By Monday afternoon, gold and silver prices, along with other metals like copper, were all holding in the green. In the last several weeks, gold and silver have not been trading quite in unison as they were in the past. This was mainly because of haven demand supporting gold during the mini turmoil we recently saw, with equities dropping amid a sharp yen recovery. While gold (XAU/USD) has been recovering steadily, aiming for its sixth consecutive month of gains, silver (XAG/USD) has struggled, closing lower for two consecutive months. But our silver forecast remains bullish, and a new rally could be underway soon.

Silver forecast: calmer markets enhance XAG/USD’s appeal

The underperformance of silver in the last couple of months follows a significant rally between March and May. The recent volatility in financial markets, driven by the unwinding of yen-funded carry trades, hit silver hard, given its higher risk sensitivity compared to gold. However, as market conditions stabilise, silver appears to be forming a base and could be set for a recovery this month.

Since last Tuesday, the market has become calmer, leading to a reassessment by rates traders of the likelihood of aggressive rate cuts by the Federal Reserve. Earlier fears had led to expectations of an emergency rate cut before September, but now the market sees an equal chance of a 25- or 50-basis-point cut at the September FOMC meeting. The lack of market panic has created a more stable environment, allowing silver to recoup some of its recent losses that were driven by the yen-funded carry unwind.

Key economic data this week: impact on silver forecast

This week, the silver forecast will be heavily influenced by critical economic data from the US and China. The US dollar index, which inversely affects silver prices, could decline if US inflation data shows no significant upward surprises. Lower inflation could support silver, as it reduces the need for higher interest rates.

Attention will be on the US Consumer Price Index (CPI) and Producer Price Index (PPI), set to be released on Wednesday and Tuesday, respectively. Recent disappointing jobs data and ISM manufacturing PMI results suggest the possibility of weaker inflation, which could pressure the US dollar and boost silver prices. Market expectations are for a modest 0.2% month-on-month increase in both headline and core CPI and PPI figures. A weaker-than-expected inflation report could reinforce market confidence in multiple rate cuts in 2024, further supporting a potential silver rally.

In addition to US inflation, silver traders will monitor US retail sales data on Thursday and earnings reports from major retailers like Walmart and Home Depot. These reports could offer insights into the health of the US consumer and the impact of tight monetary policy on consumption, which in turn could influence the silver market.

Meanwhile, the Chinese data, which includes industrial production and fixed asset investment, due out on Thursday, should be important for industrial metals like copper and silver.

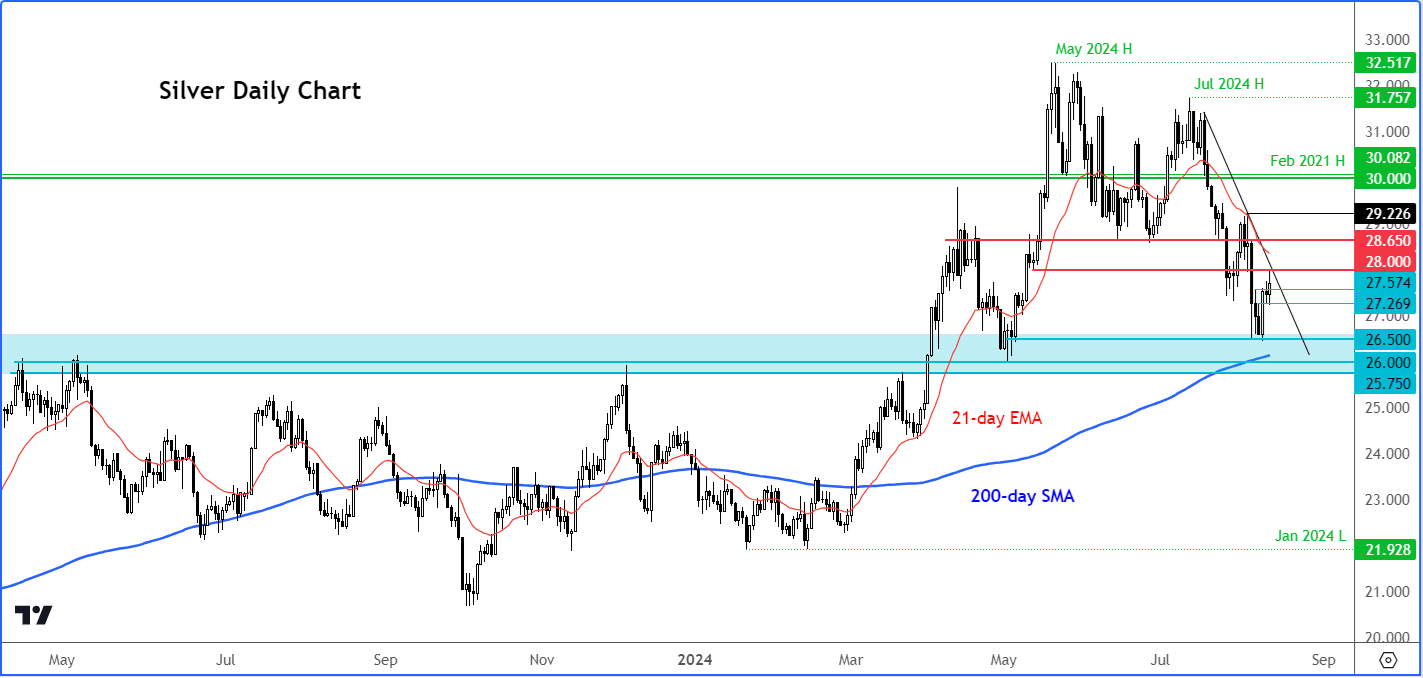

Silver technical analysis: bullish momentum building

Technically, silver might be poised for a bullish breakout. Last Thursday’s bullish engulfing candle suggests that the corrective phase may have ended, potentially paving the way for a new uptrend in silver prices.

Silver recently bounced from a key long-term support zone between $25.75 and $26.50, a level that provided a strong launch point in May. This support holding is a positive sign, and the subsequent follow-through to the upside would also appease the bulls. But it is crucial we see a quick recovery now.

For bulls, a close above the $28.00 resistance level would be ideal, with a more significant resistance level coming in around $28.65. Clearing these levels could signal the continuation of the rally that began in March, potentially leading to a much larger move higher, assuming no major disruptions from US inflation data.

On the downside, immediate support is seen at $27.55, followed by $27.26, which was last Thursday’s high. It’s crucial for silver to maintain these support levels on a closing basis in the coming days to sustain its recovery momentum.

A word or two on gold

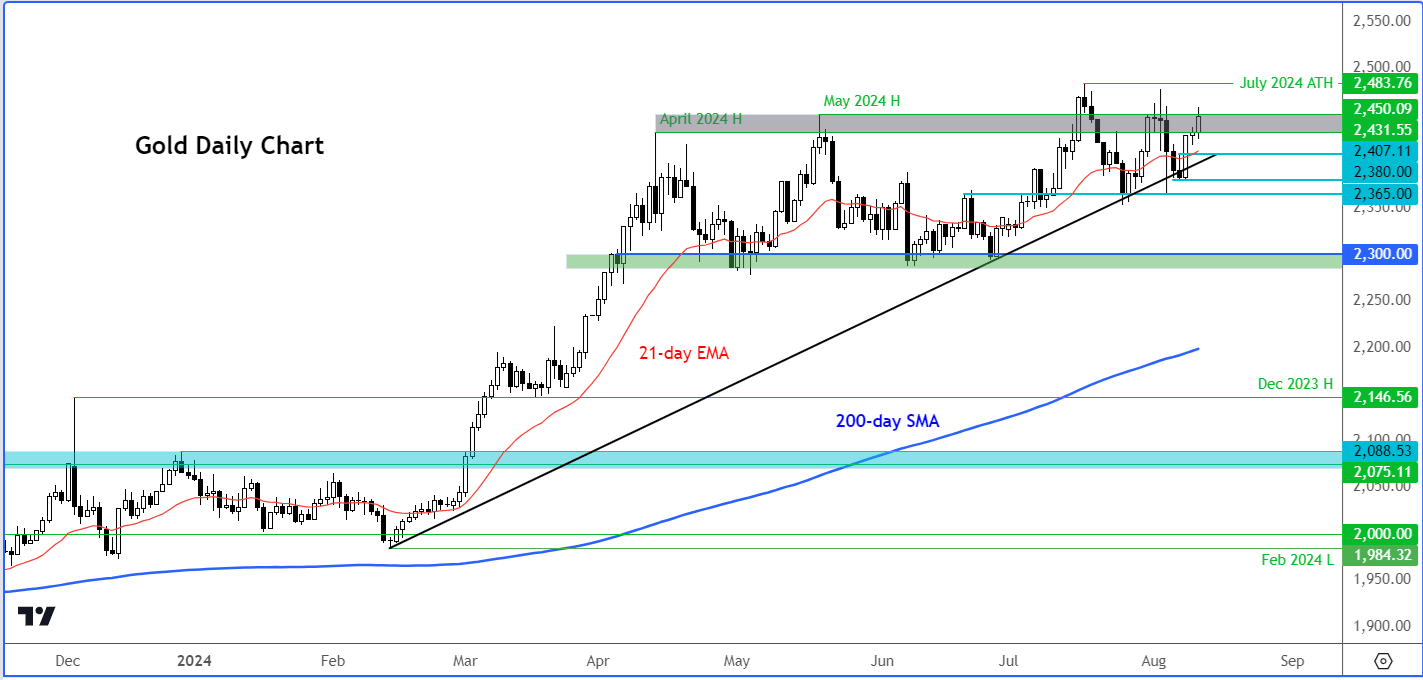

Gold’s ability to break above the shaded grey area on the chart between $2431 to $2450, marking the highs from April and May, suggests a new all-time high above July’s peak of $2483 looks imminent. The XAUUSD forecast is therefore bullish and should the yellow metal reach a new high, surely this will have some positive spill over on silver’s price action.

So, the silver forecast is cautiously optimistic as market stability returns and critical economic data is awaited, and positively correlating gold shows bullish price action. A favourable combination of technical and fundamental factors could see silver recover from recent lows and possibly resume its upward trajectory. Keep an eye on US inflation data and retail figures, as they will play a crucial role in determining the direction for silver and gold in the near term.

Source for all charts used in this article: TradingView.com

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R