- Japan’s Nikkei 225 has pulled back from multi-decade highs today

- Other cyclical assets are struggling across the Asia region

- Geopolitical headlines and higher bond yields may be contributing to the weakness

Recent adoptees of a bullish Nikkei stance are facing their first real test with a distinct risk-off tone settling in across the Asian region, seeing the index reverse slightly after hitting fresh 34-year highs on Monday.

Whether generated by fresh geopolitical headlines involving Iran or doubts about the scale of rate cuts priced in across developed markets, cyclical assets are struggling, including the Nikkei. The US bond curve has sold off upon the resumption of trade, seeing yields on 2, 10 and 30-year debt lift around 6bps, recouping some of the losses from Friday following the weak US PPI report for December. The move comes ahead of a key speech from influential Fed Governor Christopher Waller, a known policy hawk up until recently.

Domestically, there was also an upside surprise for Japanese corporate goods price inflation last month which held steady against expectations for a decline of 0.3%, providing the BOJ a minor victory in its attempts to begin normalising monetary policy.

Nikkei's upside momentum stalls

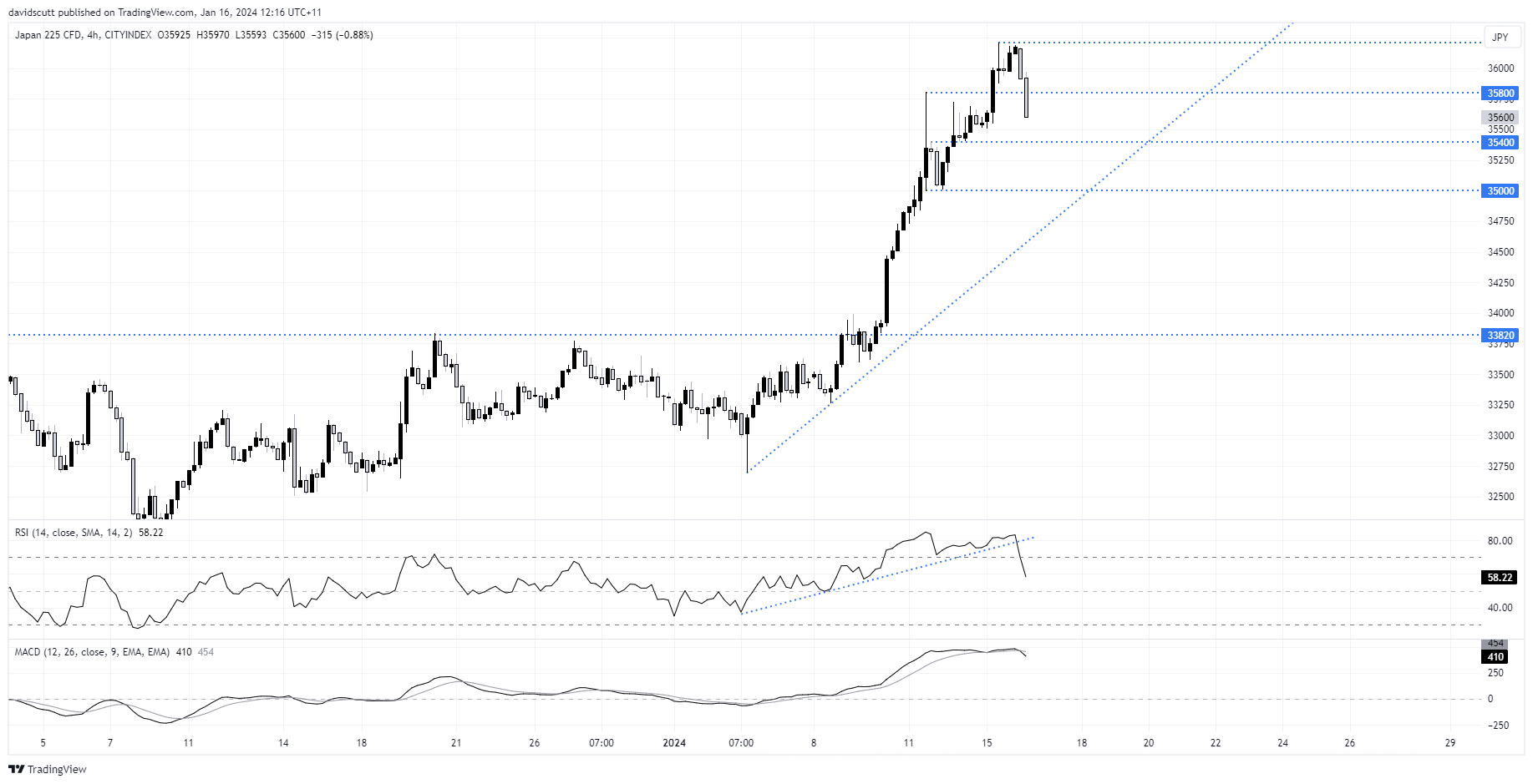

The Nikkei 225 is on track to record its two bearish candles on the four-hourly chart for the first time in over a week. With the uptrend in RSI broken and MACD crossing over from above, momentum appears to be building to the downside near-term.

While the price did a bit of work in between, 35400 and 35000 are downside targets for those considering shorts. Below, there’s really nothing until you get back to 34000, other than minor uptrend support dating back to the lows set earlier in the year. Above, the high of 35800 last week may act as resistance, allowing a stop to be placed above for protection.

-- Written by David Scutt

Follow David on Twitter @scutty