Silver Talking Points:

- Silver prices have had a strong Q4 so far, initially bouncing up to a fresh 12-year high in October before pulling back.

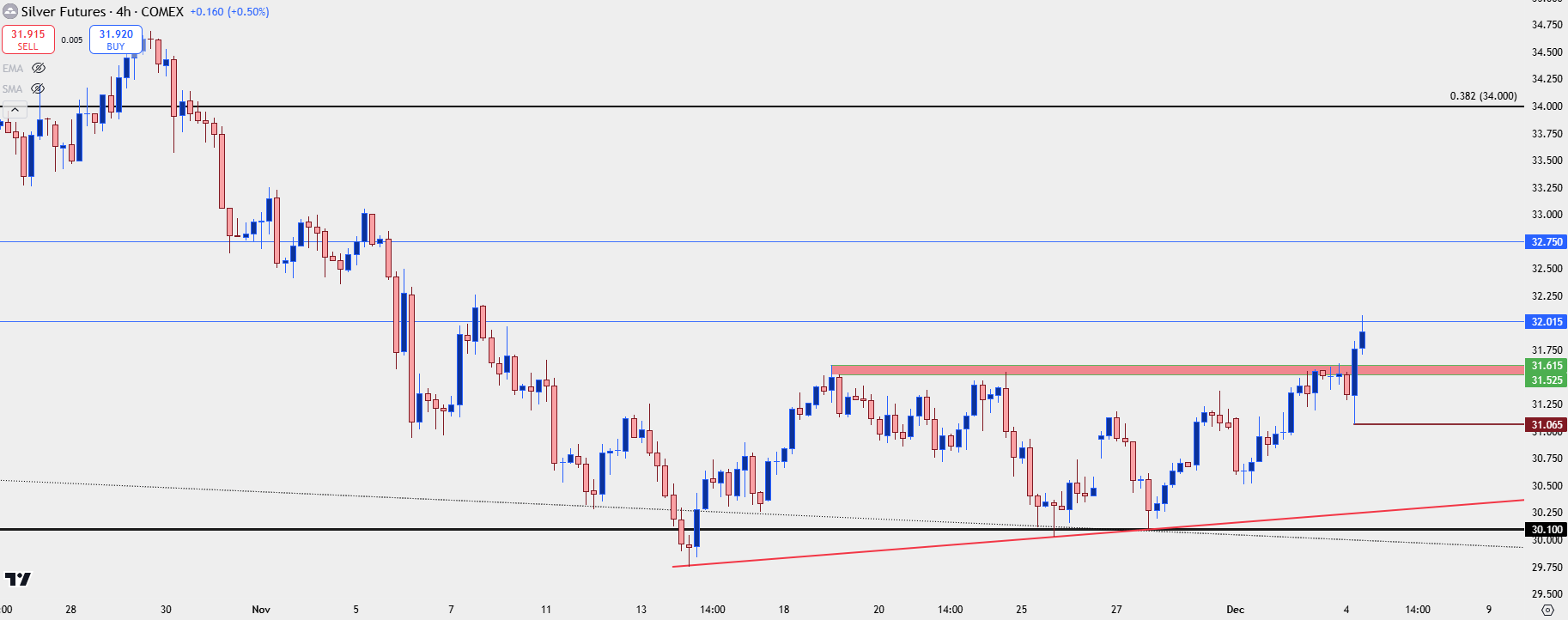

- The pullback from that breakout has held the 30-handle on multiple tests, including a higher-low last Friday at $30.10 in silver futures. That has led to another strong bounce this week as price has worked up to a resistance test at the 32.02 level, and there’s now a shorter-term series of higher-highs and lows to work with.

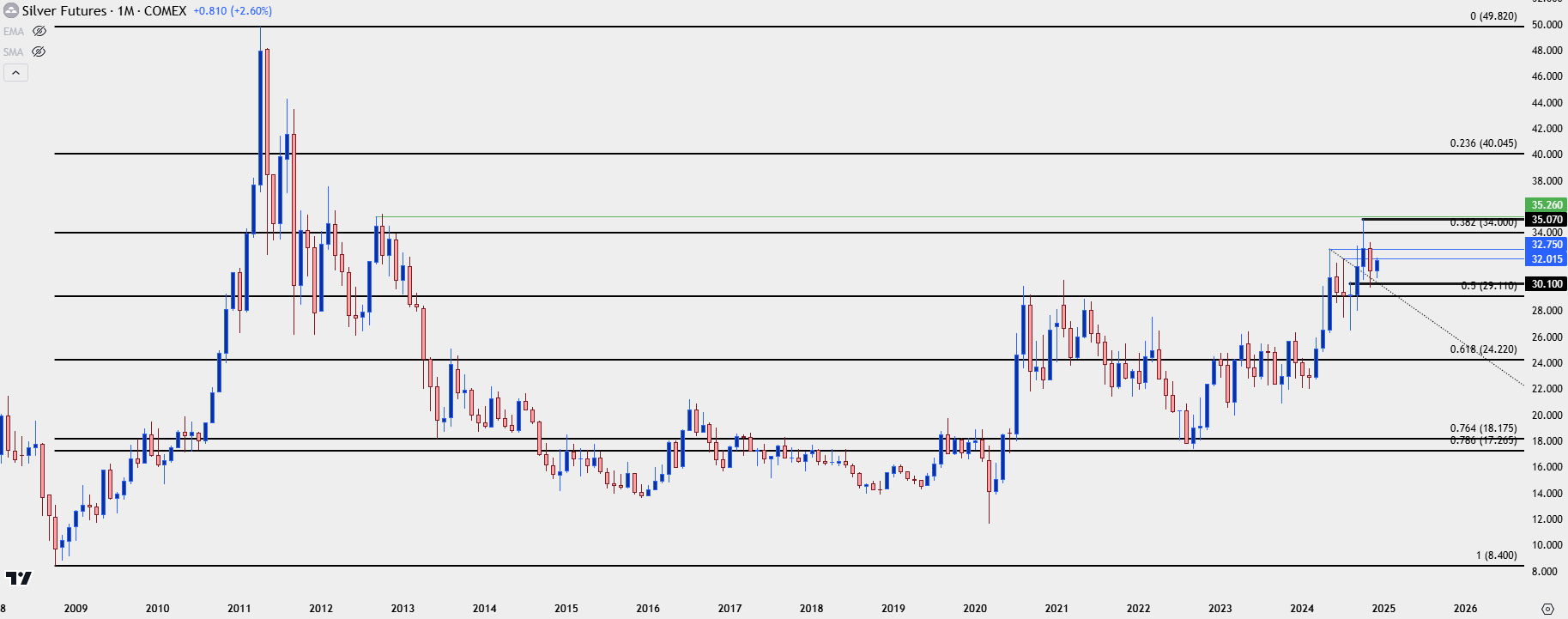

Silver prices put in a massive move to start Q4 trade, setting a fresh 12-year high with the metal’s first test of the 35-handle since October of 2012. At the time, gold prices were still gaining aggressively in a trend that had spanned most of 2024 trade and expectations were high for the Fed to continue cutting rates after their 50 bp cut in September. So that move seemed a part of a broader shift of risk-on behavior across markets, driven by the expectation for a soft and passive FOMC to push rates-lower through 2025 trade. Things have changed a bit since then, with gold posting its first monthly loss since January in November. Matters in silver haven’t been as bearish, however, if we take a step back and look at the big picture.

But – that 35 level was a big spot, and it soon led to profit taking as silver prices then sank back down for a test of the 30-level, which is also a major price level for the metal.

Silver held the initial support test of 30 in mid-November and that then led to a strong move-higher, and in the linked article I used a question in the title, asking whether the low was in. Now that we’re a few weeks later we can see that the low from November 14th has since held, and buyers have now shown two higher-lows with defense of that major psychological level.

On Friday, buyers held the low at a prior point of resistance of 30.10 and so far this week, bulls are making a push up to resistance at 32.02.

Silver Daily Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

Silver Bigger Picture

Going out to the monthly chart paints a bullish picture, in my opinion. While the test of a 12-year high did lead to an extended upper wick on the monthly bar, there was a similar extended wick on the underside of the November candle, illustrating that support at the 30-level. This keeps the door open for bulls to make another press-higher, with resistance levels overhead at 32.75, 34.00 and then, of course, 35.00.

Silver Monthly Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

Silver Shorter-Term, Strategy

Timing a longer-term move such as what shows above can always present challenge, but given the recent breakout following the build of higher-low support above the 30-level, there’s some structure to work with.

There was a prior zone of resistance that held multiple tests and that spans from 31.53-31.62. If resistance at 32.02 can remain in-place and prices pull back, that zone would ideally be the area that bulls would defend to keep the door open for short-term topside trends. A breach below that wouldn’t necessarily eliminate bullish trend potential, but if prices breach the earlier-morning low of 31.07, that should at least come into question, as there would be violation of the higher-high and higher-low structure that’s shown over the past few days.

Silver Four-Hour Price Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

--- written by James Stanley, Senior Strategist