New Zealand Dollar Outlook: NZD/USD

NZD/USD trades near the monthly high (0.5985) as it retraces the decline from the start of the week, but New Zealand’s Employment report may drag on the exchange rate as the update is anticipated to show another decline in job growth.

NZD/USD Vulnerable to Decline in New Zealand Employment

Keep in mind, NZD/USD cleared the May low (0.5875) last month to push the Relative Strength Index (RSI) into oversold territory for the first time in 2024, with the exchange rate now failing to defend the April low (0.5852) as it registers a fresh yearly low (0.5850).

Join David Song for the Weekly Fundamental Market Outlook webinar. Register Here

In turn, NZD/USD may continue to give back the recovery from the 2023 low (0.5774) even though the Reserve Bank of New Zealand (RBNZ) warns that ‘monetary policy will need to remain restrictive,’ and it remains to be seen if the central bank will keep the official cash rate (OCR) at 5.50% throughout 2024 amid signs of a slowing economy.

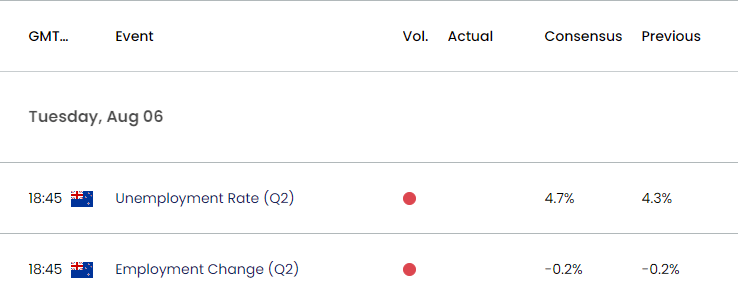

New Zealand Economic Calendar

New Zealand Employment is expected to contract another 0.2% in the second quarter of 2024, while the jobless rate is seen widening to 4.7% from 4.3% during the same period.

A dismal development may push the RBNZ to adjust its forward guidance at its next meeting on August 14, and evidence of a weakening labor market may drag on NZD/USD as it puts pressure on the central bank to adopt a less restrictive policy.

At the same time, a better-than-expected employment report may keep Governor Adrian Orr and Co. on the sidelines, and NZD/USD may attempt to retrace the decline from the July high (0.6143) on the back of waning speculation for an RBNZ rate-cut in 2024.

With that said, NZD/USD may track the range from the first half of the year despite failing to defend the April low (0.5852), but the exchange rate may struggle to retain the advance from the 2023 low (0.5774) if it struggles to push above the monthly high (0.5985).

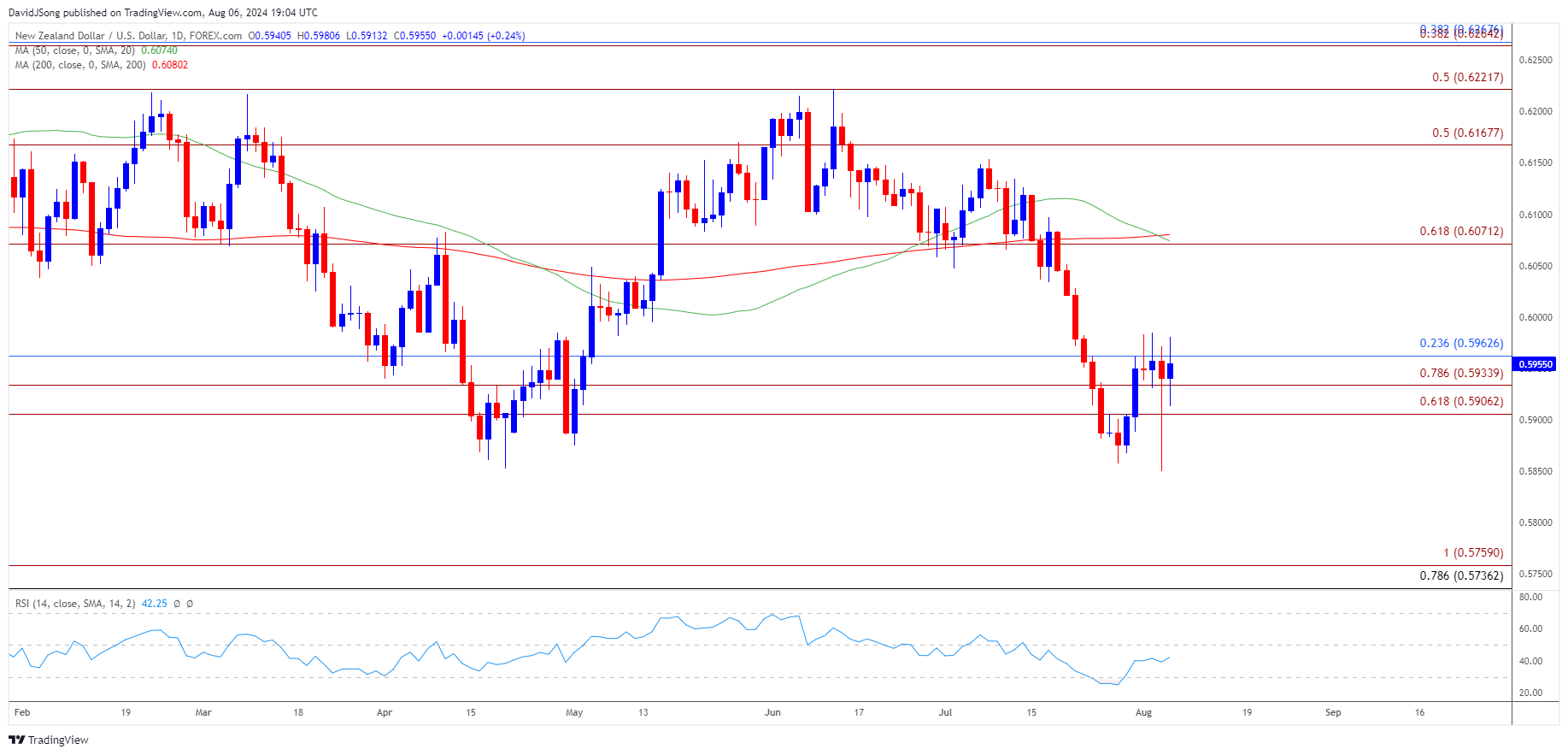

NZD/USD Chart – Daily

Chart Prepared by David Song, Strategist; NZD/USD on TradingView

- NZD/USD consolidates within the weekly range after snapping back from a fresh yearly low (0.5850) but the failed attempts to close above the 0.5910 (61.8% Fibonacci extension) to 0.5960 (23.6% Fibonacci retracement) region may lead to a test of the 2023 low (0.5774).

- Failure to defend the 2023 low (0.5774) may push NZD/USD towards the 0.5740 (78.6% Fibonacci retracement) to 0.5760 (100% Fibonacci extension) zone, with the next area of interest coming in around the 2022 low (0.5512).

- At the same time, a close above the 0.5910 (61.8% Fibonacci extension) to 0.5960 (23.6% Fibonacci retracement) region may push NZD/USD back towards 0.6070 (61.8% Fibonacci extension) as the Relative Strength Index (RSI) recovers from oversold territory.

Additional Market Outlooks

British Pound Forecast: GBP/USD Susceptible to Test of July Low

AUD/USD Forecast: RSI Falls Back into Oversold Zone

US Dollar Forecast: USD/JPY Selloff Pushes RSI into Oversold Zone

US Dollar Forecast: EUR/USD Opening Range for August in Focus

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong