S&P 500 technical forecast: SPX weekly trade levels

- S&P 500 set to snap three-week advance off key support at the yearly open

- SPX500 rally vulnerable below 2023 opening-range high- constructive above 3844

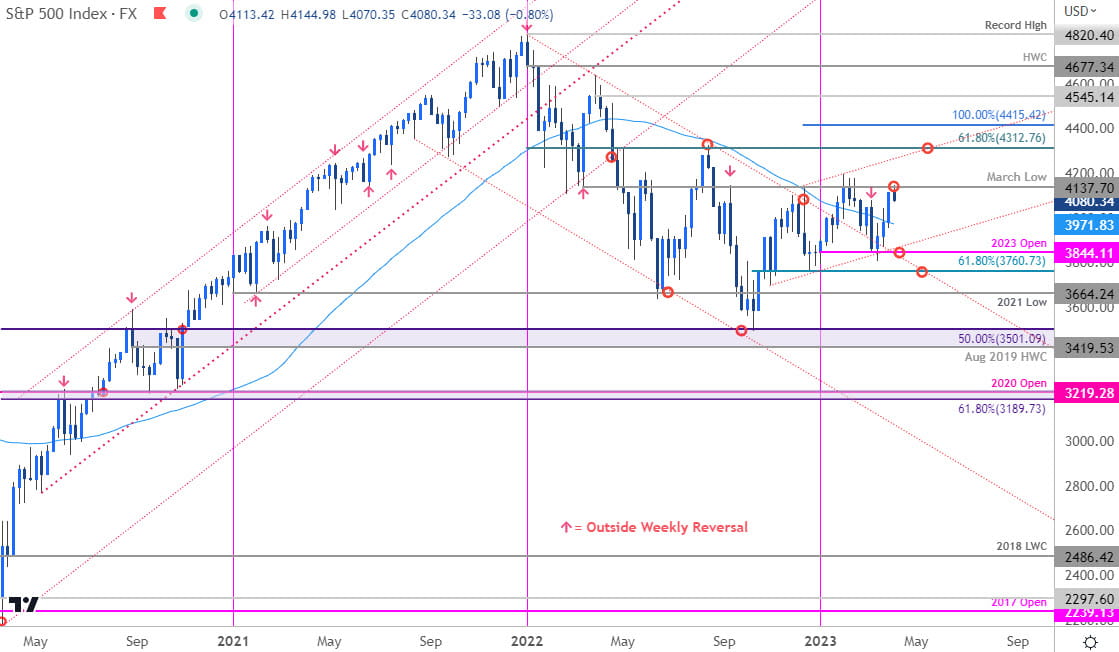

- SPX resistance 4134/37 (key), 4312, 4415– support ~3972, 3844, 3760 (critical)

The S&P 500 is poised to snap a three-week rally with SPX500 responding to technical resistance this week. While the medium-term outlook remains constructive, the advance may be vulnerable here as the bulls test the yearly opening-range highs. These are the updated targets and invalidation levels that matter on the SPX500 weekly technical chart this month.

Discuss this SPX setup and more in the Weekly Strategy Webinars on Monday’s at 8:30am EST.

S&P 500 Price Chart – SPX Weekly

Chart Prepared by Michael Boutros, Sr. Technical Strategist; SPX500 on TradingView

Technical Outlook: In my February S&P 500 technical forecast we noted that the, “sell-off is approaching key support levels into the March open. From at trading standpoint, look to reduce short-exposure / lower protective stops on a drop towards the yearly open.” The index briefly registered an intraday low at 3807 but failed to mark a daily close below 3844. A three-week rally off that mark has extended more than 8.8% off the lows with the SPX500 now testing resistance at the yearly high-week close / March 2022 swing low at 4134/37- looking for a reaction off this pivot zone.

Initial weekly support rests with the 52-week moving average (currently ~3972) backed by the objective yearly open at 3844 and the 61.8% Fibonacci retracement / December low at 3760/63- a break / weekly close below this threshold is needed to mark resumption of the broader downtrend towards the 2021 lows at 3664 and beyond.

A topside breach / close above the yearly opening-range highs at 4196 is needed to validate a larger breakout towards uptrend resistance at the 61.8% retracement of the 2022 range (4312) and the 100% extension of the October rally at 4415- both levels of interest for possible topside exhaustion IF reached.

Bottom line: The S&P 500 has rallied back into resistance near the yearly range-highs- risk for possible exhaustion / price inflection early in the month. From at trading standpoint, a good zone to reduce long-exposure / raise protective stops – losses should be limited to the yearly moving average IF price is heading higher on this stretch. Ultimately a close below 3760 would be terminal with such a scenario threatening another accelerated decline towards fresh yearly lows.

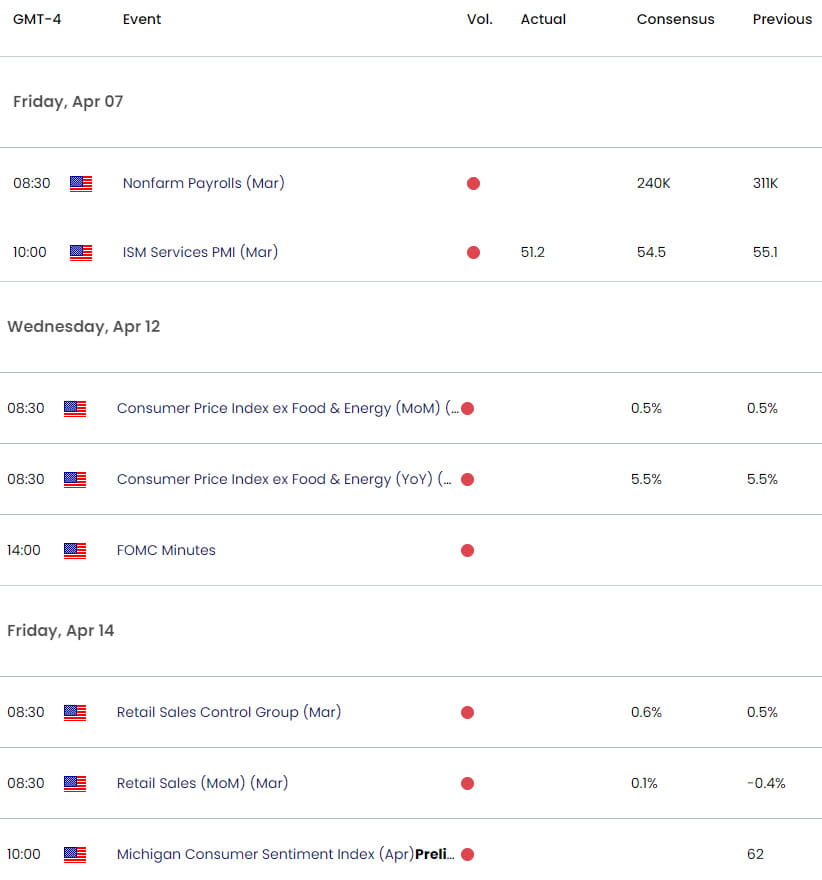

Key Economic Data Releases

Economic Calendar - latest economic developments and upcoming event risk.

Active Weekly Technical Charts

- Euro (EUR/USD)

- Canadian Dollar (USD/CAD)

- British Pound (GBP/USD)

- Gold (XAU/USD)

- US Dollar Index (DXY)

- Crude Oil (WTI)

- Japanese Yen (USD/JPY)

- Australian Dollar (AUD/USD)

--- Written by Michael Boutros, Sr Technical Strategist with FOREX.com

Follow Michael on Twitter @MBForex