Stock markets have been volatile since the start of the year and it doesn’t appear to be letting up anytime soon. There are 3 ongoing issues that are primarily causing the volatility in the markets. They are as follows:

- The end of monetary policy easing and the ensuing interest rate hikes.Most major central banks have their first meetings of the year within the next 2 weeks

- The ongoing drama surrounding Russia’s buildup of troops on the border of Ukraine (presumably getting ready to invade)

- Earnings season and forward guidance.NFLX did little to inspire confidence last week as they said they only see 2.5 million new net subscribers in Q1 vs analyst’s average estimate of 5.8 million.Could this be the beginning of the end for “Stay-at-Home” stocks?

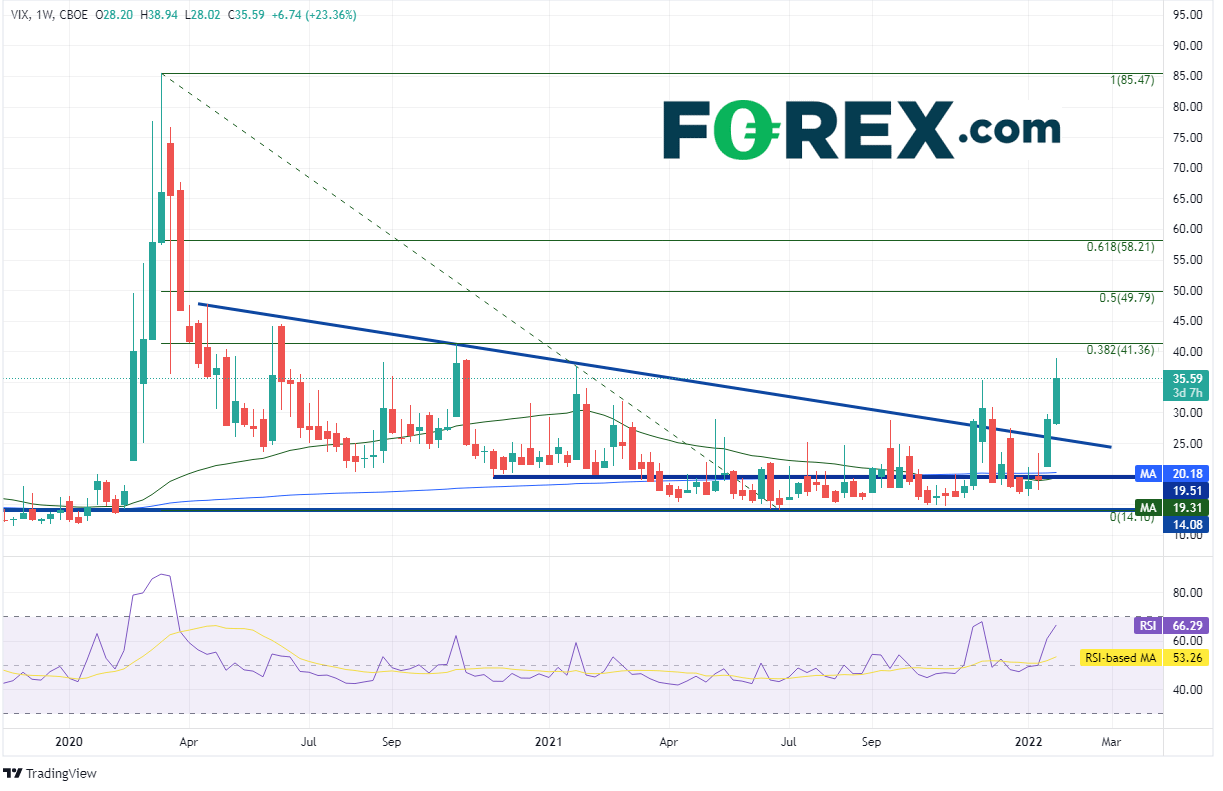

Everything you need to know about the VIX

The VIX, which is an index that trades on the CBOE, measures the volatility of the S&P 500. After spiking to 85.47 at the beginning of the pandemic in March 2020, the VIX retreated and traded as low as 14.08 by June 2021. From March 2021 to November 2021, the index formed a base between roughly 14.00 and 20.00. Several time, the VIX broke above the range, but failed each time. Last week, the VIX closed aggressively above a downward sloping trendline dating back to April 2020 and is continuing the advance this week. Resistance is at this week’s high of 38.94, the 38.2% Fibonacci retracement from the highs of March 2020 to the lows of June 2021 near 41.36, and then the 50% retracement at 49.79. Support is back at the downwards sloping trendline near 25.50, then a confluence of the 50- and 200- Week Moving Averages at 19.31 and 20.18, respectively. Below there, price is back in the range and can oscillate in the support zone, down to 14.08.

Source: Tradingview, Stone X

Trade the VIX now: Login or open a new account!

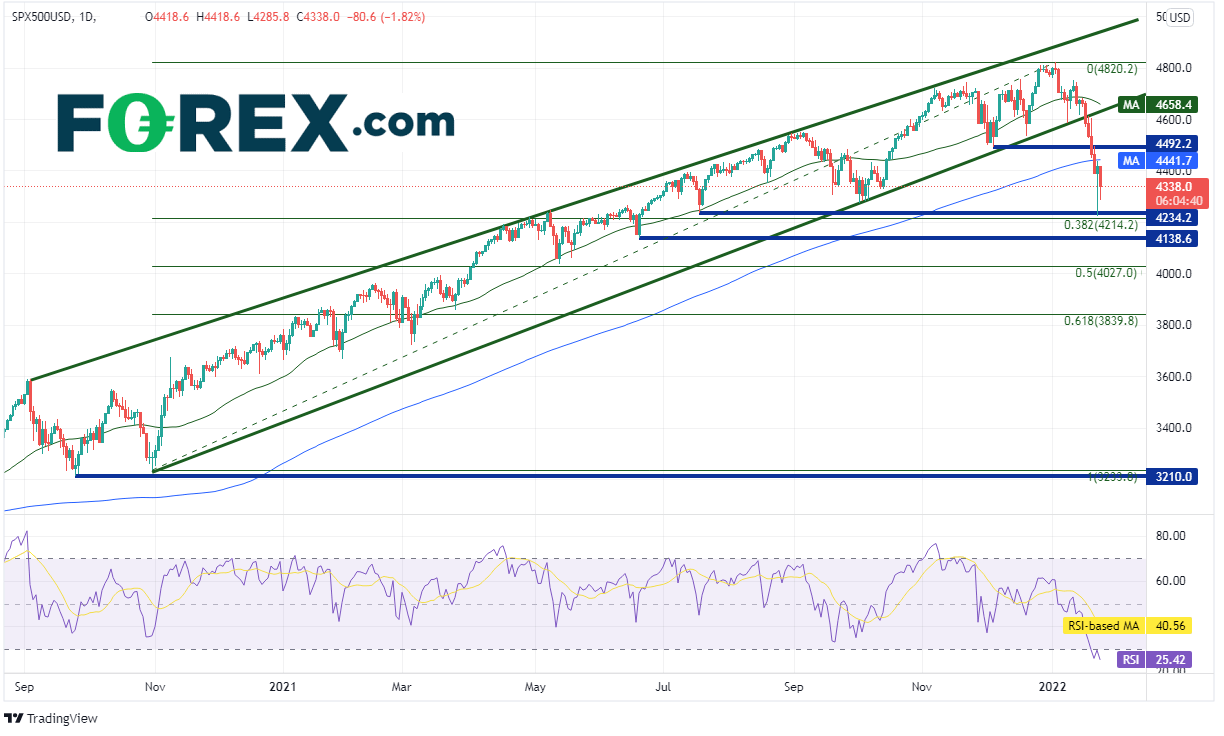

On a daily timeframe, the S&P 500 has been in an upward trend since bottoming in March 2020. More recently, price broke lower from an ascending wedge the index has been in since September 2020. On Monday, the S&P 500 fell to its lowest level since July 2021, and was more than 10% off its all-time highs of 4820.2. (See Index in Focus: S&P 500 from last week) Price held support above those July lows, as well as, above the 38.2% Fibonacci retracement from the October 2020 low to the all-time highs, near 4222. Below there, horizontal support is at 4138.6 and then the 50% retracement from the same timeframe near 4027. Resistance is just above at the 200 Day Moving Average near 4442 and then horizontal resistance at 4492.2. Above there, resistance is at the bottom trendline of the ascending wedge near 4625.

Source: Tradingview, Stone X

Trade SPX 500 now: Login or open a new account!

With the VIX moving aggressively higher this week, the volatility in the S&P 500 looks like it may stick around. Uncertainty around the Fed, the Russian/Ukraine drama, and earnings season, will all be in focus when trading the index. Watch for support and resistance areas where price may pause on its way to its next level.

Learn more about forex trading opportunities.