The last SoMP was in August, pre extended lockdowns in Sydney and Melbourne, and the vaccination rate surge during the quarter.

As a result of the recent bond market turmoil, the statement accompanying Tuesday's RBA interest rate decision included greater detail than usual, stealing much thunder from tomorrow's SoMP.

Below is a comparison of the RBA’s updated forecasts from Tuesday against forecasts from the August SoMP. Perhaps surprisingly, given higher than expected inflation and extended lockdowns, forecasts have changed very little.

GDP

RBA meeting Tuesday

The central forecast is for GDP growth of 3 per cent over 2021 and 5½ per cent and 2½ per cent over the following two years.

August SoMP

GDP growth is expected to be a little over 4 per cent over 2022 and around 2½ per cent over 2023.

Employment

RBA meeting Tuesday

The central forecast is for the unemployment rate to trend lower over the next couple of years, reaching 4¼ per cent at the end of 2022 and 4 per cent at the end of 2023.

August SoMP

The central forecast is for the employment rate to reach 4 ¼ percent by the end of 2022 and 4 percent at the end of 2023.

Inflation

RBA meeting Tuesday

The central forecast is for underlying inflation of around 2¼ per cent over 2021 and 2022 and 2½ per cent over 2023.

August SoMP

In underlying terms, inflation is expected to be 1¾ per cent over 2022 and 2¼ per cent over 2023.

Therefore, the real interest will not be in the details but an explanation of why forecasts have changed so little despite all that has happened and the cajoling of the bond market.

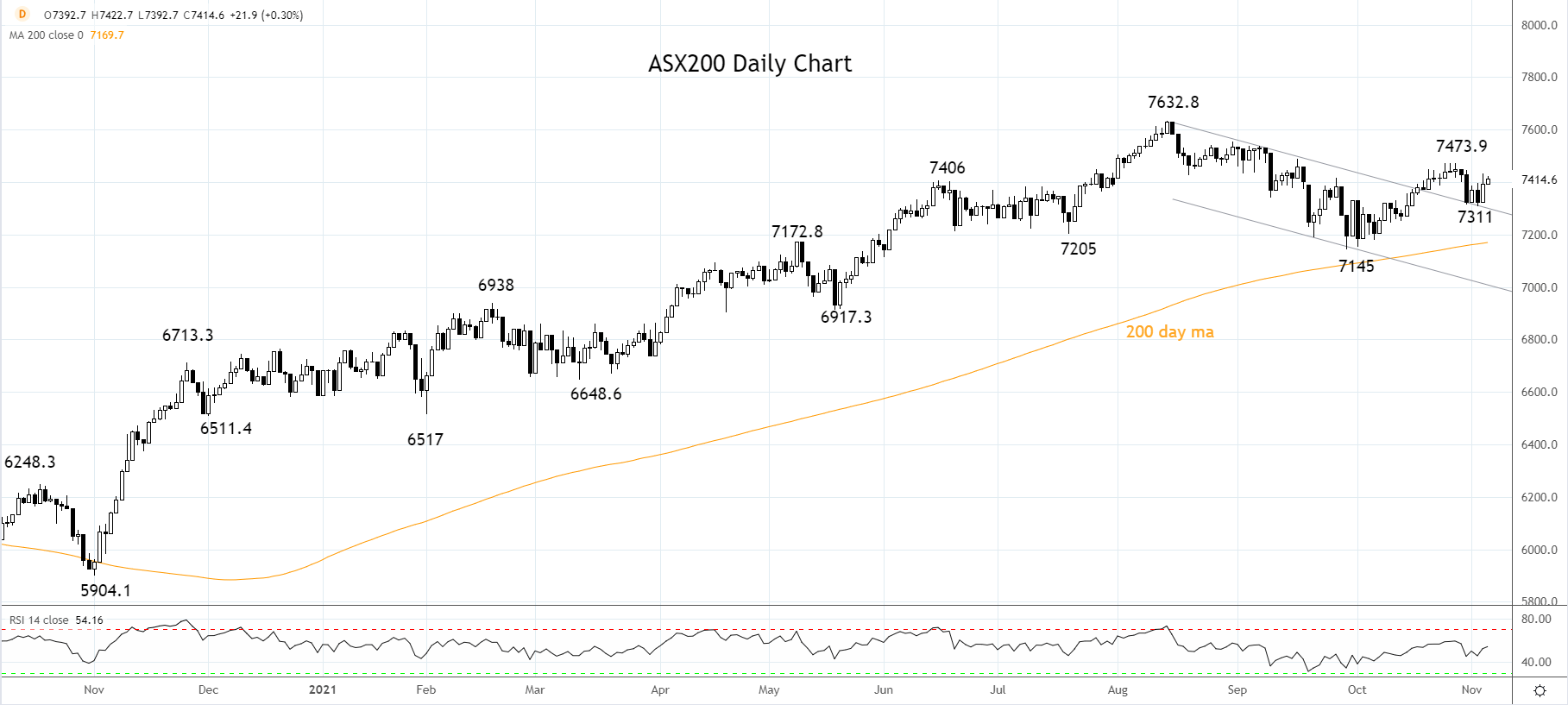

Turning now to the ASX200. As viewed on the chart below, after four consecutive tests of the support near 7310 (from the top of the broken trend channel), the ASX200 spring boarded higher yesterday and built on those gains today.

Providing the ASX200 holds above the support from the quadruple low 7310 area, we remain bullish, looking for a retest of the August 7632 high, with scope towards 7750 into year-end.

Source Tradingview. The figures stated areas of November 4th, 2021. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

- Open a Forex.com account, or log in if you’re already a customer.

- Search for the pair you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.