Whilst NZD/JPY appears to be leading the way lower, NZD/CHF looks to be carving out a similar path.

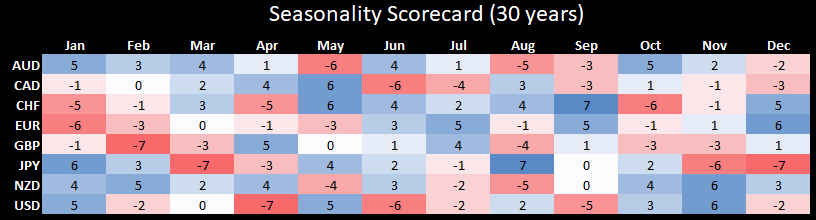

Firstly, it’s interesting to note May tends to be a strong month for CHF and JPY crosses and weak for NZD. In both cases, NZD has closed lower against CHF and JPY over 53% of the time. The table below provides a score for each major, based upon how many pairs it closed higher(lower) over 50% of the time. For example, AUD has closed lower against 6 of its peers over 50% of the time in May, over the past 30 years. Whilst these seasonal tendencies are not predictive, it provides a template to base trade ideas around. And, as price action suggests both NZD/JPY and NZD/CHF have been topping out, we’re keen to explore further shorting potential.

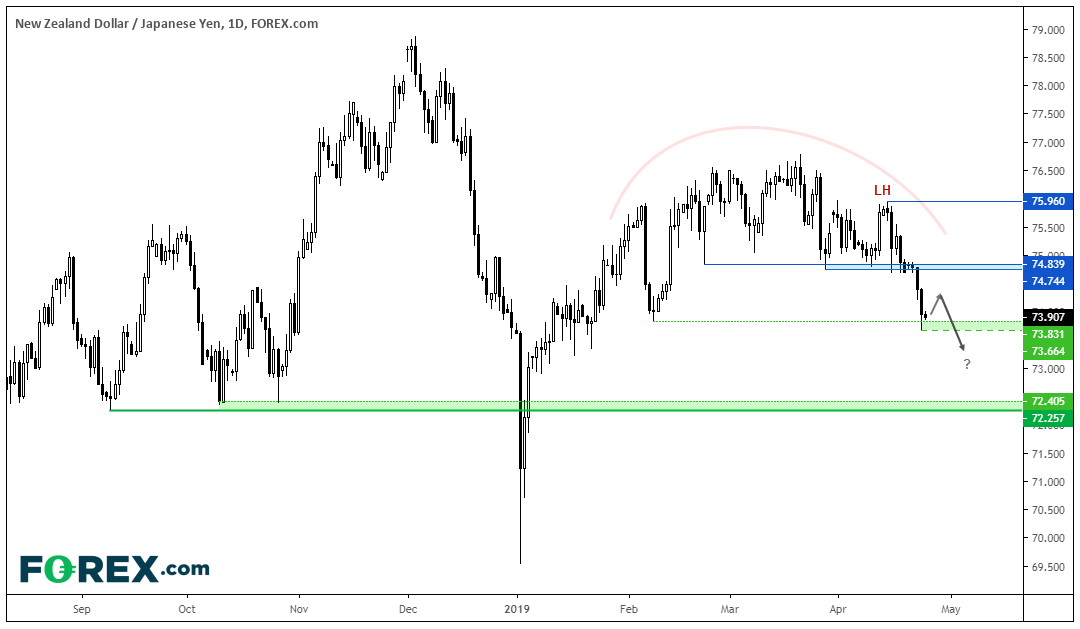

Bearish momentum has picked up on NZD/JPY since the 75.96 high (lower high) and, whilst prices have stalled around 73.83 support, but we suspect further losses could materialise following a minor pullback. Keep in mind that news is light today and AU and NZD have Anzac Day, so volumes will likely be thinner in today’s session. That said, with momentum pointing firmly lower on the daily, it could be worth seeking bearish setups on intraday timeframes after a period of consolidation. If prices can break beneath 73.66, the lows around 72.35 come into focus for bears.

Currently holding above the 0.6718 lows, we suspect NZD/CHF is on the brink of breaking key support and playing catch-up with NZD/JPY. Although far from perfect, there has a slight rounding off at the tops as bulls struggled to push it higher, so we’re essentially looking at some form of topping pattern above 0.6718. More interestingly though, is that the majority of days above key support have been bearish, which suggests the tide could be turning.

A measured move from the obscure looking top projects an approximate target around 0.6500, although we could find interim support around 0.6676 and 0.6587.