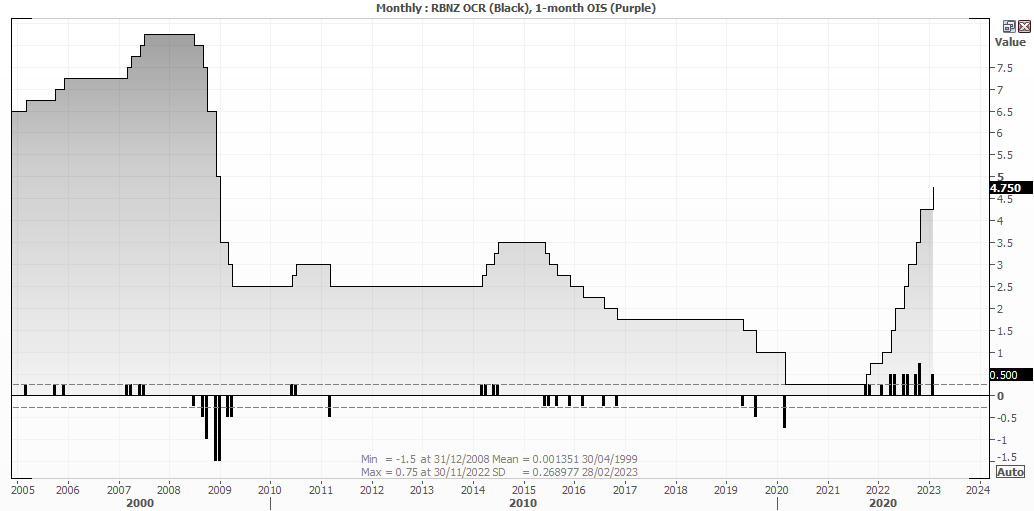

- The RBNZ hiked rates by 50bp to 4.75%

- The OCR is now its highest level since December 2008

- The pace of tightening has slowed back to 50bp, after a single 75bp hike

- 75bp hikes seem unlikely again over the foreseeable futures, if at all

The tone of the meeting reads like a hawkish 50bp hike with risks attached, as opposed to November’s outright hawkish 75bp hike. But that is not to say the February meeting can be seen as a dovish 50bp hike either.

The RBNZ are willing to look through the short-term noise of cyclone Gabrielle without completely ignoring the risks of its impact on the economy. But they have downgraded the hike-increment discussion to between 50 or 75bp, when previously it was between 50, 75 or 100. And given their November meeting gave the impression a 75bp hike today was likely, the RBNZ have stepped off the hawkish gas somewhat.

Ultimately, they continue to acknowledge the need for a short period of negative growth this year to bring inflation towards target. And perhaps they will get it with the unwelcomed weather events. But upside pressures to inflation prevail, so unless the wheels fall of the economy soon, another 50bp hike seems likely at this stage. But its timing could be dictated by the immediate impact of cyclone Gabrielle.

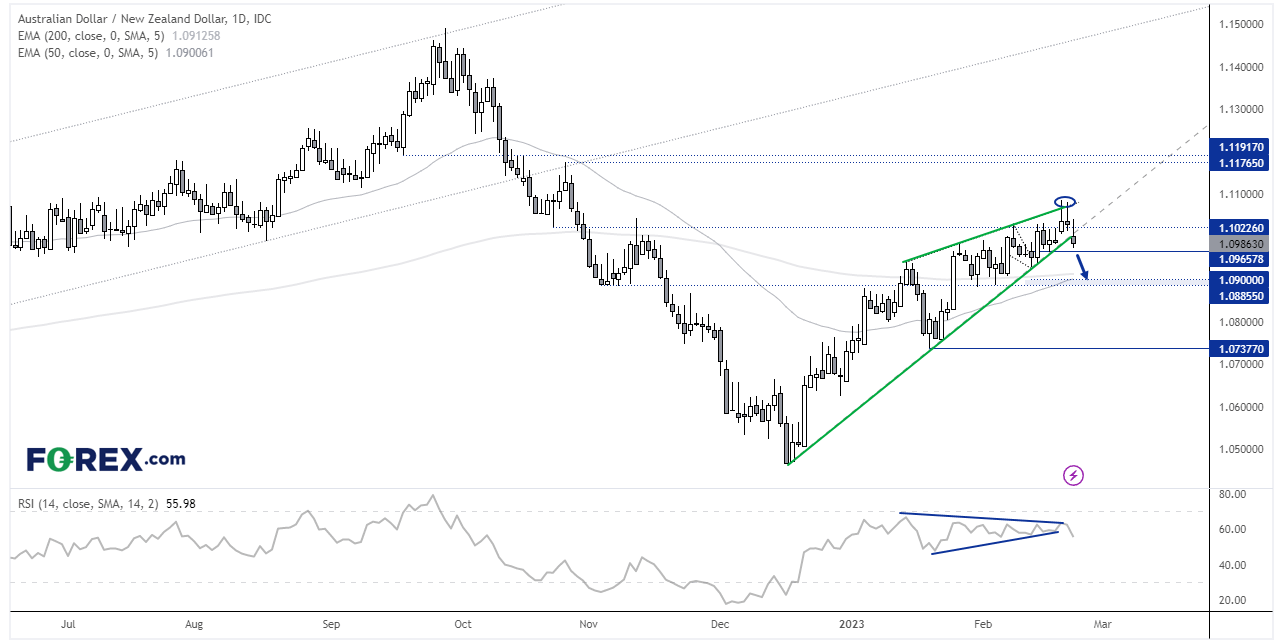

AUD/NZD daily chart:

The combination of soft wage inflation for AU and the less-hawkish meeting has sent AUD/NZD lower. Abd that requires a revision of our earlier analysis, as it raises the potential for a pullback. Two upper spikes / bearish hammers may have marked to the top of a rising wedge, which suggests a move to 1.0740. I’m not yet convinced it could move that far – at least immediately, but a bearish divergence has formed alongside the alleged rising wedge. Therefore a break below 1.0965 could see it head for the 200-day EMA, around 1.0900.

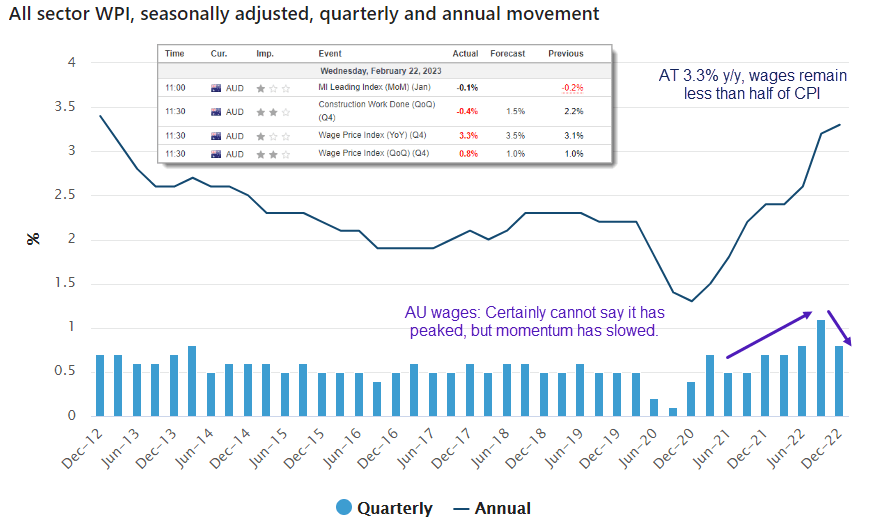

AU wage data softer than expected (but not quite soft enough)

At 3.3% y/y, wages remain less than half of headline CPI – which is hardly the ‘wage spiral’ the RBA fear. And that should keep the hawks at bay. Both the quarterly and annual read were below market expectations and, whilst it is clearly too soon to get excited over ‘peak wages’, momentum is slowing so perhaps we are near.

Ultimately, I suspect the RBA remain on track for a 25bp hike in March and May, but the data is not weak enough to call for a pause.

Summary of the statement:

- RBNZ hiked 50bp to 4.75%

- Early sighs of price pressures easing

- CPI and expectations remain elevated, employment remains too tight

- Too early to accurately access monetary policy implications on recent weather events

- The timing, size, and the nature of funding the Government’s fiscal response are also yet to be determined

- Over the coming weeks, prices for some goods will likely spike and activity will weaken further than previously expected

- 2023 global outlook is subdued, which will weigh on NZ export markets

- Continued growth in services exports will provide some export revenue offset

- While there are early signs of demand easing it continues to outpace supply, as reflected in strong domestic inflation

Summary of the meeting:

- Overall, the economy has developed broadly in line with expectations at the time of the November Statement.

- Monetary policy is set with a medium-term focus

- The Committee agreed that the medium-term impacts of the severe weather events do not materially alter the outlook for monetary policy

- The Government’s fiscal policy response would be more effective at addressing these, rather than any monetary policy activity

- CPI inflation, at 7.2 percent in the year to the December 2022 quarter, remains well above the 1 to 3 percent target range set out in the Remit

- Measures of persistent or ‘core’ inflation have remained very high

- A reduction in aggregate demand (negative growth) was necessary to return inflation to target over the forecast period

- Members viewed the risks to inflation pressure from fiscal policy as skewed to the upside

- Members noted the rapid pace and extent of tightening to date implies monetary policy is now contractionary.

- Increases of 50 and 75 basis points were considered.