US futures

Dow future -0.36% at 40,480

S&P futures -0.02% at 5540

Nasdaq futures 0.02% at 19700

In Europe

FTSE -0.60% at 8253

Dax -0.76% at 18500

- The tech sector steadies after the rout this week

- IT outage adds to a jittery mood

- Netflix subscriber additions impress

- Oil is set for a weekly decline

Tech selloff steadies, Netflix subscriber additions impress

U.S. stocks point to a mixed open at the end of a choppy week for the markets.

The sell-off in tech stocks and mega-cap growth stocks appears to have steadied after a week, which has seen investors rotate away from the sector.

A series of factors, including US-China trade tensions and questions over President Biden's fate in the upcoming elections, have helped spark the sell-off in tech stocks. Upcoming tech earnings are also adding jitters to the market. Worries are surfacing that earnings from the tech giants won’t match their lofty valuations.

A huge IT outage is also in focus, disrupting operations in multiple industries, including airlines, banks, some broadcasters, and healthcare systems.

The rotation out of tech was already unnerving the market, but this global outage has just added to the jittery mood.

No major U.S. data is due to be released today. Instead, attention will be on Federal Reserve official Christopher Waller, who is due to speak later and could provide further clues on when the Fed could cut rates.

Corporate news

Netflix is pointing to a stronger start after the streaming giant reported better-than-expected second-quarter results and blowout subscriber additions thanks to strong content in its ongoing crackdown on password sharing. Netflix added 8 million subscribers and posted a 16.8% increase in revenue to $9.56 billion. However, Q3's outlook missed expectations, creating some volatility in the stock immediately after earnings.

Crowd strike has slumped 10% on reports that a software update from the cybersecurity firm has caused a global IT outage.

Microsoft is also set to open lower on indications the outage of affected devices running on the Microsoft Windows operating system.

American Express is set to fall almost 2% after the credit card giant reported disappointing revenue growth. However, it beat estimates for second-quarter profits amid ongoing spending by wealthy customers.

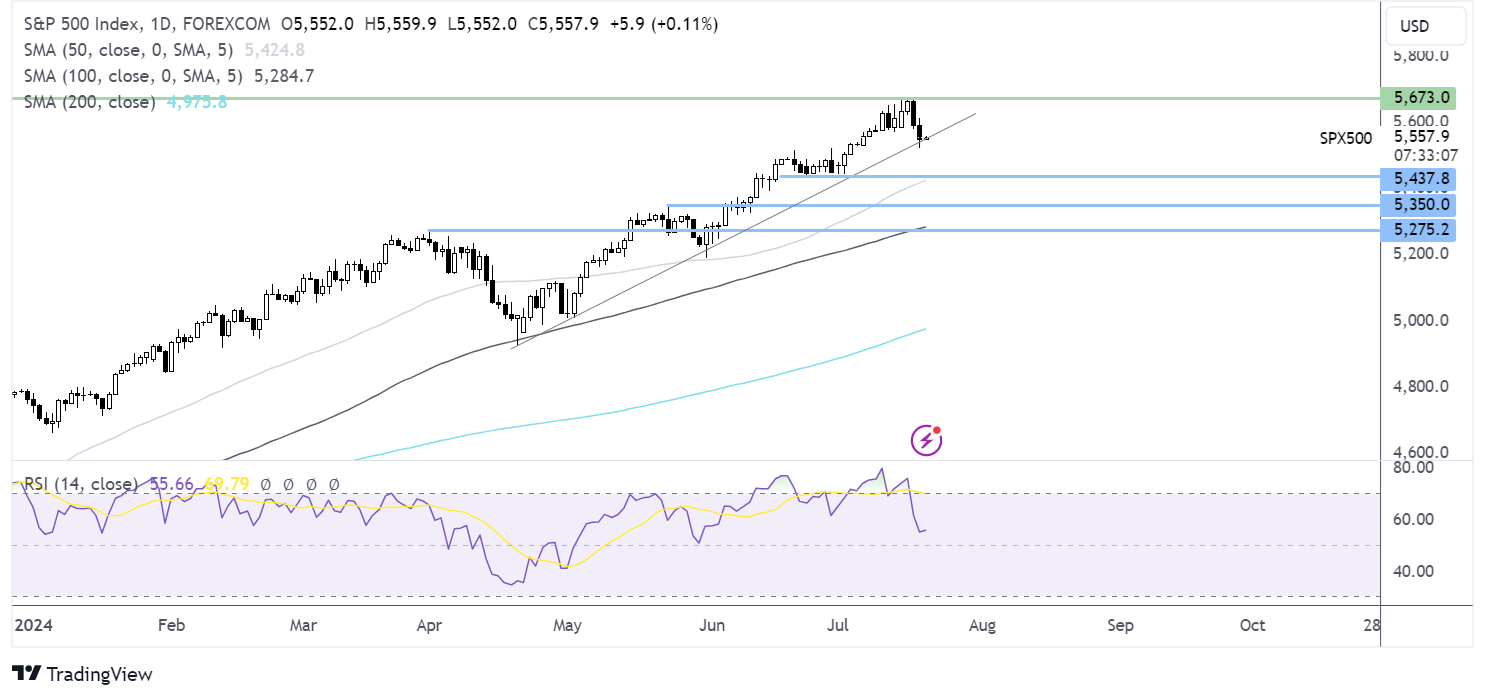

S&P500 forecast – technical analysis.

The S&P 500 has fallen from its all-time high of 5667 and is testing the rising trendline support. A break below here and 5525, the weekly low, could open the door to 5444, the July low. Should buyers successfully defend the rising trendline support, a rise toward 5670 could be on the cards.

FX markets – USD rising, GBP/USD falls

The USD is rising as it continues its recovery from a three month low against its major peers. After two weeks of declines, the USD is set to rise across the week.

EUR/USD is falling after German PPI fell 1.6% year on year after falling 2.2% in the previous month. The data comes after the ECB left interest rates on hold at 3.75% over the cutting rates by 25 basis points in June. Christine Lagarde said the September meeting was wide open, but she also calmed fears over service sector inflation which the market has interpreted as a signal that rates could be cut in September.

GBP/USD is falling after UK retail sales tumbled in June, highlighting concerns over the health of the UK consumer. Households remain squeezed, with interest rates at a 16-year high. Retail sales tumbled -1.2% month on month after rising 2.9% in the previous month. The data comes as unemployment remains at a 2 1/2-year high, and wage growth eases to a 2-year low.

Oil is set for a weekly loss.

Oil prices are heading lower and set for a second straight weekly decline as demand concerns overshadow a larger-than-expected draw in US inventories and optimism that the Fed could cut interest rates soon.

This week, the lack of concrete stimulus measures from China at the key Communist Party conference has added to the downbeat mood, pointing to a bumpy road ahead for policy implementation. This comes as the Chinese economy grew at a slower-than-expected pace in Q2.

Meanwhile a stronger dollar was also negatively impacting the price of oil as a stronger dollar makes oil more expensive for buyers with other currencies. The US dollar is climbing for the second straight session.