S&P 500 rally threatened as geopolitics enters the ring: The Week Ahead

This time yesterday, I had US inflation and the ECB meeting as next week’s main events. Yet the escalation of tensions surrounding the Middle East and the prospects of the conflict spreading beyond Gaza has unsettled markets. US indices such as the S&P 500 are on track for their worst week of the year, crude oil reached a fresh YTD high and the risk-off sentiment was even enough to knock gold from its record high and snap its 8-day winning streak. Traders therefore need to be on guard for headline risks surrounding the Middle East next week, alongside the usual bouts of economic data and central bank meetings.

The week that was:

- There was a mixed message between two key business sentiment reports in the US, with manufacturing on the rise whilst deflationary forces appeared in the services report

- The ISM manufacturing report showed that the sector expanded for the first time in 18 months, with rising new orders and prices paid hitting a 20-month high.

- Yet ISM services stole the shows, with the ‘prices paid’ index expanding at its slowest pace I four years, employment contracting for a second month and the headline index and new orders expanding at a softer pace

- Traders seems to pay closer attention to the softer ISM services report than the several Fed members who seemed be pushing back on imminent rate cuts

- Appetite for risk took a knock turn for the worse on Thursday, due rising concerns of a wider Middle Eastern conflict, with Israel’s President vowing to take on Iran and their allies –prompting Biden to seek assurances of civilian protection for continued support from the US

- Crude oil prices rose above $86 for the first time since September on supply concerns, Wall Street indices suffered one of their worst days this year and printed prominent bearish reversal candles

- The ECB’s latest minutes sparked hopes of June cut by saying they opted not to discuss easing at ‘this meeting’

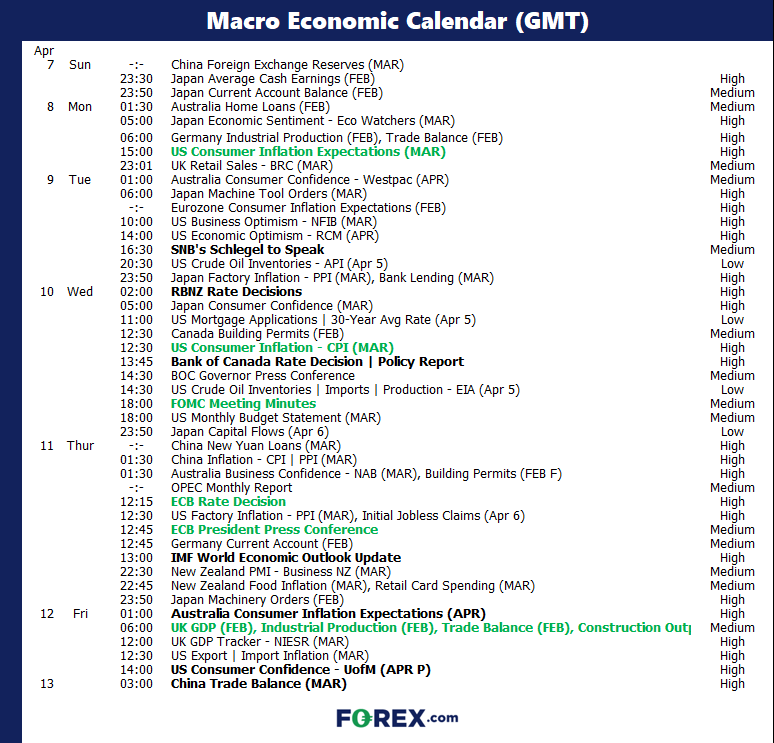

The week ahead (calendar):

The week ahead (key events and themes):

- Rising tensions in the Middle East

- US inflation

- FOMC minutes

- Central bank meetings (ECB, BOC, RBNZ)

- UK data dump

Rising tensions in the Middle East

This theme has never really gone away since Israel invaded the Gaza strip. But the risks of the conflict spreading across the Middle East is rising once again, and adds that leaves markets such as WTI crude oil, gold, global indices and the yen vulnerable to incoming headlines as it can directly impact sentiment.

Trader’s watchlist: USD/JPY, WTI Crude Oil, Gold, S&P 500, Nasdaq 100, Dow Jones, VIX, Bonds (yields)

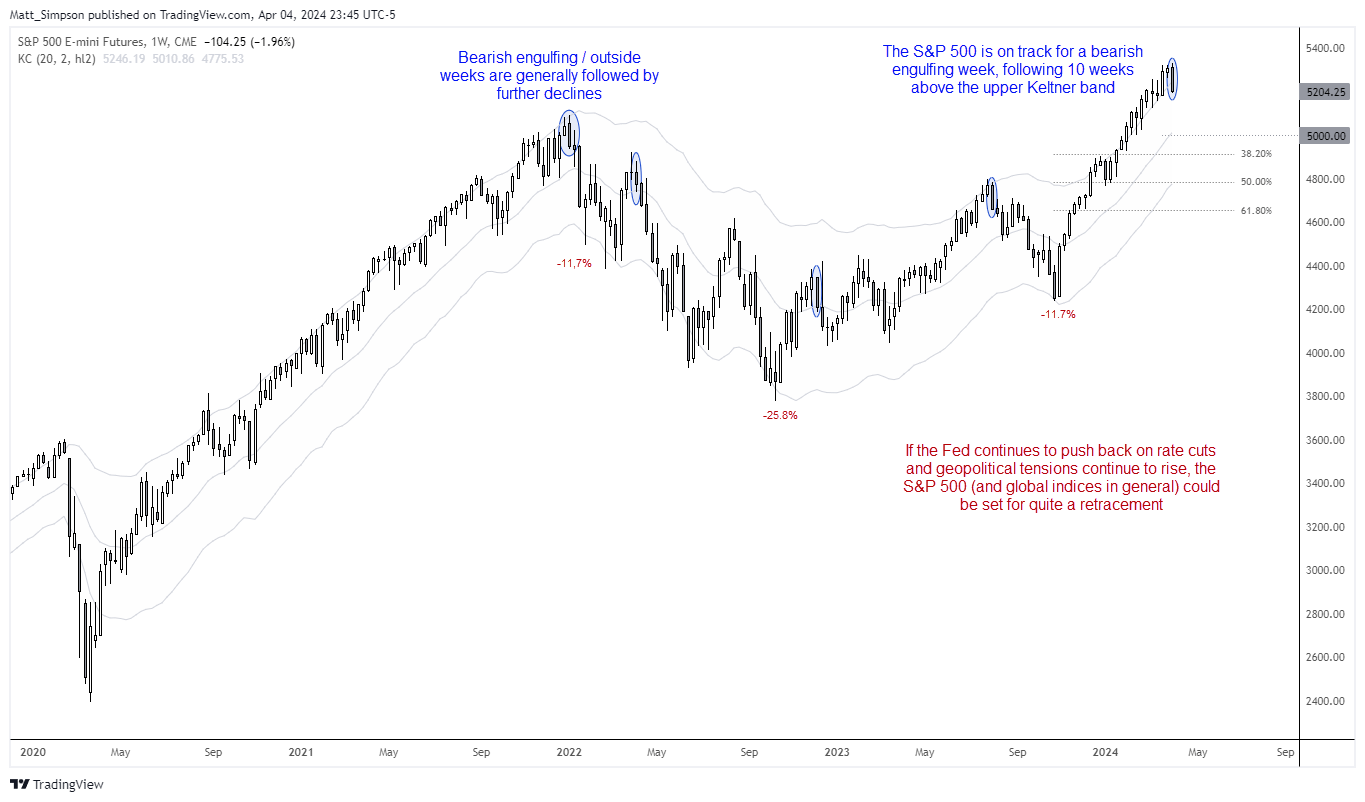

S&P 500 technical analysis:

The combination of ‘higher for longer’ Fed rates and rising geopolitical tensions in the Middle East currently has the S&P 500 on track for its worst week of the year. A potential bearish engulfing candle is also forming on the weekly chart, which currently sits just within the upper Keltner band following a 10-week stretch above it.

Given we have note really seen a proper retracement since July, a pullback to at least 5,000 seems plausible, which is near its 20-week EMA.

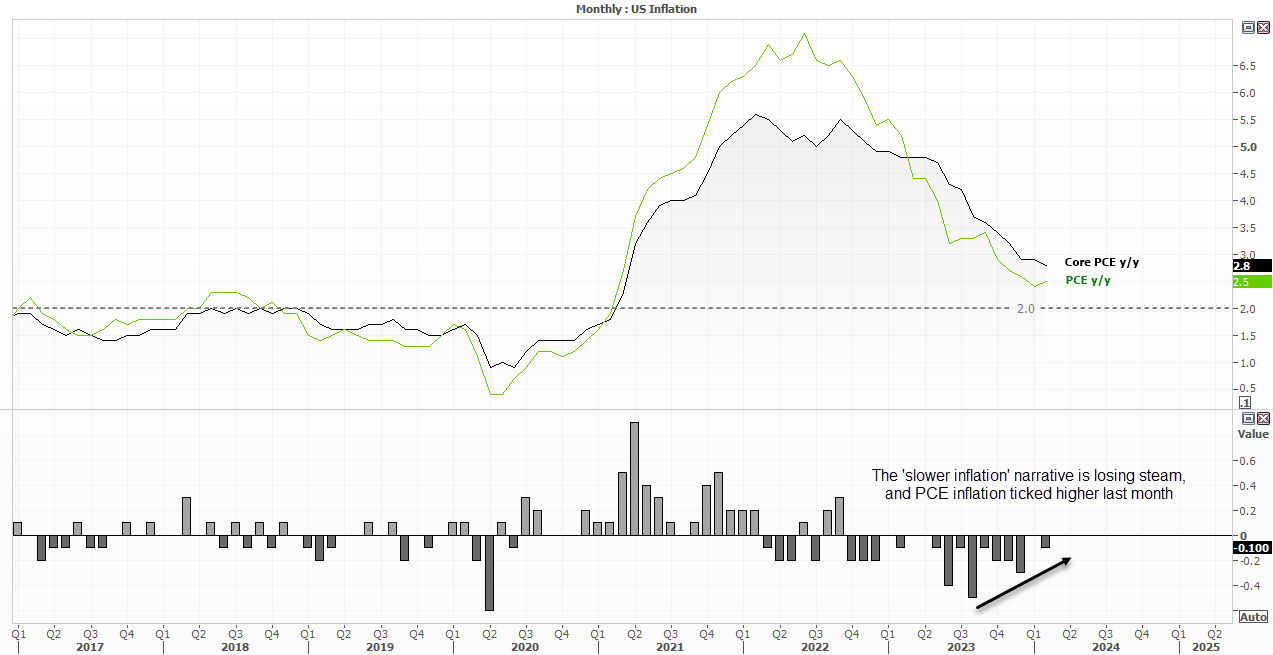

US inflation

PCE inflation data came in as expected last week, and that now shifts attention to the headline US CPI report next week. Some Fed members remain unconvinced that inflation is under control, so traders really need to see it dip lower next week to stand any chance of a June Fed cut. Yet as CE inflation is less volatile than its headline CPI counterpart, it makes it difficult to construct an overly bearish case for the US dollar as PCE is unlikely to fall out of bed any time soon. If anything, it might remain around current levels which provides little to no further clues over the Fed’s next move. And that could lead to lower levels of volatility than we’re accustomed to for such important economic releases.

Trader’s watchlist: EURUSD, USD/JPY, WTI Crude Oil, Gold, S&P 500, Nasdaq 100, Dow Jones

FOMC minutes

I’m not convinced we’re likely to glean too much from the FOMC minutes, but that doesn’t mean they should not be on the radar (just in case). The Fed released their updated forecasts ad dot plot which still favoured a median of three cuts this year, although some of the more hawkish estimates had dropped off and joined the ‘two cut’ side of the dot plot. And personally, I find public comments from Fed members to be far more beneficial for deciphering current sentiment of the Fed, over the backwards looking FOMC minutes. Still, traders are always quick to react, so if they think they see something dovish within them, they may decide to act and drive US yields the dollar lower.

Trader’s watchlist: EURUSD, USD/JPY, WTI Crude Oil, Gold, S&P 500, Nasdaq 100, Dow Jones

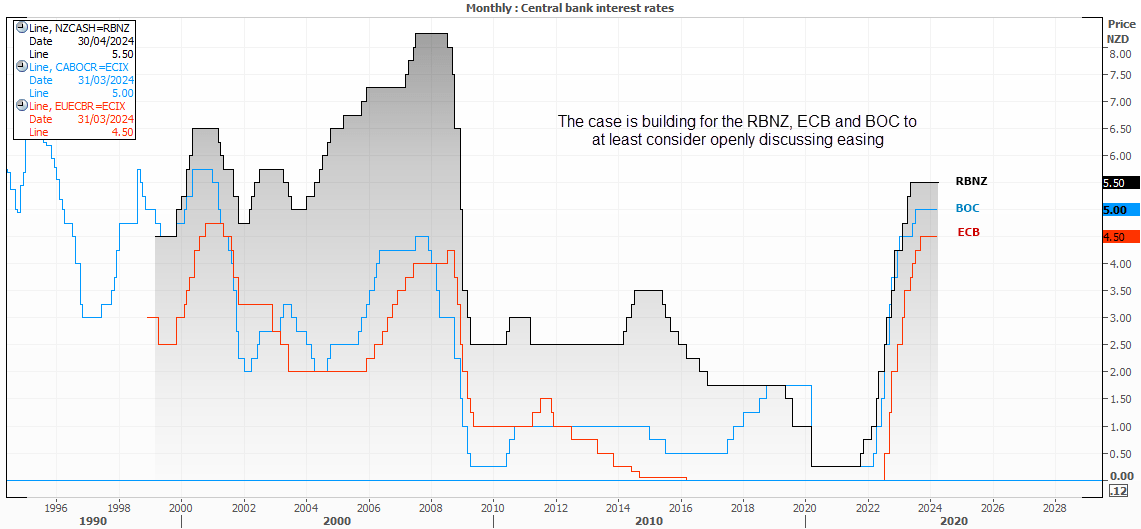

Central bank meetings (ECB, BOC, RBNZ)

It is unlikely we will see any chance of monetary policy from the ECB, BOC or RBNZ next week. But excitement is building that the ECB may cut as soon as June, which begs the question as to whether it will be discussed next week.

But if prior ECB communications are anything to go by, we may be left disappointed. Besides, the Fed continue to push back on cuts, and I therefore doubt the ECB will feel inclined to signal such a move ahead of the Fed, two months ahead of June.

The RBNZ said in the February statement that “the OCR needs to remain at a restrictive level for a sustained period of time”. Whilst GDP has since confirmed a technical recession with two negative quarters, it would seem hasty to announce a dovish pivot. But perhaps they will relax the tone of their ‘hold status’ which could weigh further on NZD pairs.

The Bank of Canada may also be a position to slightly loosen the wording of their hold status, given a recent survey showed consumers expect lower inflation in 12 months and a BOC member described recent CPI data as “encouraging”. But again, I do not expect an outright pivot. And small changes to a statement can make a big difference to market pricing. And a good start would be for the BOC to remove “The Council is still concerned about risks to the outlook for inflation, particularly the persistence in underlying inflation” from their statement.

Ultimately, traders will look for subtle changes to statements or comments from press conferences for clues of a dovish pivot, which would be good as a rate cut at this stage and weigh on the respective currency.

Trader’s watchlist: EUR/USD, EUR/GBP, DAX 40, CAC 40, STOXX 50, NZD/USD, USD/CAD, NZD/CAD, EUR/CAD, EUR/NZD

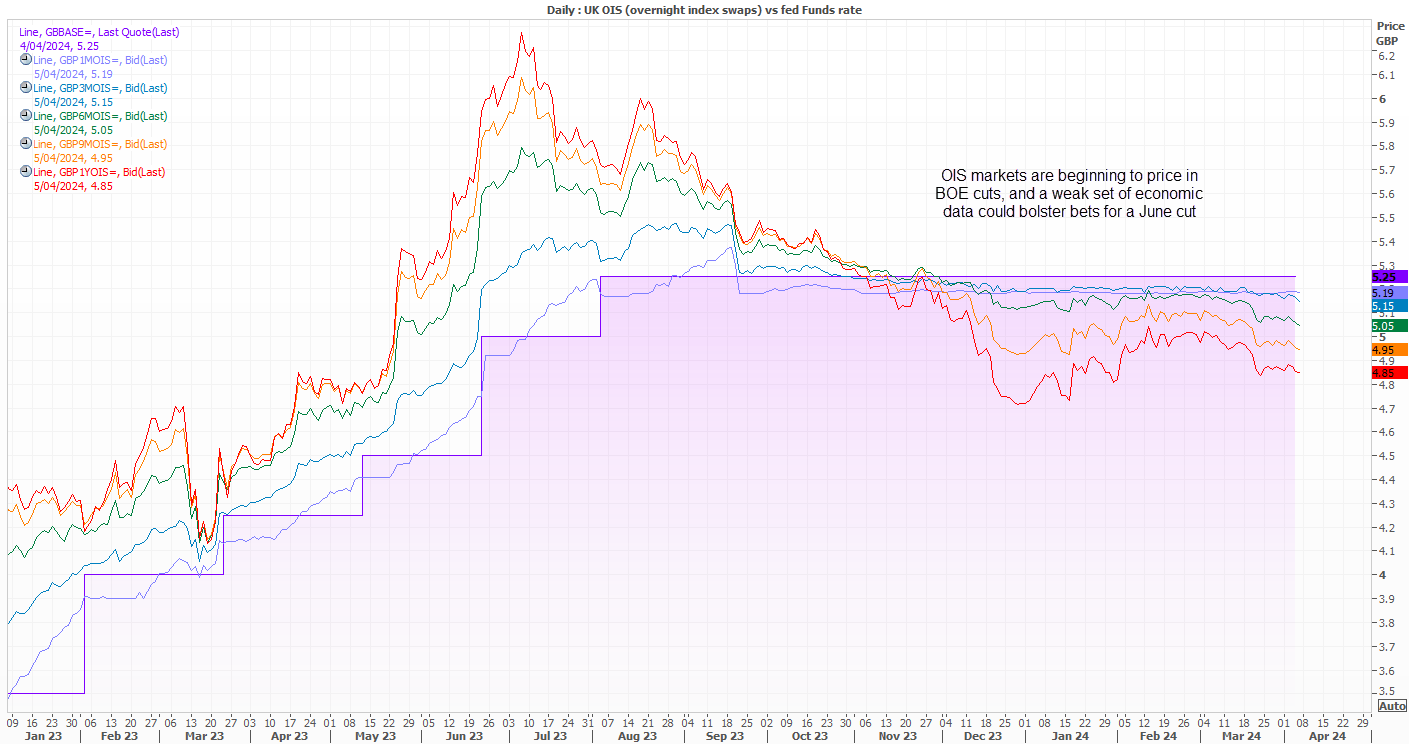

UK data dump

With markets feverishly trying to decipher whether the BOE will cut ahead of the Fed (and more aggressively this year), UK economic data remains a key driver for sentiment towards the British pound. Traders will therefore keep a close eye on Friday’s data dump ahead of the UK open, which includes GBP, industrial production, construction output and trade balance data. Ultimately, softer-than-expected data will likely drive GBP pairs lower on bets the BOE may act sooner, even if they have claimed that current market pricing is too dovish.

Trader’s watchlist: GBP/USD, GBP/JPY, EUR/GBP, FTSE 100

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge