S&P 500 technical outlook: SPX500 short-term trade levels

- S&P 500 threatening a third daily decline / fourth-consecutive weekly decline

- SPX500 sell-off approaching key technical levels- risk for price inflection

- SPX resistance 4000, 4025 (key), 4090-4105– support 3906/28 (key), 3844, 3760

The S&P 500 plunged more than 6.5% off the yearly high with the index threatening a fourth consecutive weekly sell-off. The decline is now testing a critical support pivot and we’re looking for possible price inflection off this mark in the days ahead. These are the updated targets and invalidation levels that matter on the SPX500 short-term technical charts.

Discuss this SPX setup and more in the Weekly Strategy Webinars on Monday’s at 8:30am EST.

S&P 500 Price Chart – SPX Daily

Chart Prepared by Michael Boutros, Sr. Technical Strategist; SPX500 on TradingView

Technical Outlook: The S&P 500 is testing a critical support zone today at 3906/28- a region defined by the May low-day close and the 61.8% Fibonacci retracement of the December advance. Note that we have yet to mark a daily close below the 200-day moving average- looking for possible inflection here with the bears at risk while above.

S&P 500 Price Chart – SPX 240min

Chart Prepared by Michael Boutros, Sr. Technical Strategist; SPX500 on TradingView

Notes: A closer look at the index shows the SPX500 trading within the confines of a descending pitchfork formation extending off the February highs with the 25% parallel further highlighting the 3906/28 support zone.

Initial resistance now stands back at 4000 with a breach / daily close above the 38.2% retracement of monthly decline at 4025 needed to suggest a larger reversal is underway - both areas of interest for possible topside exhaustion IF reached.

A break below this key pivot zone would be needed o mark resumption of the short-term downtrend with such a scenario exposing the lower parallel / objective yearly open at 3844 and the 61.8% retracement of the October rally at 3760.

Bottom line: The S&P 500 is testing a critical support zone which if broken, could fuel another bout of accelerated losses for the index. From at trading standpoint, a good zone to reduce short-exposure / lower protective stops – rallies should be capped by 4025 IF price is heading lower with a close below 3906 needed to fuel the next leg in price.

Review my latest S&P 500 weekly technical forecast for a longer-term look at the SPX trade levels.

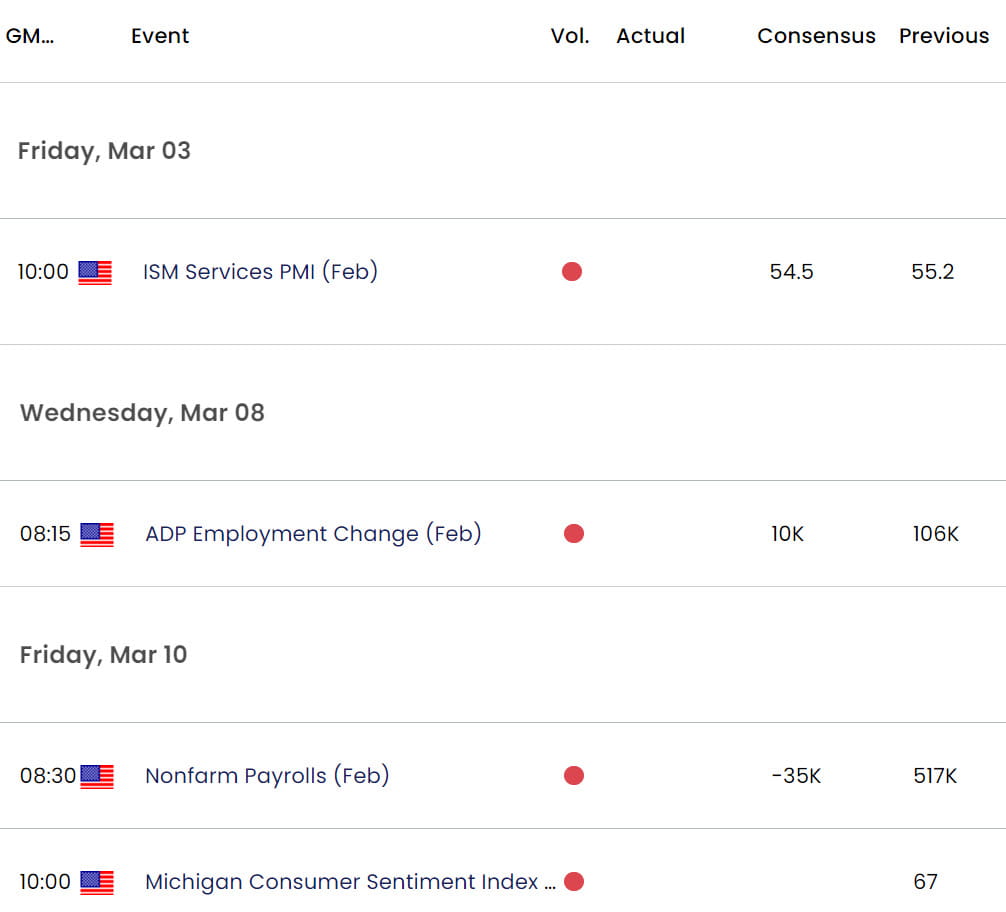

Key Economic Data Releases

Economic Calendar - latest economic developments and upcoming event risk.

Active Short-term Technical Charts

- US Dollar short-term price outlook: DXY looks for a low

- Japanese Yen short-term price outlook: USD/JPY Rally Fizzles

- Gold short-term price outlook: XAU/USD grasps at support

- Australian Dollar short-term outlook: AUD/USD trend support in focus

- Canadian Dollar short-term outlook: USD/CAD Bulls Emerge

- Euro short-term technical outlook: EUR/USD decision time

--- Written by Michael Boutros, Sr Technical Strategist with FOREX.com

Follow Michael on Twitter @MBForex