S&P 500, Nasdaq 100, DJIA Key Points

- Q4 earnings season has been mixed, with an average amount of companies beating earnings and revenue expectations, but by less than usual

- The S&P 500 and Nasdaq 100 remain in healthy uptrends for now…

- …but the DJIA is showing some cracks and is the key index to watch for signs of weakness from here.

S&P 500, Nasdaq 100, DJIA Fundamental Analysis

With most of Q4 earnings season behind us, it’s worth reviewing what we’ve learned so far. Strong results from prominent “Magnificent Seven” names drove US indices to new record highs, but taking a more holistic view reveals a more mixed picture.

According to the earnings mavens at FactSet, 67% of the companies in the S&P 500 have reported results, and 75% of them have beat expectations, roughly in-line with the 5- (77%) and 10-year averages. That said, the magnitude of the beats have been relatively limited at 3.8% above estimates vs. a long-term average in the 7-8% range. Revenue results have been similar with roughly two-thirds of companies beating revenue estimates (historically average), but generally by a smaller amount (1.2%) than we’ve seen of late.

Looking ahead, Nvidia’s (NVDA) earnings next week will be a major hurdle, especially as the stock has now eclipsed fellow “Magnificent Seven” rivals Alphabet/Google (GOOGL) and Amazon (AMZN) in market capitalization this week. From a macroeconomic perspective, Tuesday’s hotter-than-expected CPI reading and this morning’s worse-than-anticipated retail sales report represent possible headwinds for the US consumer as we head through Q1.

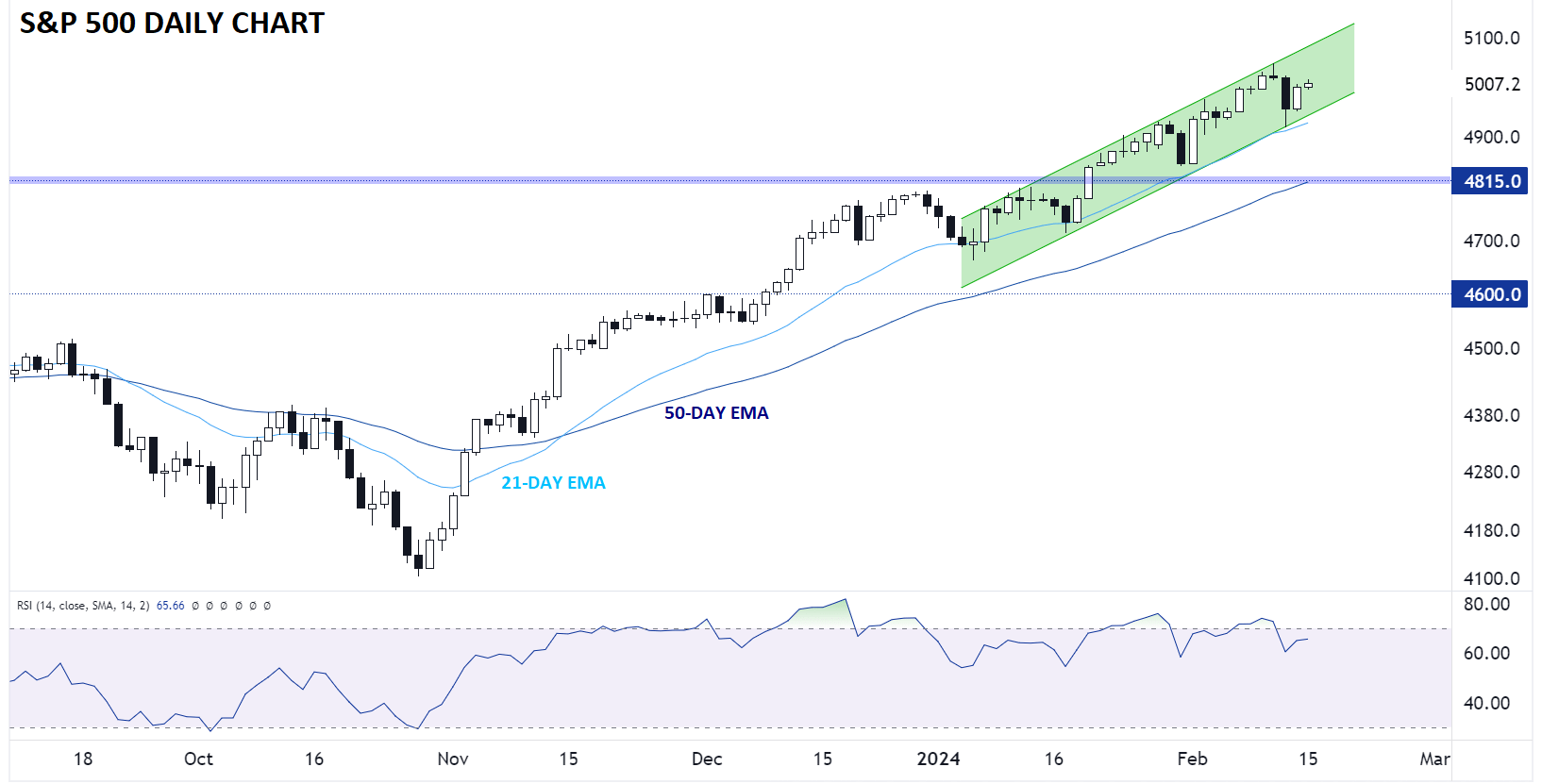

S&P 500 Technical Analysis – SPX Daily Chart

Source: TradingView, StoneX

Looking at the technical outlook for the S&P 500, prices remain in a healthy uptrend for now, despite Tuesday’s big drop. With the index essentially at record highs as we go to press, there’s little in the way of major overhead resistance, so traders may want to maintain their bullish outlook as long as the near-term bullish channel and 21-day EMA hold as support (currently around the 4940 area). Only a break below that area would open the door for a deeper retracement toward previous-resistance-turned-support and the rising 50-day EMA at 4815.

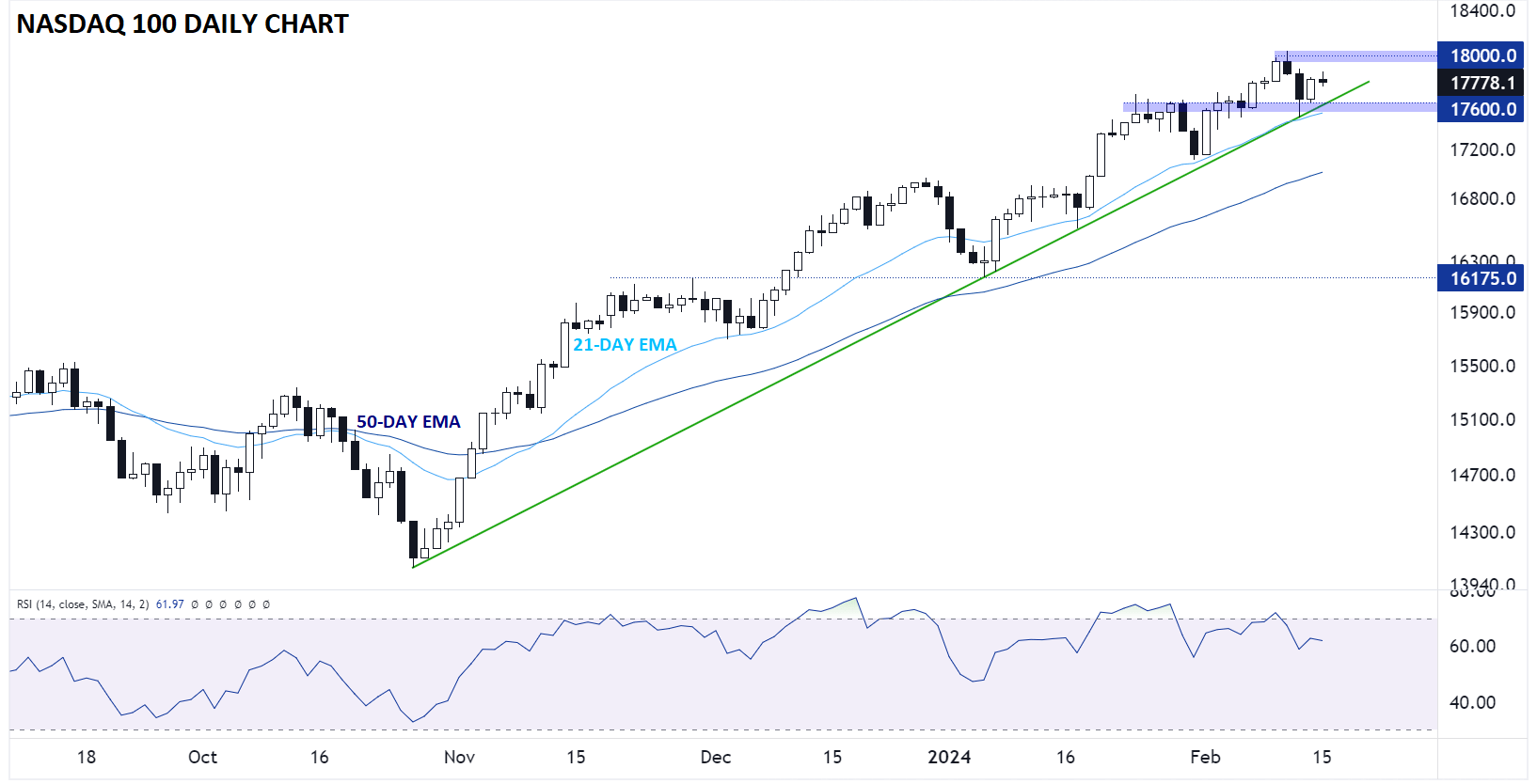

Nasdaq 100 Technical Analysis – NDX Daily Chart

Source: TradingView, StoneX

The tech-focused Nasdaq 100 is in a similarly bullish structure from a technical perspective, with prices holding above a bullish trend line off the October lows and the 21-day EMA. With the obvious caveat that next week’s NVDA earnings will be a major catalyst to watch (5.3% weighting in the Nasdaq 100, in addition to its implications for other major holdings), the path of least resistance remains to the topside for now. A clean break above 18,000 would reconfirm the uptrend and could have bulls turning their eyes toward $20K as the year goes on whereas a drop below 17,600 support could expose the 50-day EMA at $17K next.

Dow Jones Industrial Average Technical Analysis – DJIA Daily Chart

Source: TradingView, StoneX

In contrast to its broader rivals, the Dow Jones Industrial Average has already broken the trend line off its October lows, suggesting that it remains the laggard of the bunch. For traders who are skeptical of the current relentless rally in US indices, considering short positions with a tight stop above this week’s record high may make sense from a risk/reward perspective, though betting against medium-term bullish momentum certainly has risks of its own.

As with the other indices, a confirmed breakout to record highs would alleviate any near-term bearish considerations and could open the door for a bullish continuation toward $40K next.

-- Written by Matt Weller, Global Head of Research

Follow Matt on Twitter: @MWellerFX