S&P 500 Key Points

- The S&P 500 has finished 12 of the last 13 weeks higher, a 1-in-100 event over the last 70+ years.

- Average returns after past such streaks have been strong in the short-term, but more mixed over the next 6-12 months, with lower than average volatility.

- Technically speaking, the S&P 500 remains in a healthy uptrend, with potential to test 5,000+ depending on this week’s fundamental data.

S&P 500’s 1-in-100 “Quarter”

Three months ago, in late October 2023, the S&P 500 and other major indices bottomed simultaneously, and in the 13 weeks since then, they’ve gone (essentially) “up only.”

After last week’s 1%+ rally, the index has now finished 12 of the last 13 weeks higher, an historically rare phenomenon. As the chart below shows, the S&P 500 has finished higher in each of 12+ weeks in less than 1% of rolling 13-week periods since 1950:

Source: TradingView, StoneX

Put differently, the current 12-of-13-“up”-week streak has only happened on 29 occasions out of over 3,800 potential 13-week periods over the last 73+ years; Conveniently, this sample size is essentially the number of occurrences (30) when statistical analysis becomes more predictive.

Interestingly, we have to go back nearly 40 years to the mid-1980s to find the last such occurrence (and the early 1970s before that!). As the chart below shows, there are really only 8 non-overlapping previous examples of such streaks, but analyzing their forward returns could still be instructive:

Source: TradingView, StoneX

S&P 500 Returns After 12 “Up” Weeks in a Quarter

Historically speaking, this pattern of 12 winning weeks out of the last 13 has been a short-term bullish signal, though the longer-term returns (6 and 12 months out) have been worse than average:

- Average price-only 4-week return after 12 “up” weeks in 13: +0.8% (vs. +0.7% in all periods)

- Average 13-week return: +1.8% (vs. 2.2%)

- Average 26-week return: +2.4% (vs. +4.4%)

- Average 52-week return: +7.1% (vs. +8.9%)

In other words, the current streak is a bullish sign throughout the rest of Q1, but as we come into spring, and especially the second half of the year, the outlook for the S&P 500 is less bullish than usual.

Of course, trading and investing are focused on both return and risk, and looking at the standard finance measure of “risk”, standard deviation, we find some evidence that markets may see lower volatility over the rest of the year after consistent rallies like we’ve seen of late:

- S&P 500 4-week standard deviation after 12 “up” weeks in 13: 2.0% (vs. 4.2% in all periods)

- S&P 500 13-week standard deviation: 7.5% (vs. 7.3%)

- S&P 500 26-week standard deviation: 11.3% (vs. 10.7%)

- S&P 500 52-week standard deviation: 8.6% (vs. 15.8%)

After the S&P 500 rises 12 weeks of the last 13 as we just saw, price volatility over the next year is almost half of what it usually is (8.6% vs. 15.8%)! Of course, there’s more than just this bullish Nov-Jan “quarter” that will impact the S&P 500’s returns and volatility, so this analysis is far from exhaustive, but it would be interesting to see lower-than-usual returns and volatility amidst a year when the global economy is expected to slow and the Fed, along with other major central banks, is expected to cut interest rates aggressively.

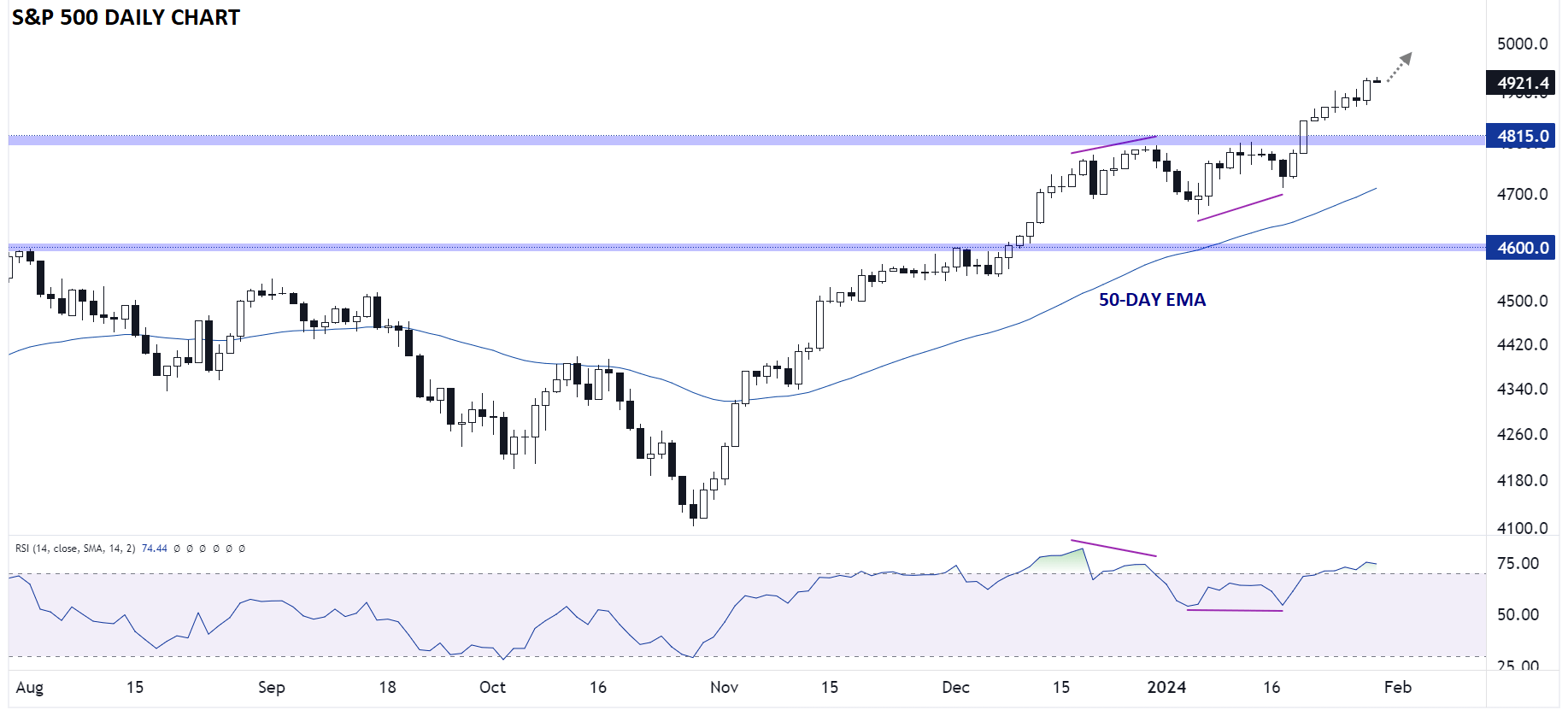

S&P 500 Technical Analysis – SPX Daily Chart

Source: TradingView, StoneX

Zooming into the daily chart reveals a relatively bullish short-term technical outlook for the S&P 500. As the chart above shows, the index set a fresh record high above 4900 yesterday, and the 14-day RSI is only just in “overbought” territory. The index digested December’s bearish divergence in the RSI well, correcting through time rather than through price, so the uptrend remains healthy for now.

Short-term hurdles abound, between major earnings from the likes of Microsoft, Alphabet/Google, Apple, Meta/Facebook, and Amazon this week, as well as top-tier macroeconomic releases including tomorrow’s Fed meeting and Friday’s NFP report, but based purely on the technical trend and strong recent quarter, the path of least resistance remains to the topside for a potential test of 5,000+ in the short term.

-- Written by Matt Weller, Global Head of Research

Follow Matt on Twitter: @MWellerFX