US futures

Dow futures 0.04% at 38110

S&P futures 0.62% at 5081

Nasdaq futures +0.78% at 17572

In Europe

FTSE 0.4% at 8117

Dax 0.72% at 18050

- Core PCE & personal spending were stronger than expected

- Alphabet & Microsoft surge after earnings

- Oil is set to rise across the week

Alphabet & Microsoft beat forecasts

US stocks are rising after impressive numbers from tech giants Alphabet and Microsoft and despite hotter-than-expected call PCE inflation.

Core PCE, the Fed's preferred measure for inflation, rose 2.8% annually in March, in line with February's reading but ahead of expectations of 2.6%. On a monthly basis, core PCE rose 0.3%, unchanged from the previous month. Meanwhile, personal spending was also stronger than expected, rising 0.8% in line with the previous month. Still, ahead of the 0.6% forecast. Households keep spending amid a robust jobs market despite the high interest rates and elevated prices.

The data came after GDP figures yesterday showed that the US economy grew at a slower pace than expected in Q1. However, the core PCE figure for the quarter showed hotter-than-expected overall inflation.

Attention now turns to the Federal Reserve interest rate decision next week, where the Fed is expected to leave rates unchanged at the 5.25 to 5.5% level. Policymakers have adopted a more hawkish stance in recent speeches, which, together with signs of sticky inflation, has caused the markets to push back on rate cut expectations.

The market is now just pricing in one full 25 basis point rate cut this year, with September looking to be a likely date. However, a more hawkish Federal Reserve next week may see this pushback further.

Corporate news

Alphabet has risen 12% in premarket trade, hitting a record of over $174.70 a share, after posting stronger-than-expected Q1 earnings thanks to strong demand for its AI offerings. The tech giant posted EPS of $1.89 versus $1.51 expected on revenue of $80.54 billion, ahead of the $78.59 billion forecast. Alphabet also declared its first-ever dividend of $0.20 per share.

Microsoft trades 4% higher premarket, as robust demand for its AI products helped the firm post stronger than expected Q1 earnings. Microsoft posted EPS of $2.94 versus $2.82 expected on revenue of $61.86 versus $60.80 expected. This marked total revenue growth of 17% year over year. The solid numbers and near-term monetization of AI have helped lift the share price.

Snap is set to open 20% higher after the social media firm posted stronger-than-expected Q1 earnings and offered an upbeat outlook. Other social media stocks also rose after the US approved a bill that gave US video streaming app TikTok a year to divest or leave the US.

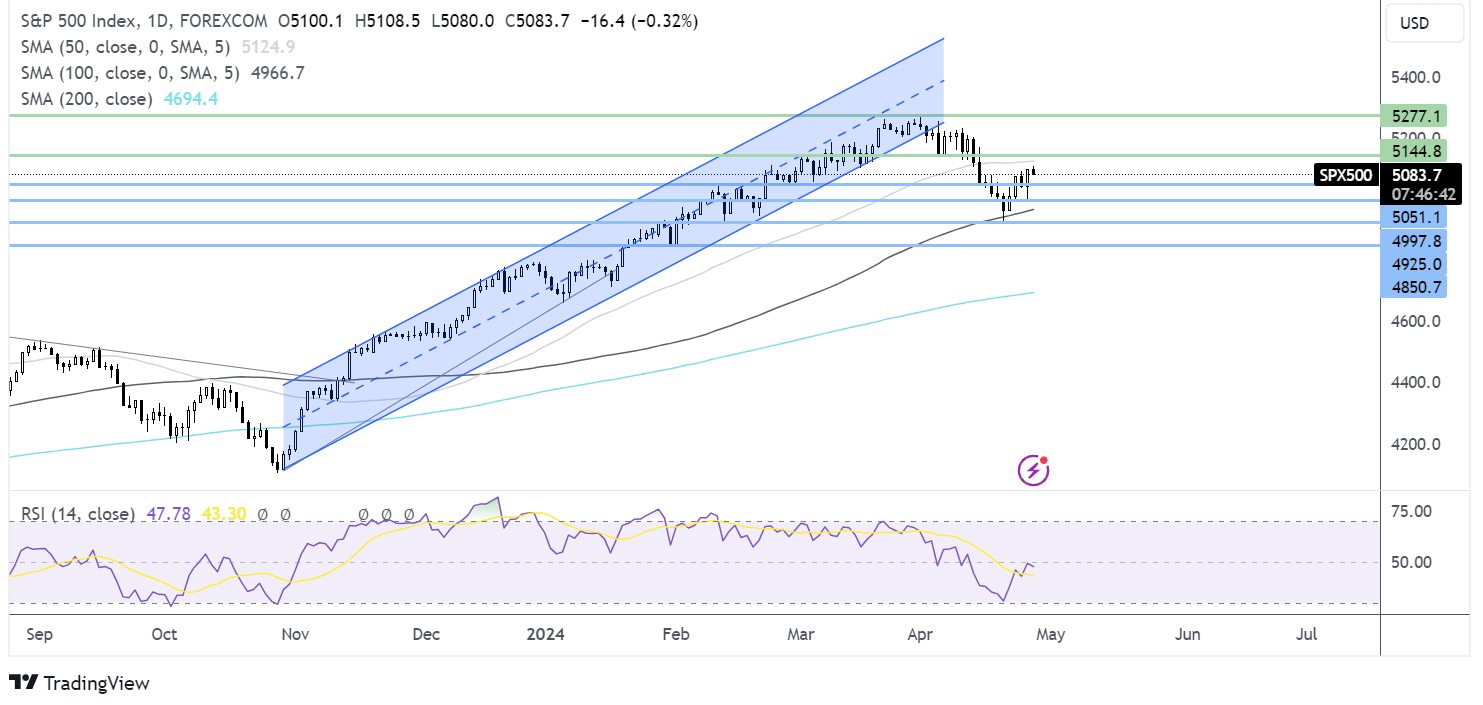

S&P 500 – technical analysis.

S&P 500 has recovered from last Friday’s low at 4925 and has extended gains back above 5000 and 5050, as it eyes its next target of 5140, the early April low. The long lower wick on yesterday’s candle suggests that selling pressure was low at the lower levels. On the downside, support at 5055 and 5000 is seen.

FX markets – USD rises, EUR/USD falls

The USD is rising after inflation data was hotter than expected, supporting the view that the Fed is is no rush to cut rates soon.

EUR/USD is falling, but it's still set to book gains across the week after the euro has been boosted by optimism that the economy is recovering. German consumer confidence and business optimism were both stronger than expected this week, adding to signs of recovery. Meanwhile, attention is now turning to eurozone inflation data and GDP figures next week.

USD /PY has risen confidently above 156 after the Bank of Japan left interest rates on hold at 0.1% in line with forecasts. The central bank also upwardly revised its inflation forecast but downwardly revised its growth outlook, raising questions over whether the central bank would be able to hike rates. Meanwhile, take-care inflation was much weaker than expected, at 1.8% below the target 2% level. Investors remain jittery over intervention fairs.

Oil holds steady

Oil prices are rising for a second straight day and are on track to book gains of 1.5% across the week, snapping a 2-week losing streak.

The move higher in oil comes after U.S. trade secretary Janet Yellin said she is confident about the growth outlook for The US economy despite the weaker-than-expected Q1 GDP data.

Meanwhile Fed rate cut expectations remain very much in focus after cool PCE data and ahead of the Federal Reserve interest rate decision next week. Well, the Fed is not expected to move on rates, and a more hawkish-sounding Fed could point to slower economic growth, hurting the oil demand. Outlook.