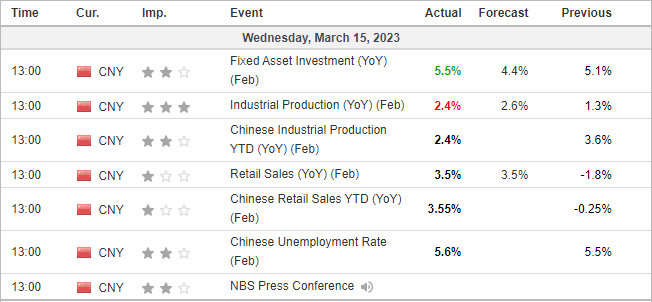

China’s banks lent a record ¥4.9 trillion in January as the economy reopened form lockdowns. And there was some anticipation to see whether the new loans were making their way through the economy to aid the governments GDP target of ‘around’ 5% this year. Early data suggests they are.

- Retail rose to 3.5% as expected, up from -1.8% previously

- Fixed asset investment rose 5.5%, above 4.4% expected and 5.1% prior

- Industrial output rose 2.4% y/y (whilst this was below estimates of 2.6% y/y, is a big improvement from 1.4% in January).

During the accompanying press conference, the NBS (National Bureau of Statistics) cited seasonality for the slight rise in the unemployment rate to 5.5%, but more importantly, China’s growth target of around 5% is in line with economic data although the economy does face many challenges.

Whilst these may not be knockout numbers, they’re certainly an improvement and will contribute to Q1 GDP figures. And against the backdrop of the bad start to the week we had regarding the fallout from SVB, a little good news can make a big difference to help sentiment. The data saw Asian equities and US futures point higher, along with AUD, EUR and GBP which are currently the strongest majors.

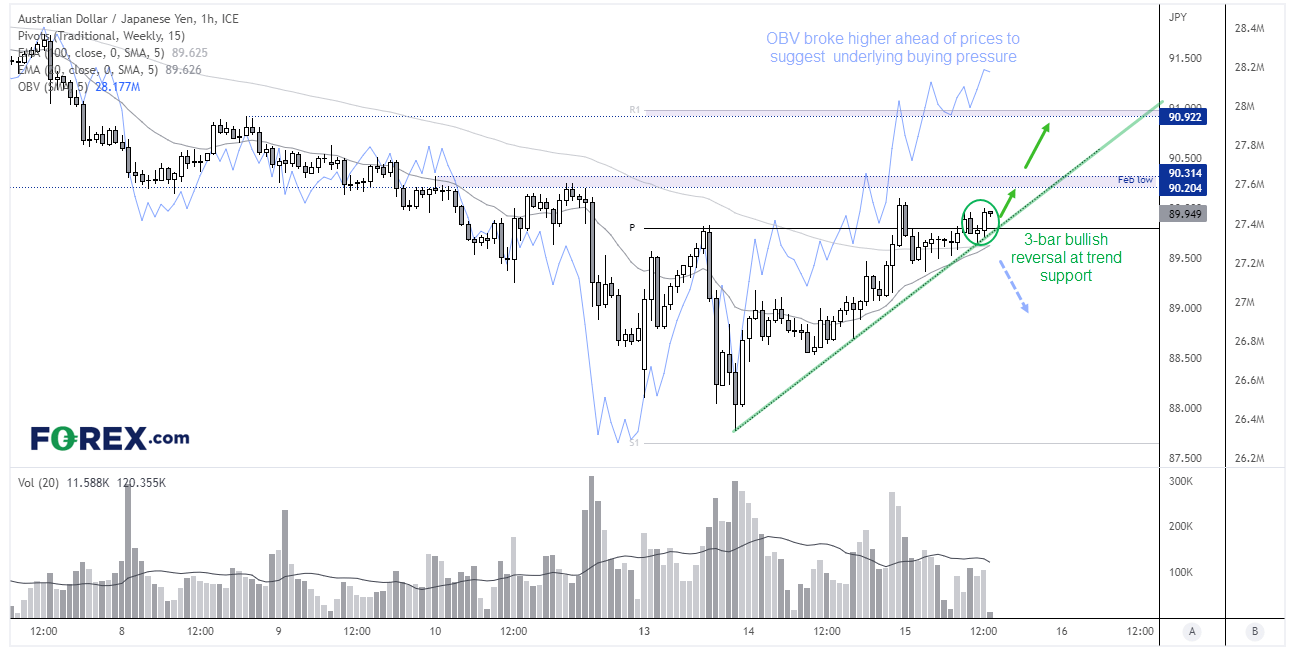

AUD/JPY 1-hour chart:

A bullish trend is developing on the 1-hour chart. Strong volumes accompanied yesterday’s rally to the high, and prices are continuing to drift higher today in Asia whilst respecting trend support. Prices are also above the 20 and 50-bar EMA’s around 89.50, a level which the bias remains above. Bulls will need to break prices above the round number of 90, and a resistance zone also sits nearby between 90.20/30 – but if we can get above here, it opens up a run for the highs around 91.

Cleary, we need appetite for risk to pick up today for risk pairs such as AUD/JPY to benefit, and the idea scenario would be higher yields, equities and commodity FX. But if sentient turns sour, a clear break beneath 89.50 would pique our bearish interest.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge