- Silver and NZD/USD hit fresh lows, pressured by rising U.S. rates and strong dollar

- Quiet economic calendar next week could allow for countertrend reversals

- Key levels offer fresh trading opportunities on both the long and short sides

Overview

Silver and New Zealand dollar have been hammered by higher U.S. rates and relentless U.S. dollar strength, sliding to fresh lows on Thursday. While that environment is unlikely to change anytime soon, sitting near key levels on the charts, it provides fresh setups to play them from either the short or long-side.

After such a prolonged move lower, and with markets now pricing far fewer rate cuts from the Federal Reserve, the risk of some form of short squeeze is growing in the near-term.

Traders slash Fed rate cut bets

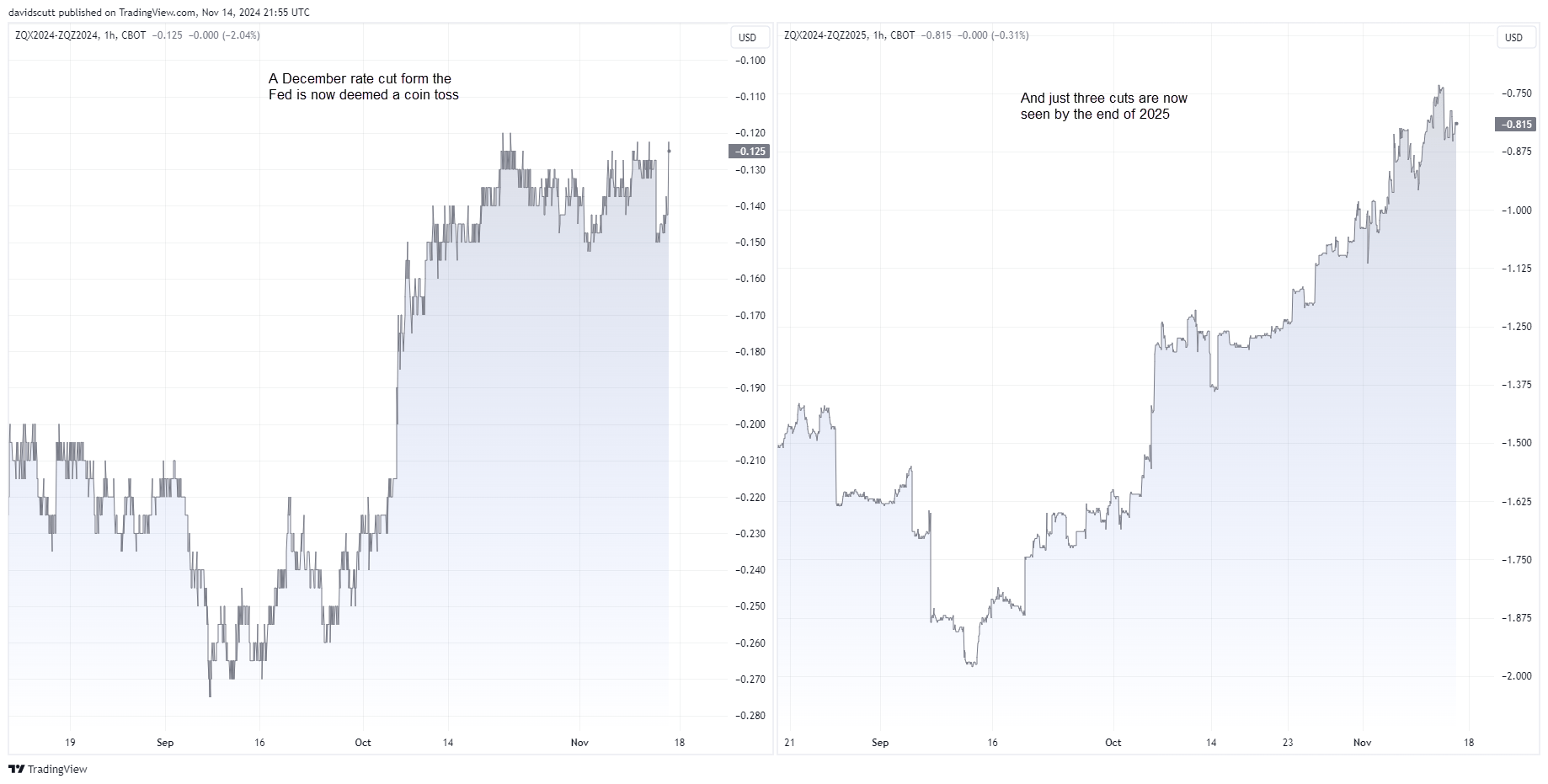

Market expectations for Fed rate cuts continue to shrink, driven by strong U.S. economic data and signals from Fed officials, including Jerome Powell on Thursday, that the pace of easing could slow considerably in the months ahead. A 25bps cut in December is now seen as a coin flip, with just three cuts priced by the end of 2025, down from nearly eight two months ago.

Source: TradingView

U.S. bond yields powering dollar wrecking ball

As rate cut bets have dwindled, that’s combined with expectations for an expansionary fiscal policy environment under the Trump Administration to lift Treasury yields sharply higher, weighing on the Kiwi and silver.

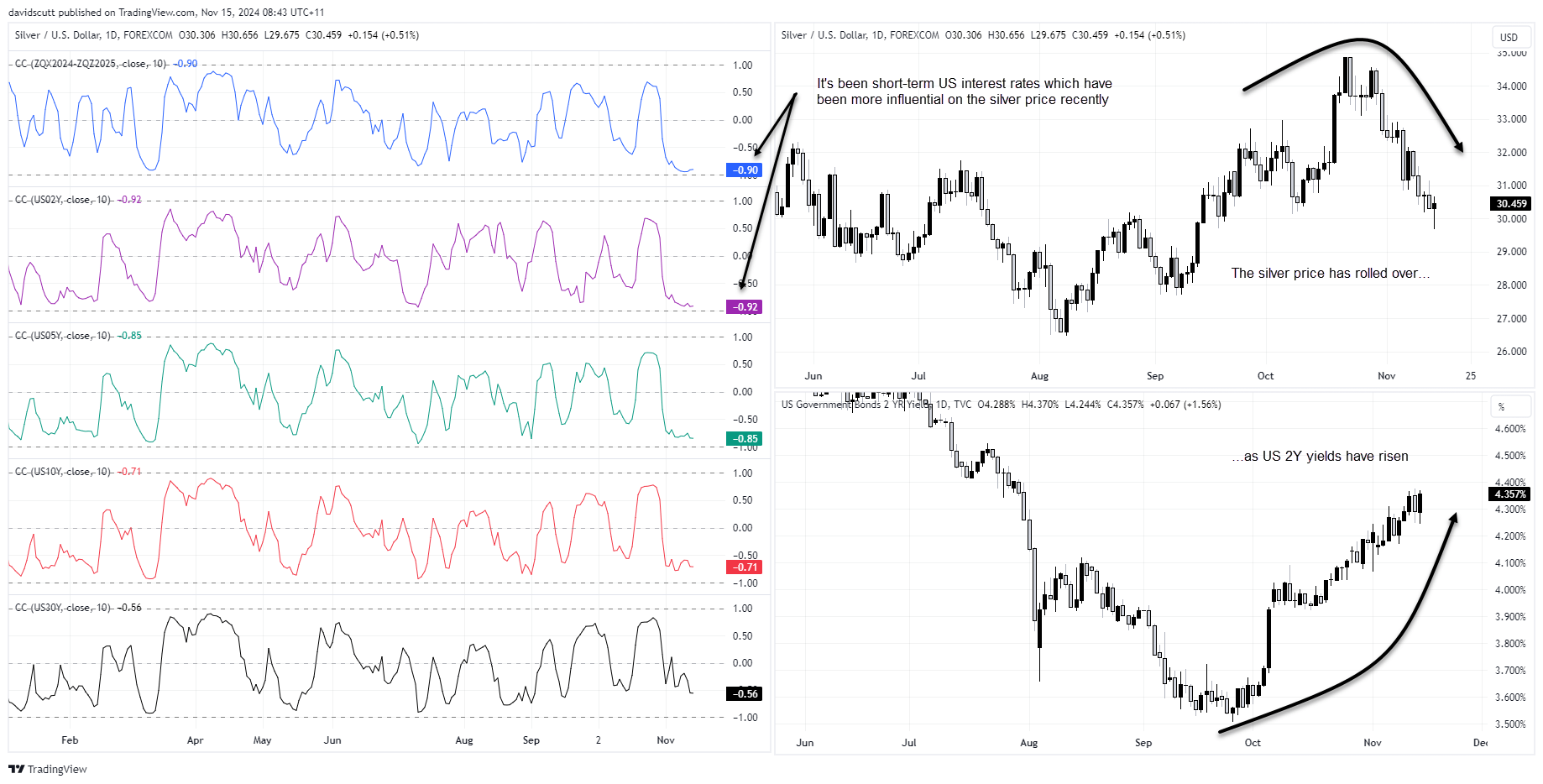

It’s been the front-end of the U.S. interest rate curve – which is largely driven by Fed rate expectations – that’s been most influential on silver over the past fortnight.

Source: TradingView

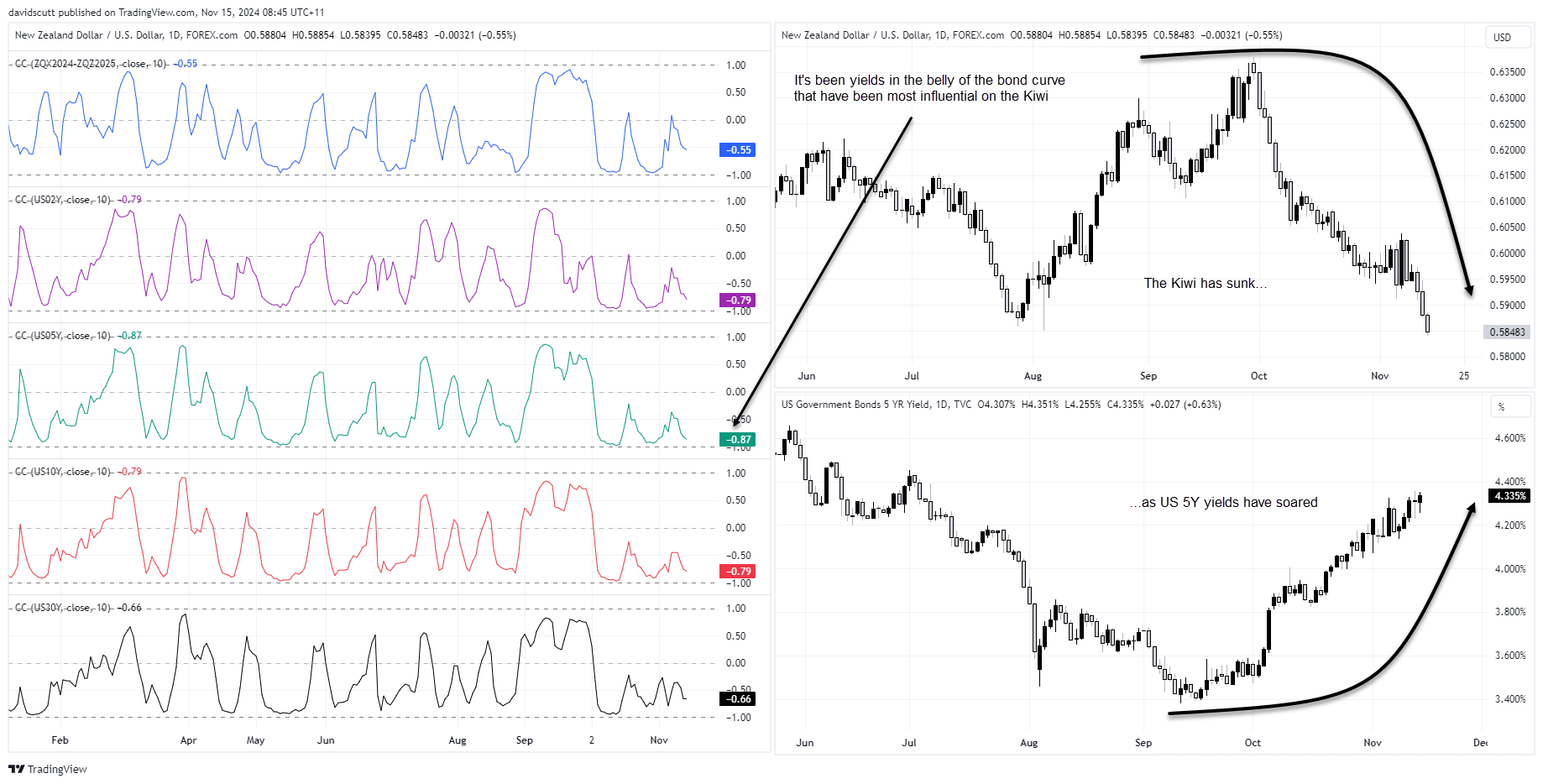

Similar trends have also been evident for NZD/USD, although it’s the belly of the curve – which includes debt with maturities between two to 10-years and incorporates fiscal policy – that’s been more influential on its movements.

Source: TradingView

Quiet calendar an invitation to squeeze?

While doubtful we’ll see a shift in the macroeconomic backdrop of higher U.S. rate and dollar near-term, especially with an incredibly quiet calendar next week, the lack of potential catalysts that could amplify those trends provides a window for countertrend reversals. The only near-term hurdle is the U.S. retail sales report for October released later Friday.

Silver may have put in a near-term bottom

Source: TradingView

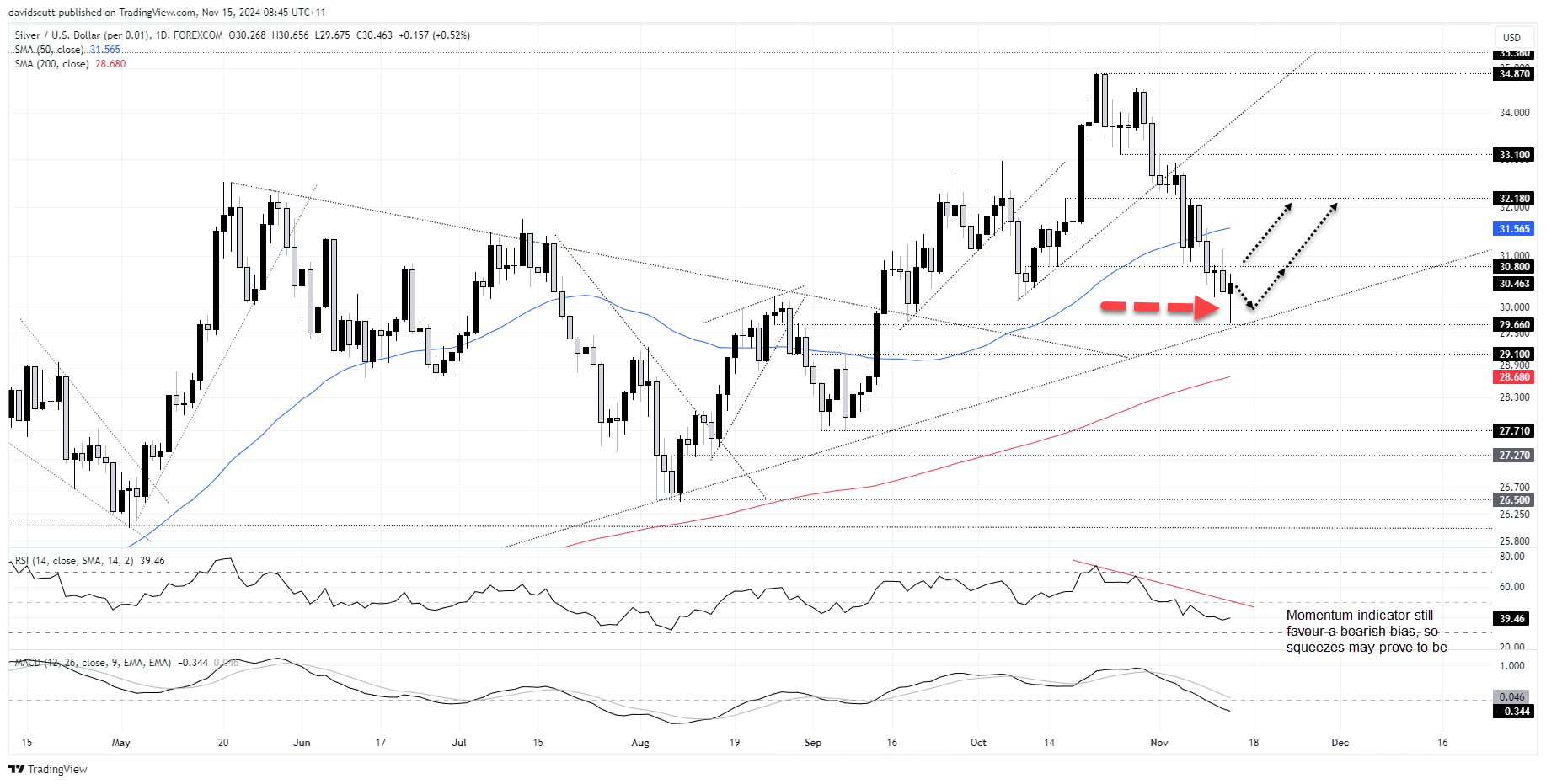

A squeeze may have already started in silver with a hammer candle printing on Thursday. Traders took one look at the intersection of uptrend support established in February and horizontal support at $29.66 and baulked, sparking a price reversal often seen around market bottoms.

While momentum indictors such as RSI (14) and MACD continue to provide negative signals, favouring a bearish bias, the price signal hints we may see further upside in the near-term.

$30.80 is the first topside level of note with the 50-day moving average and $32.18 the next after that.

Some traders may want to get long purely on the price signal, but ensure you use a tight stop given a lack of nearby technical levels to use for protection.

Setups with better risk-reward would be to wait for a potential break above $30.80 or a pullback towards uptrend support, allowing for stops to be placed below either level for protection.

Kiwi teetering on 2024 low

Source: TradingView

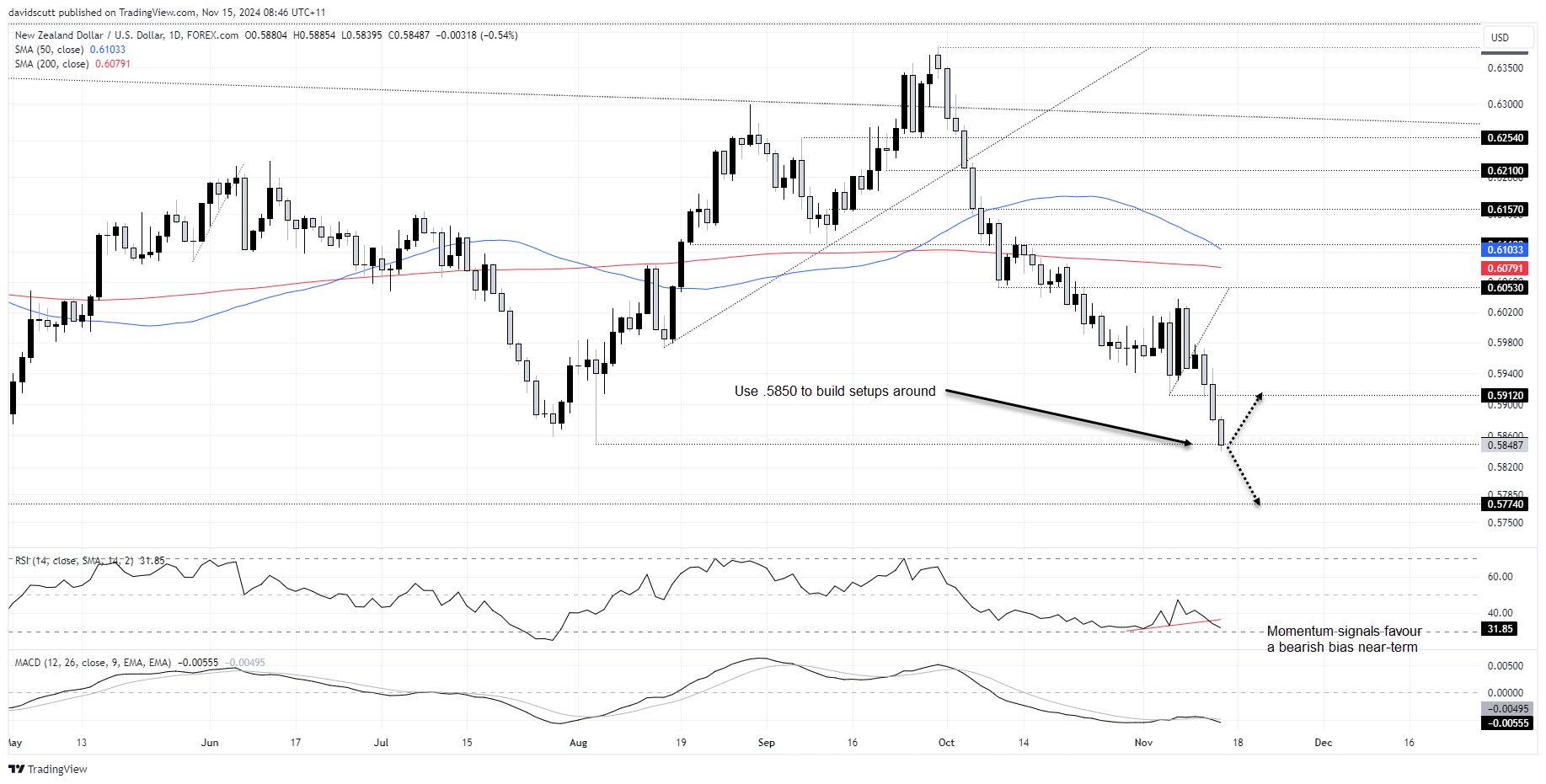

The case for upside in NZD/USD looks less convincing near-term, fumbling around the low set during Japan’s market meltdown in August. RSI (14) has broken its uptrend and MACD has crossed over from above, confirming the bearish signal on momentum. While shorts are favoured, the Kiwi has fallen a long way already, so let the price action tell you what to do near-term.

If it makes fresh lows, consider selling with a tight stop above .5850 for protection. .5774 comes across as appropriate trade target. Alternatively, if the price can’t crack .5850 convincing, you could buy with a tight stop beneath targeting a return to former support located at .5912.

-- Written by David Scutt

Follow David on Twitter @scutty