Gold is recovering after its past sell-off but has probably rallied enough, and now needs to consolidate. True to form, silver moved before gold and by a larger percentage. US economic data last week showed a slowing labor market and reduced consumer confidence. European economic confidence is floundering, while China continues to struggle. Core inflation was below expectations but perhaps not enough to satisfy the Fed.

Gold recovery

The first half of August saw gold and silver prices moving lower in the face of a stronger dollar and higher bond yields. A mid-month rally reversed this trend, continuing to the end of August. Gold gained 3.4% from $1,884 to $1,953, before correcting. This was a perfect Fibonacci 38.2% retracement from the high ($2,063 per ounce), posted on 5th April to the low ($1,884 per ounce), on 17th August.

Technically, gold is forming a double bottom. For this to be confirmed, spot gold would have to reach $1,990 per ounce, from $1,935 per ounce at the time of writing, setting up a short-term target of $2,097 per ounce. While technically feasible, the fundamentals suggest this is unlikely. The gold market has already seen some short covering on COMEX, spurring the rally that we have just seen – barring unforeseen exogenous shocks it doesn’t currently look as if gold will rally further.

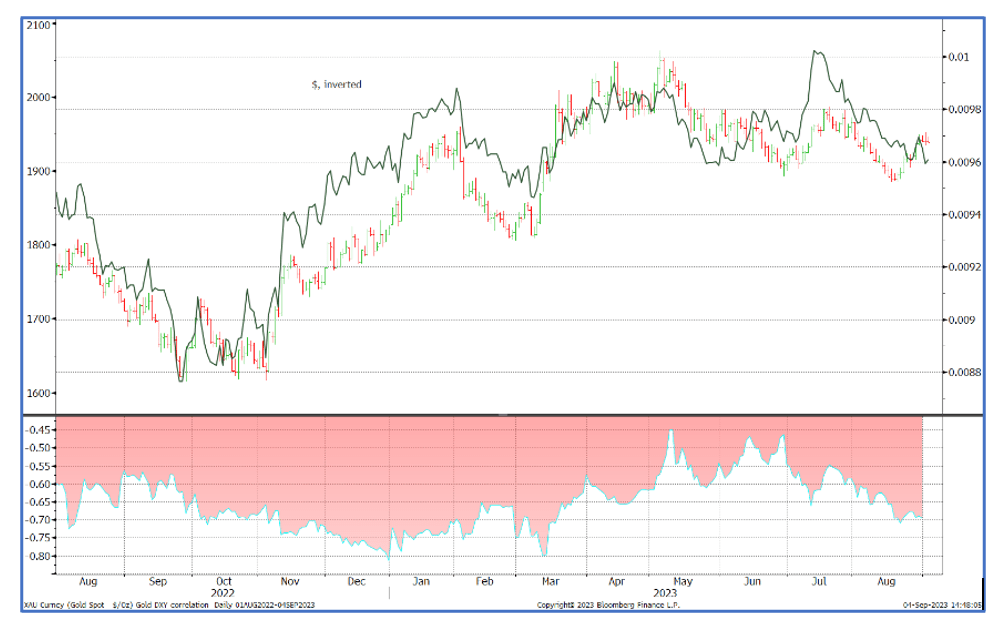

Gold versus US dollar relationship, one-year view

Source: Bloomberg, StoneX

What might take the gold price higher?

A rising gold price, driven by a flight to quality, would require a substantial drop in the US dollar, lower Treasury yields (if we were to see dire US economic data), or evidence of renewed stress in the US banking system (which remains a possibility, as highlighted by the recent credit downgrades to that sector.)

Economic data

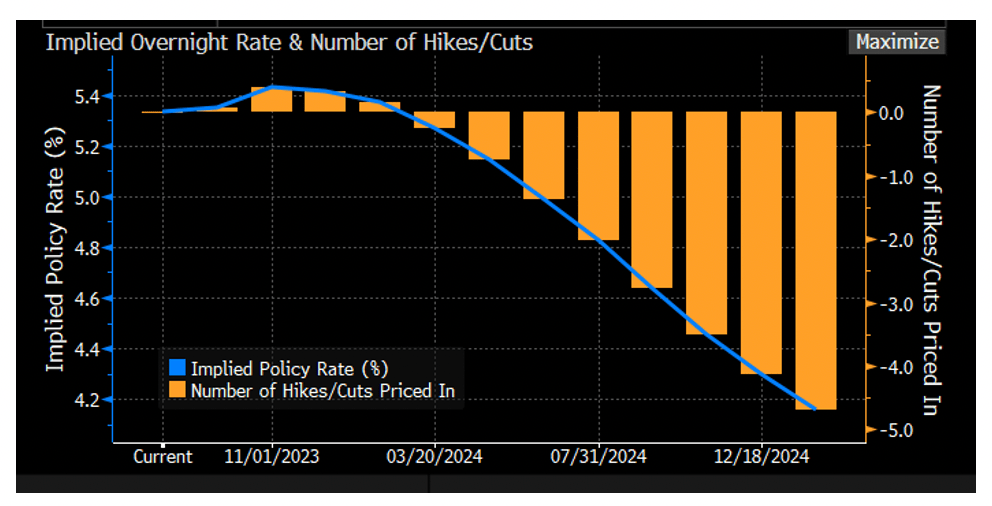

As usual the US economy has commanded a lot of attention and a heavy raft of data hit the markets last week. The underlying tone, with faltering confidence, a slowing in the job market and PMIs still below 50 has meant that the markets are now more or less writing off the possibility of a rate hike in the FOMC meeting of 19-20 September. It will be particularly interesting to see how the dot plot projections shape up this time (this is the grid, produced once a quarter, on which each FOMC member adds a “dot” to show where they expect the fed funds target rate to be at the end of the current and following year, plus further out).

Bond markets’ Implied fed funds target rate

Source: Bloomberg

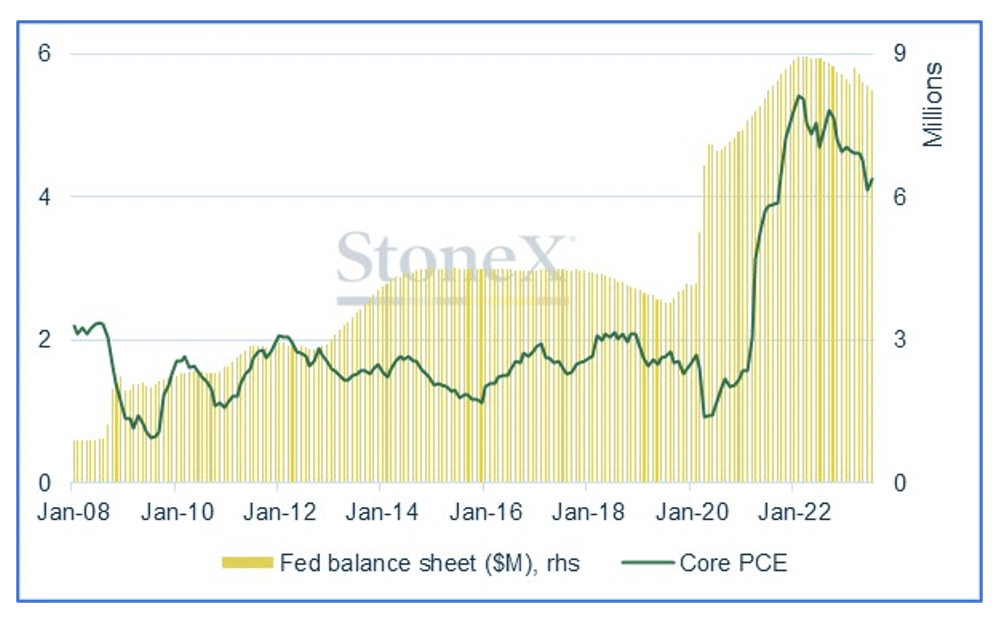

Inflation risks sill on the Fed’s mind

The Core PCE (Personal Consumption Expenditure) is a key parameter reviewed by the FOMC when it comes to framing monetary policy. While trending down, last week’s number was 4.23%, still way above the Fed’s 2% target, and a cautionary note when it comes to the outlook for rates. Whether September signifies the end of the Fed’s tightening cycle, or whether it turns out to be another “pause”, will remain data-dependent, but one thing we can be sure of is that the Fed is unlikely to be in a hurry to start cutting rates.

The Fed’s balance sheet and the core PCE

Source: Bloomberg, StoneX

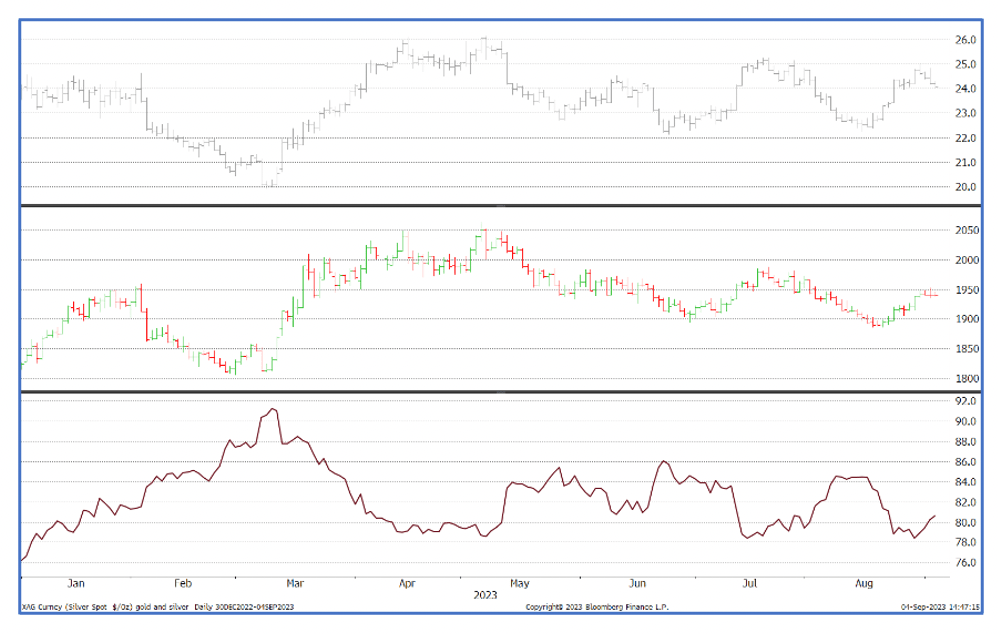

Silver

Gold’s exuberant sister metal was, as usual, more volatile. Silver rallied by 12.7% in the period while gold rallied by just 3.7%. As we noted last week, silver will often move before gold because of the size of the market, and its more volatile nature. COMEX data, below, shows a sharp turnaround from a net short to a net long position in silver.

Gold/silver ratio, short-term

Source: Bloomberg, StoneX

Trading activity

ETPs

There has been tentative interest in the precious metal ETPs after recent price falls. From the spot low on 21st August, four out of ten trading days saw gold ETP fund creations at a rate of just 40%, albeit that is higher than the 30% rate over the year up to that point. That said, the period in question still resulted in a net redemption of 9.7 tonnes of gold.

- Silver ETP investors were reluctant to come back into the market, with only three days of creations since silver started its rally on the 17th August, and a net reduction of 432 tonnes in the period. Given the fact that holdings exceed 22,000 tonnes, the silver ETP position is effectively flat.

Physical investment

The latest numbers from the Commodity Futures Trading Commission (CFTC), which date to August 29th – effectively a week out of date, but still an indication – shows that the gold price rally in the week ending August 29th (to $1,938 from $1,889) was accompanied by the addition of fresh longs for gold and silver in the Managed Money sector, the first time in six weeks.

Gold

- Longs were increased by 48 tonnes, or 15%, to 375 tonnes, and shorts were reduced by 46 tonnes, or 15%, to 253 tonnes.

- Net long gold positions increased from 28 tonnes to 122 tonnes (compared to a 12month average of 150 tonnes long). This was the first net long position since mid-July.

Silver

- Outright longs gained again, following from the bullish change of the previous week, so that over the fortnight outright longs rose by 1,892 tonnes (37%) and shorts were reduced by 1,830 tonnes (30%)

- This takes the net position from a short of 44 tonnes a fortnight previously, to a net long of 1,122 tonnes (not that far from the twelve-month average of 1,386 tonnes)

Taken from analysis by Rhona O’Connell, Head of Commodity Market Analysis for EMEA & Asia, StoneX Financial Ltd.

Contact: [email protected].