It doesn’t always work out this perfectly, but from a macroeconomic perspective, there have been clear themes to the past couple weeks – “Central Bank Week” to start the month then “Inflation Week” just winding down – and between the US, UK, and Canadian retail sales reports, as well as earnings reports from Walmart (WMT), Target (TGT), Home Depot (HD), and Lowes (LOW), it’s pretty clear that next week will be “Retail Week” (…though inflation will once again be closely monitored as well!).

Tackling US retail sales first, consumers are expected to have increased their spending by 1.2% m/m, with the core (ex-auto) figure rising 1.0% m/m. With global supply chains still gummed up, there’s a chance that many consumers pulled forward their Christmas shopping from the usual November window to October to avoid any risk of shipping delays ruining their holidays (…or was that just my wife?), so an upside surprise is possible from the US report, and similar dynamics are at play in the UK and Canada as well.

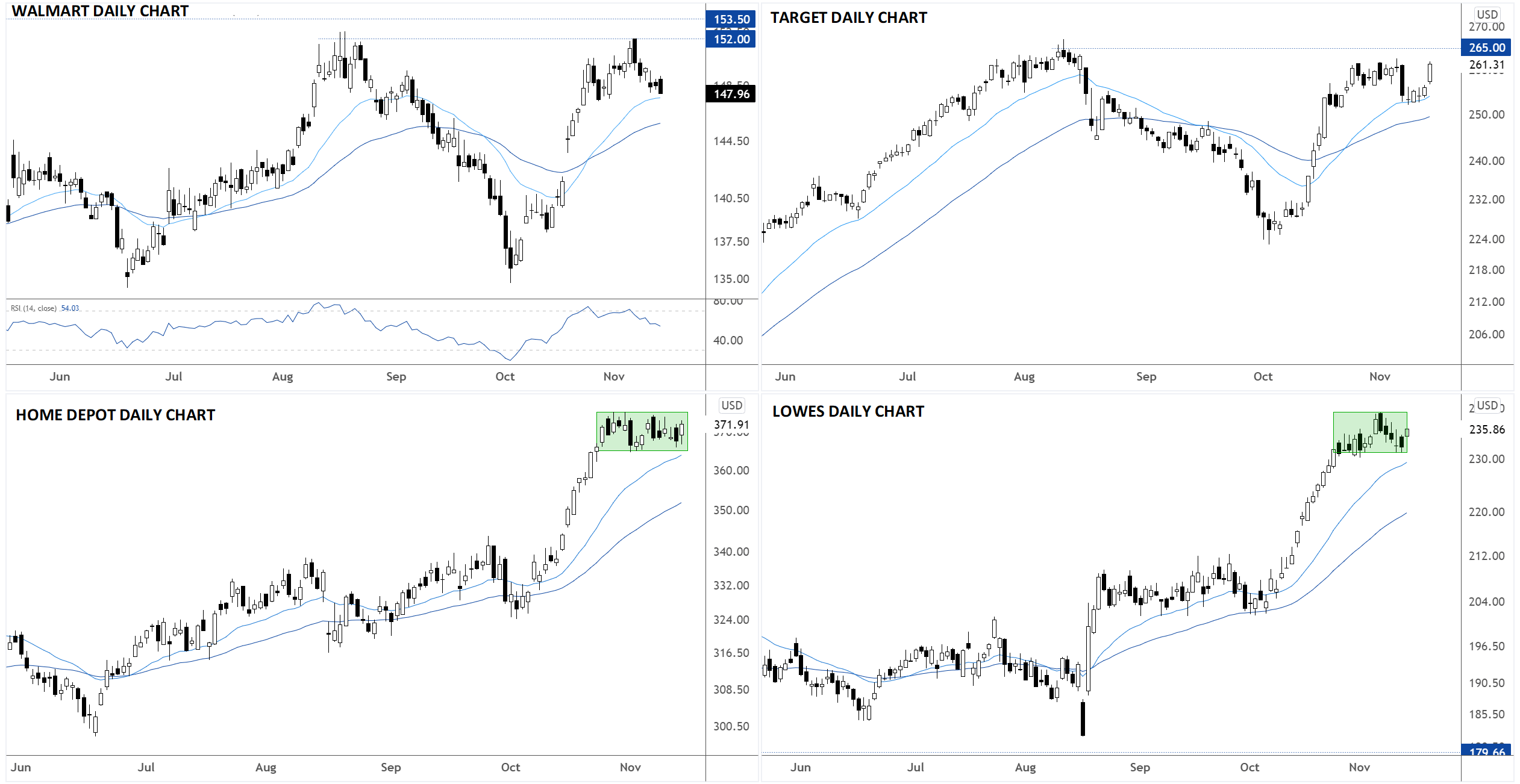

Looking at specific retailers’ results, “The Big 4” to watch next week will be as follows (all releases are before the opening bell):

- Walmart (WMT): Tuesday – $1.39 in EPS expected on $135.7B in revenue

- Home Depot (HD): Tuesday – $3.38 in EPS expected on $34.5B in revenue

- Target (TGT): Wednesday – $2.81 in EPS expected on $24.6B in revenue

- Lowes (LOW): Wednesday – $2.40 in EPS expected on $21.6B in revenue

Looking at the charts, all these stocks have been trending generally higher over the past several weeks, though the shares of the home improvement giants (Home Depot and Lowes) have clearly outperformed the general retailers (Walmart and Target). If we do see a strong retail sales report and the experienced management teams atop these firms are able to navigate supply chain disruptions, it’s possible that we could see fresh record highs in all of these names by the end of next week!

Source: TradingView, StoneX

How to trade with FOREX.com

Follow these easy steps to start trading with FOREX.com today:

- Open a Forex.com account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.