With just one week to go until the US election, we take a statistical look at how key markets have performed in the days surrounding this major event.

The data may appear daunting at first, but there are a couple of distinct patterns which are worth noting.

- European and US stocks tend to rise the day prior, and of the US election, yet hand back gains the two days after

- The Japanese yen (JPY) tends to attract safe-haven flows two days prior to the election (T-2) and the two days after (T+1 and T+2)

- Volatility also increases at T+1, although keep in mind that this captures the overnight volatility form the US (during the Asian session) as the election results pour in

- Data covers the past eight elections from 1992, with the exception of US index and VIX futures which are from the 2000 election

Please note that this data is not predictive, as it merely looks at the averages of historical performances of the respective markets. However, it can be used to complement your own analysis.

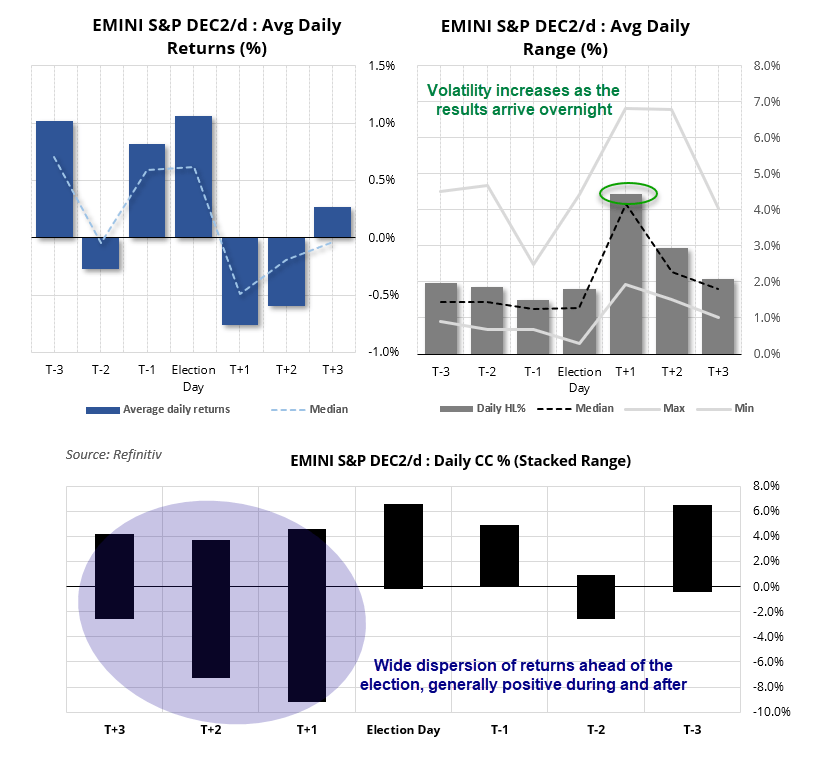

S&P 500 futures: US election performance

- Average and median returns are positive on election day

- However, the wide dispersion of returns in the three days ahead of the election suggests the positive average returns over this period may be less reliable

- Note the pickup of volatility the day after the election (T+1) which is because this captures the overnight US data as results arrive

- The median daily range is more than double the median range ahead of the election

- Data is from November 2000 onwards

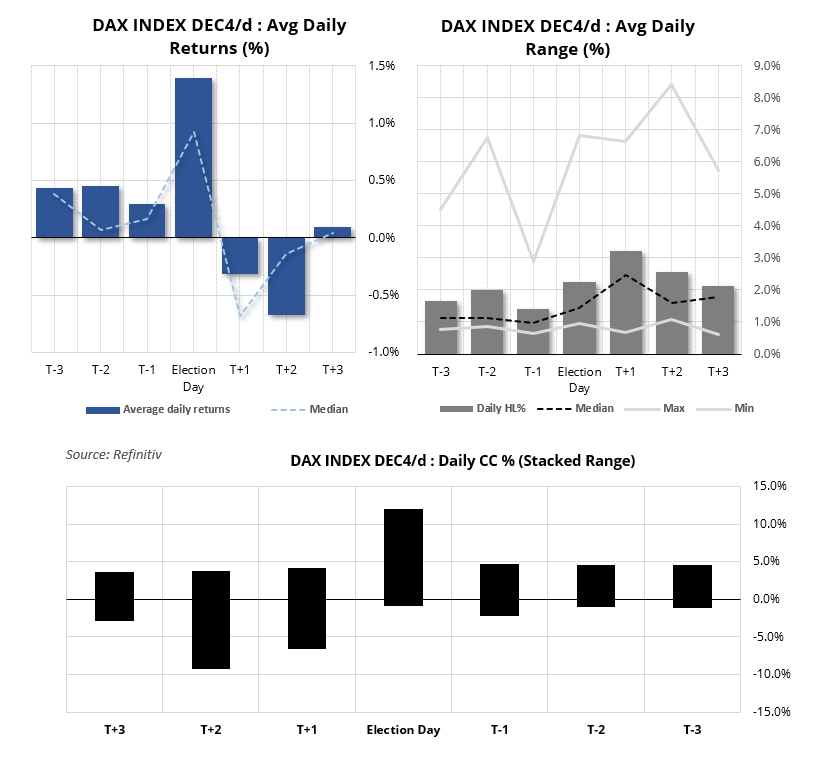

DAX futures: US election performance

- Similar to the US markets, DAX futures tend to perform well on US election day

- Volatility also increases the day after, as the votes are confirmed

- A wide dispersion of results the three days deems the positive average returns over this period less reliable

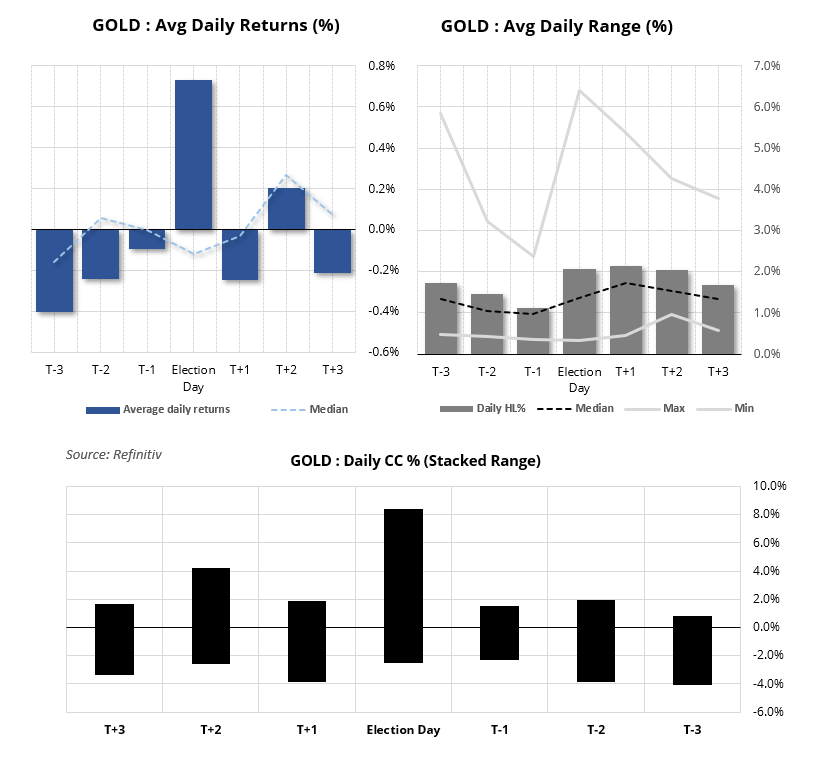

Gold spot: US election performance

Gold has presented some very mixed results.

- While it has a clear positive average on election day, its median (typical) return has been negative.

- The tree days leading up to the election has seen gold post negative returns on average, which is against the traditional convention of traders ‘hedging’ into the risk event via the yellow metal.

- The daily high-to-low range is typically between 0.98% - 1.7%

- The most volatile days have been between election day and T+2 (with T+1 being the peak)

- The two days ahead of the election has seen daily volatility diminish

- Similar to the US markets, DAX futures tend to perform well on US election day

- Volatility also increases the day after, as the votes are confirmed

- A wide dispersion of results the three days deems the positive average returns over this period less reliable

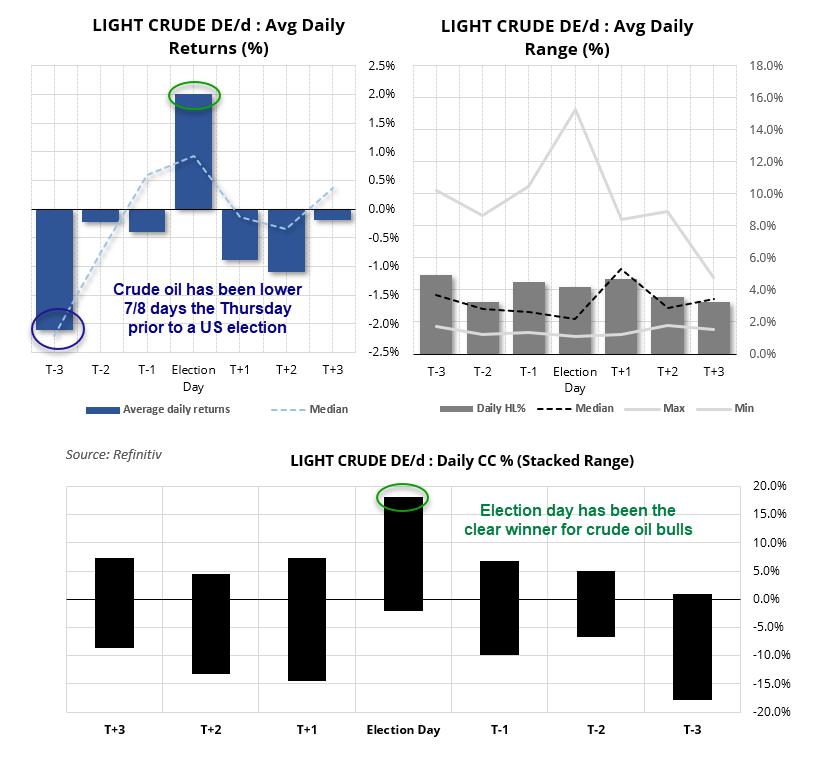

WTI crude oil performance around the US election

- Election day has been a clear winner for crude oil prices over the past eight US elections, with a average returns of 2% and positive median return of 0.9%

- The three days prior (T-3) has posted average and negative returns of around -2%, with minor average returns also being posted the two days prior to the election

- T-3 (prior Thursday) has produced negative returns 7 of the past 8 elections

- The dispersion (stacked range) also shows the three days either side of the election tend to be negative, with just election day providing a positive skew for crude oil returns.

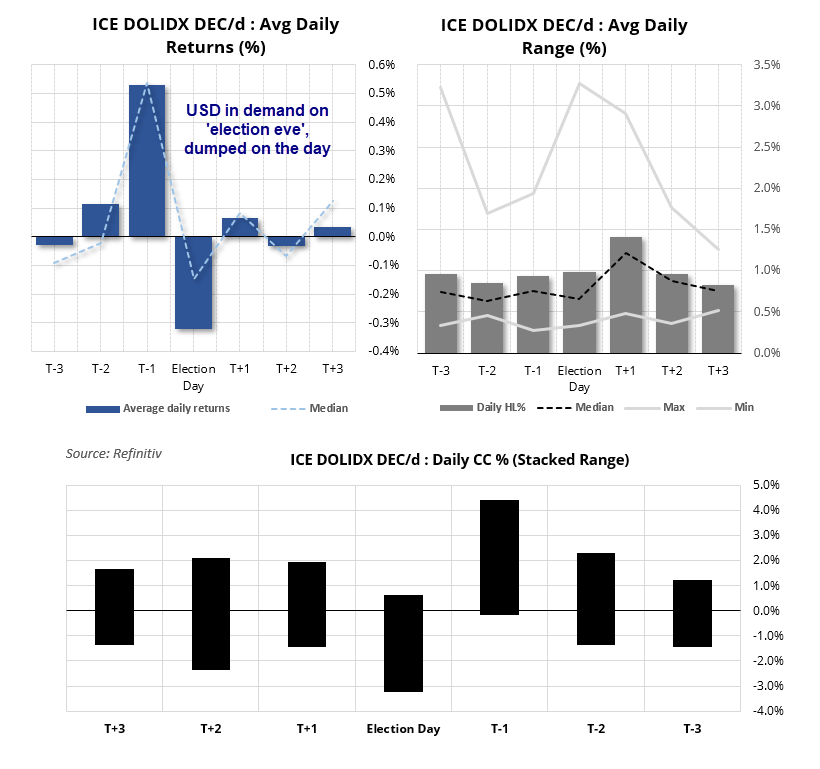

USD index: US election performance

- Performance of the USD index is mixed to suggest unreliable signals overall

- T-1 (election eve) is the clear winner for the USD index

- And election day is the clear loser, where average and median returns are concerned

- Volatility peaks at T+1 as the results flow in

- Election day has negative average returns alongside a negative skew, to suggest USD profits are booked on election day

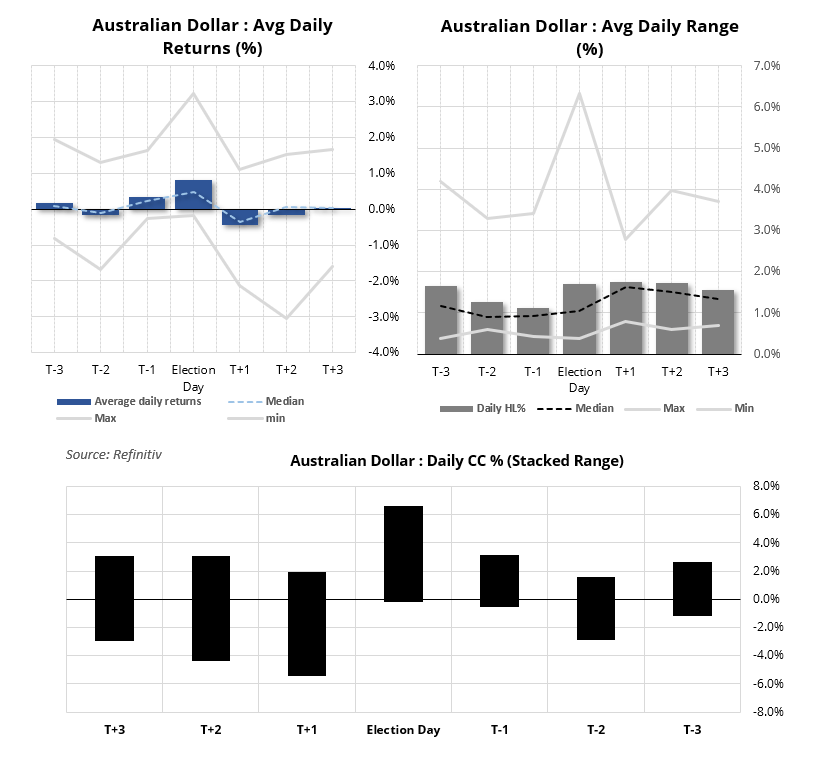

AUD/USD performance around the US election

Daily returns

- AUD/USD average and median returns peak on election day, painting a ‘risk-on’, positive bias

- Yet average returns dip to negative the day after the election

- Median posts positive gains on T+2 whereas average posts negative returns

Average daily range:

- Median high-low range of 0.9% to 1.6%

- Volatility tends to diminish the two days ahead of the election

- The maximum has been lifted notably, thanks to the election during the GFC in 2008

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

Latest market news

Today 08:30 PM

Today 07:15 PM

Today 04:10 PM