply an 85% chance [*updated odds at the bottom of this report] that Democrats retain their majority in the house. The probability of a Democratic majority has never fallen below 50% since the contracts started trading so I would not consider the hypothesis that Republicans take control of the House in November.

- Senate: betting odds imply a 63% chance* that Democrats gain the majority in the Senate. However, betting odds priced in a 70%+ chance of a Republican majority until February so we cannot rule out the possibility of last-minute Republican comeback.

- Presidency: betting odds favor Biden by a 60 / 40 probability*, which is consistent with Biden’s 10 point lead in the RealClearPolitics poll average. Of course, betting odds and polls failed to forecast the outcome of the Brexit vote and the 2016 election as voters were reluctant to reveal preferences which went against the media consensus in favor of “remain” and Hillary Clinton, respectively.

The “shy Trump voter” effect may indeed lead polls to underestimate Republican support but the margins are much wider now than they were in 2016, especially after polls tightened in the last days before the Brexit vote and U.S. election. It would seem counter-intuitive for the “shy voter” effect to be stronger in this election after Trump’s administration and the global rise of populists have normalized speeches and opinions which were viewed as politically incorrect in 2016.

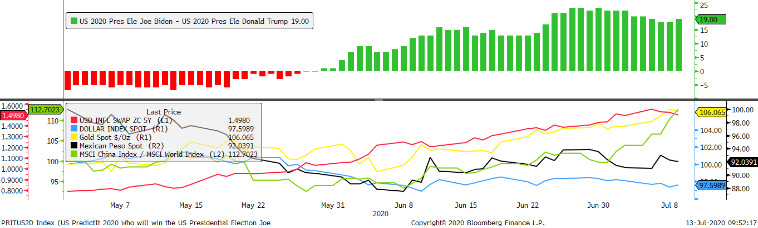

Source: PredictIt. Note that this chart has not been updated through July and August.

Net Probability of a Democratic Victory: Presidency, House, and Senate

Hence, investors can reasonably discard the three scenarios in which Republicans take the House and focus on the following four outcomes:

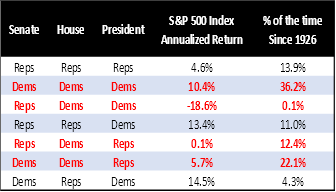

- The highest probability scenario would be a “blue wave”, where Democrats win the presidency, take over the Senate, and keep the House. This political configuration occurred about 36% of the time since 1926. Stocks’ performance has been slightly above average when Democrats control both chambers and the Presidency, but with the caveat that these blue waves tended do occur after major bear markets (more on this later)

- The second most likely outcome is for the Democrats to win the House and the Senate, but lose the Presidency, which has historically been associated with mediocre market returns.

- The third most likely scenario would be for the Democrats to keep the House, win the Presidency, but lose the Senate. Outside of a few days at the end of lame-duck presidencies, this configuration has never been tested since 1926.

- The fourth most likely outcome would be a continuation of the current configuration: A Republican President and Senate and a Democratic House, which is usually associated with very poor market returns.

Source: Bloomberg

The general conclusion from this exercise is somewhat negative for stocks as the two best configurations for stocks (Senate – D, House – R, Presidency - D and Senate – R, House – R, and Presidency – D) are extremely unlikely. Even the best- case scenario for stocks, a Democratic blue wave, comes with an important caveat: blue waves typically occur after major economic calamities, such as the Great Depression and the 2008 financial crisis. Stocks’ strong performance during all-blue administrations is at least partly an illusion caused by stocks’ tendency to sell-off before the election.

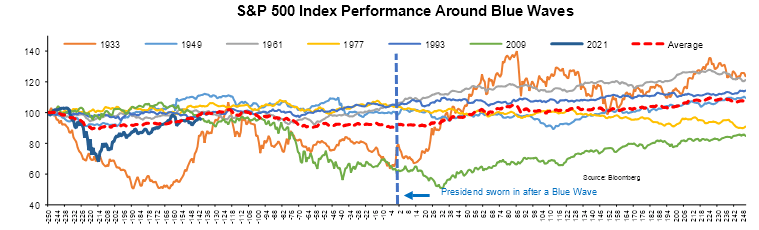

Looking at the average of the past six “blue waves” (red dashed line below), stocks have tended to fall by 10 percentage points in the five months preceding the swearing in of a new Democratic President. This would suggest that the market should peak in August and experience a double-digit correction in the fall, which is conveniently consistent with the normal seasonal pattern of U.S. equity indices.

Source: Bloomberg

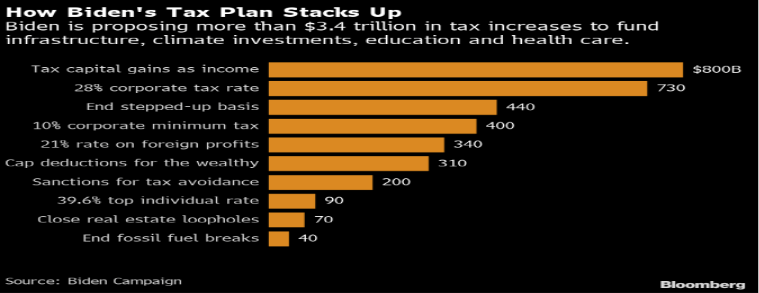

Biden’s tax plans would also support the forecast of a double-digit decline in stocks as investors start pricing in the impact of tax increases on corporate earnings. The Biden campaign has proposed about $3.4 trillion in tax increases to fund infrastructure, climate investments, education, and healthcare.

Source: Bloomberg, Biden Campaign

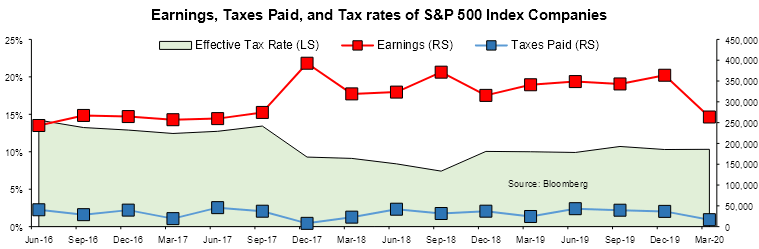

The plan to raise the corporate tax rate to 28% from 21% would be the most damaging to corporate earnings, especially as it should be combined with a 10% minimum tax rate. Of course, there is only a tenuous relation between the headline tax rate and what corporations actually pay. For example, the effective tax rate paid by S&P 500 index companies was close to 16% before the Trump tax cuts and dropped to 10% after them. My best guess is that a Biden administration would eventually restore the status quo ex ante.

The S&P 500 index rallied by 13% between October 2017 to January 2018 in anticipation of the Trump tax plan, so it follows that a normalization of tax rates by the Biden administration could trigger a double-digit correction for the main equity indices.

Source: Bloomberg

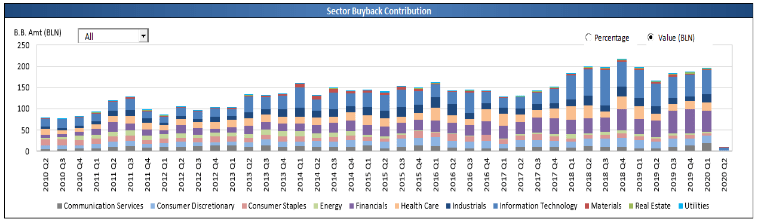

Buybacks would be another possible transmission channel from a blue wave. Joe Biden famously called on “on every CEO in America to publicly commit now to not buying back their company's stock over the course of the next year”. Tweets have no legal value and the promises of Presidential candidates are often just that, so I doubt that a general, across-the-board buyback ban would be a priority for the new administration. However, it seems likely that there will be much greater scrutiny on how corporations use taxpayer-funded (or rather Federal-Reserve-monetized) financial aid and emergency loans.

These measures would likely have little impact on the FAMG stocks (Facebook, Apple, Microsoft, and Google), which have spent $313 billion in buybacks in the past three years. Restrictions on buybacks would have a much greater impact on the next three sectors for repurchases: financials, healthcare, and industrials. These three sectors will likely need continued government support to cope with the economic disruptions caused by the spread of Covid-19. Since these three sectors accounted for 44% of all buybacks in the past two years, a suspension of repurchases would lead to a significant reduction in the demand for stocks.

Source: Bloomberg

Market Themes for a Blue Wave

Joe Biden likes to cultivate the idea that his administration would be a welcome return to normality – “nothing would fundamentally change”, as he famously promised donors. Yet, Joe Biden’s economic agenda already tilts more to the left than the platforms that H. Clinton and B. Obama campaigned upon. Two measures should have an especially significant economic impact: an increase of the federal minimum wage to $15 per hour (from $7.25 today) and the expansion of the $600/week enhanced unemployment insurance benefits.

As I explained in “Goldilocks and the Three Clogs”, the central bank-funded explosion of the deficit since April has had little impact on inflation so far because households have dramatically increased their precautionary savings. Personal income soared by a record 12% in April, but households were reluctant to spend the extra cash without the confidence that these benefits would keep coming. A Biden administration could unleash a lot of pent-up demand simply by giving a precise timeline for the enhanced unemployment benefits and ensuring that the federal minimum wage converges towards the current level of unemployment benefits – which will be necessary to incentivize the recovery of the labor market.

Hence, a blue wave would likely exacerbate the inflationary pressures I described in “the 800-Pound Gorilla in the Market”. Furthermore, a Biden administration would continue Trump’s policy of benign neglect for deficits: his recently-announced $700 billion “Buy American” campaign is unfunded, for example.

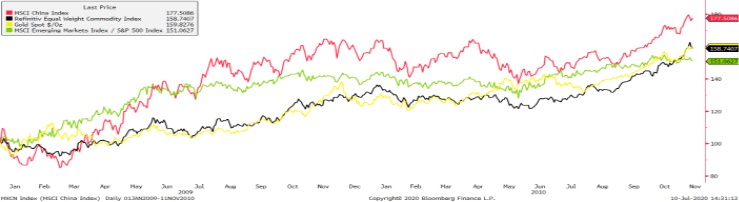

Rapid income growth, wide deficits, tax increases, and inflation would have a negative effect on the dollar, which should help emerging markets with large USD-denominated liabilities. The positive effect on international economies would be reinforced by a more cooperative approach to foreign relations. As the chair of the Senate’s Foreign Relations Committee, Joe Biden has articulated a less isolationist foreign policy doctrine: the U.S. would try to join the TPP treaty with the rest of the Pacific rim countries, appease the rhetoric with Mexico, Canada, and European allies, and roll back some of Trump’s tariffs on Chinese imports.

This weak-USD, reflation, pro-international growth scenario would play out like the big macro trades which emerged after the last blue wave between B. Obama’s 2008 victory and the Republican takeover of the House in 2010: gold and commodities soared, and emerging markets outperformed U.S. stocks.

The 2008 Blue Wave Trades: EM, Gold, and Reflation

Source: Bloomberg

The market seems to be slowly realizing that a Biden administration may reverse the “Trump trades” of the past four years: the U.S. Dollar index is weakening, the Peso has rallied since Biden took the lead in the polls, inflation expectations have increased, Chinese stocks have soared, and Gold is just 5% below its 2011 record high [Editor’s note: That high has since been eclipsed].

Given the carnage in inflation-sensitive assets in the past decade, I would not worry about having missed the beginning of the bounce: cycles of weak U.S. dollar and international outperformance typically last for a decade.

Odds of a Biden Victory versus Reflation Trades

Source: Bloomberg

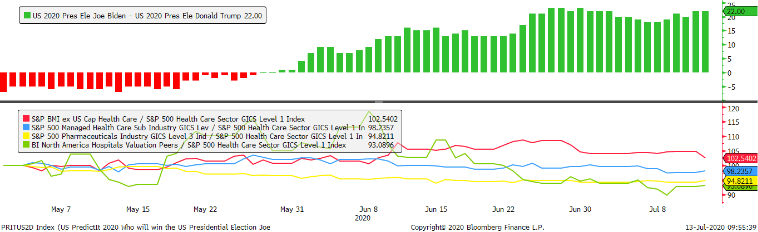

The Healthcare Play

At the sector level, a blue wave would have the greatest impact on healthcare stocks. Biden’s healthcare plan promises to rejuvenate the Affordable Care Act with the addition of a public option, tax credits, and the expansion of Medicare in the 14 states which had refused it when the ACA passed.

Three industries would be negatively (at first, at least) impacted by such a plan:

- Private insurers and managed care providers: although J. Biden opposes a full nationalization of the healthcare system and promised that workers who are happy with their current plans should be able to keep them, the introduction of a subsidized public option will create competition for private insurers. Also, restrictions on insurers’ ability to increase premia due to pre-existing conditions would reduce margins and create moral hazard as morbidity increases in private insurers’ patients’ pools

- Big pharma: Biden promised to repeal the law that prohibits Medicare from negotiating lower prices with drug companies. Biden’s plan would also limit price increases for all brand-name, biotech and “abusively priced” generic drugs to inflation and allow consumers to buy prescription drugs from other countries. Generally speaking, big drug companies have been the biggest beneficiaries of the complexity of the U.S. healthcare system so they would suffer the most from more cost control and more transparent pricing.

- Hospitals, whose financial health is already jeopardized by patients’ postponing of surgeries and regular care due to Covid-19 fears, would suffer from the lowering of the eligibility age for Medicare to 60 from 65 as Medicare reimbursement rates are lower than those of private insurers. Also, the abolition of “surprise billing” (i.e. a patient checks into a in-network hospital but is treated by an out-of-network provider, resulting a very painful surprise bill) would reduce providers’ income.

The main investment implications are already playing out: international healthcare stocks, which are less exposed to U.S. regulatory risk, have outperformed as the probability of a November blue wave has risen. As I explained in “the Next Big Thing”, non-U.S. healthcare stocks are the best play on the strong secular tailwinds for the sector. Second, managed care stocks and hospitals have also logically underperformed the broad healthcare sector. Investors may want to look into private equity-sponsored debt, loans, and CLOs as the victim of efforts to control the costs charged by hospitals and providers: according to the Center for Economic and Policy Research, private equity firms have closed roughly 7,300 deals in healthcare totaling $833 billion since 2000. Deals increased 20-fold to $100 billion in 2018 from less than $5 billion per year in 2000.

Healthcare Industries’ Performance versus Odds of a Biden Victory

Source: Bloomberg

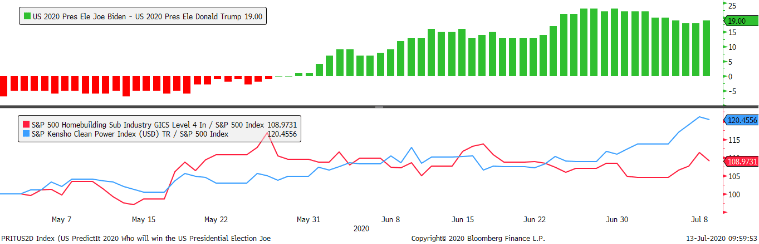

The Left-Drift Play: Homebuilders and Green New Deal

Speculative investors may consider plays on a “drift-to-the-left” of the Biden administration. At this point, the consensus is that Joe Biden would staff a fairly typical center-left administration with experienced hands from the Obama and Clinton administrations. But historical events shape leaders (rather than the opposite) and savvy politicians know to adjust to shifts in popular opinion. If the elections bring a historical blue wave in the fall, many Democrats will want to do more with this historical opportunity than Biden’s promise of “a return to the good old days of the Obama and Clinton administrations”.

Taking a longer-term perspective, broad demographic trends, such as the rise of minorities, urbanization, and the generational turning from Boomers to left-leaning Millennials and Gen Z-ers should lead to more progressive and inflationary policies aimed at reducing the unsustainable generational inequalities which have exploded in the past 30 years (See my “Not OK Boomer” report). Joe Biden is a certainly an unlikely vehicle for this movement, but history often works in counter-intuitive ways – just think of D. Trump, a New York billionaire registered as a Democrat from 2001 to 2009 as the champion of the “forgotten man” and the religious right.

This slow-but-powerful drift to the left started with the rise of a new left-leaning generation of congresswomen after the 2018 midterms and was confirmed a string of progressive victories against established incumbents in recent Democratic primaries. This slow metamorphosis of the Democratic Party resembles the transformation of the Republican Party after the 2008 Tea Party movement, which powered a successful wave of populist insurgents in the 2010 midterms and the complete transformation of the party under D. Trump. Establishment Democrats will likely retain the control of the party under a Biden administration, but they will need to pre-emptively embrace parts of the progressive agenda to avoid humiliating defeats in primary challenges.

Investors should thus expect infrastructure spending and the green new deal to rise in the administration’s pecking order. Increasing the construction of new affordable housing in tense markets should be the easiest way to address America’s generational crisis, create jobs for the young, and kickstart household formation among Millennials and Gen Z-ers. The commitment is already there, with a promise to “invest $640 billion over 10 years so every American has access to housing that is affordable, stable, safe and healthy, accessible, energy efficient and resilient, and located near good schools and with a reasonable commute to their jobs”. Logically, homebuilders and clean power stocks have risen with the odds of a blue wave in the fall.

Relative Performance of Homebuilders versus Odds of a Biden Victory

Source: Bloomberg

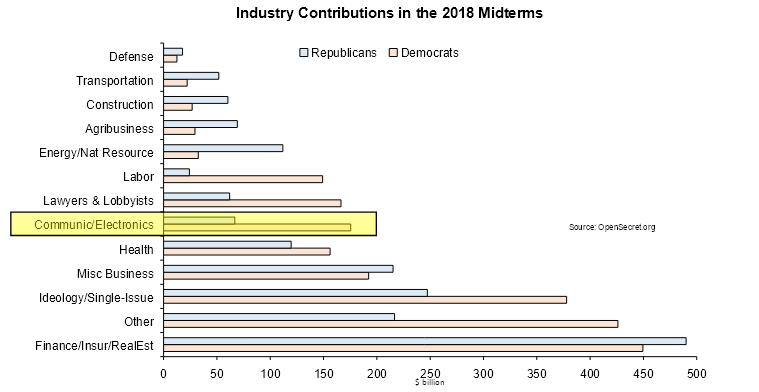

Last, cynics may want to look at political donations by industry to get a sense of where the priorities of the new administration might lay. The Center for Responsive Politics breaks down the $3.9 billion (Jesus!) of political contributions spent in the 2018 midterms. Contributions by tech firms still trail the financial sector and single-issue donors, but I suspect they are rising quickly (for example, Google became the single largest lobbyist in the U.S. in 2018) and they may be underestimated as a lot of Silicon Valley money funds Democratic candidates via discrete, nominally-independent non-profit organizations such as Mind the Gap. 72% of the tech industry’s political contributions go to democratic candidates, a ratio that is close to that of organized labor.

I would not necessarily view big tech as the primary beneficiary of a blue wave: sure, it is always good to have a grateful friend in power, but it is not like the industry was under any existential threat from the Trump administration. A FAANG-friendly administration may help slow antitrust investigations of the tech monopolies and postpone efforts to close tax loopholes, but it cannot address the two biggest threats to the stocks’ long-term prospects: overvaluation and excessive dominance of their markets, which will mechanically reduce their growth potential.

The cynical “lobbying trade” on a blue wave may thus be better expressed by avoiding the industries whose contributions are most skewed towards Republicans: oil & gas, agribusiness, and insurance.

Source: OpenSecret.org

*Current Democratic odds as of 1 September 2020:

House: 82%

Senate: 51%

Presidency: 57%

If you enjoyed this report, please consider subscribing to Vincent’s research directly to receive all of his insights immediately and review past reports.

The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. References to over-the-counter (“OTC”) products or swaps are made on behalf of INTL FCStone Markets, LLC (“IFM”), a member of the National Futures Association (“NFA”) and provisionally registered with the U.S. Commodity Futures Trading Commission (“CFTC”) as a swap dealer. IFM’s products are designed only for individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of IFM. INTL FCStone Financial Inc. (“IFCF”) is a member of FINRA/NFA/SIPC and registered with the MSRB. IFCF is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CF