- RBNZ is intent on defeating inflation even if it means sacrificing the economy

- It sees a greater chance than not of another rate hike this year. Cuts are not expected until late 2025

- Cash rate left at 5.5%, although a hike was strongly considered

- NZD/USD surges 1% to two-month highs above .6150

The Reserve Bank of New Zealand (RBNZ) is intent on defeating inflation even if it means sacrificing the economy, delivering a major surprise at its latest monetary policy meeting by flagging the likelihood that rates may need to increase again with a later starting date for cuts. The Zealand dollar surged on the unexpected hawkish pivot.

RBNZ delivers hawkish surprise

As expected, the RBNZ kept the cash rate unchanged at 5.5% in May. However, that was about the only thing that didn’t surprise with the bank delivering a slew of hawkish changes, whether it be its updated forecasts or commentary.

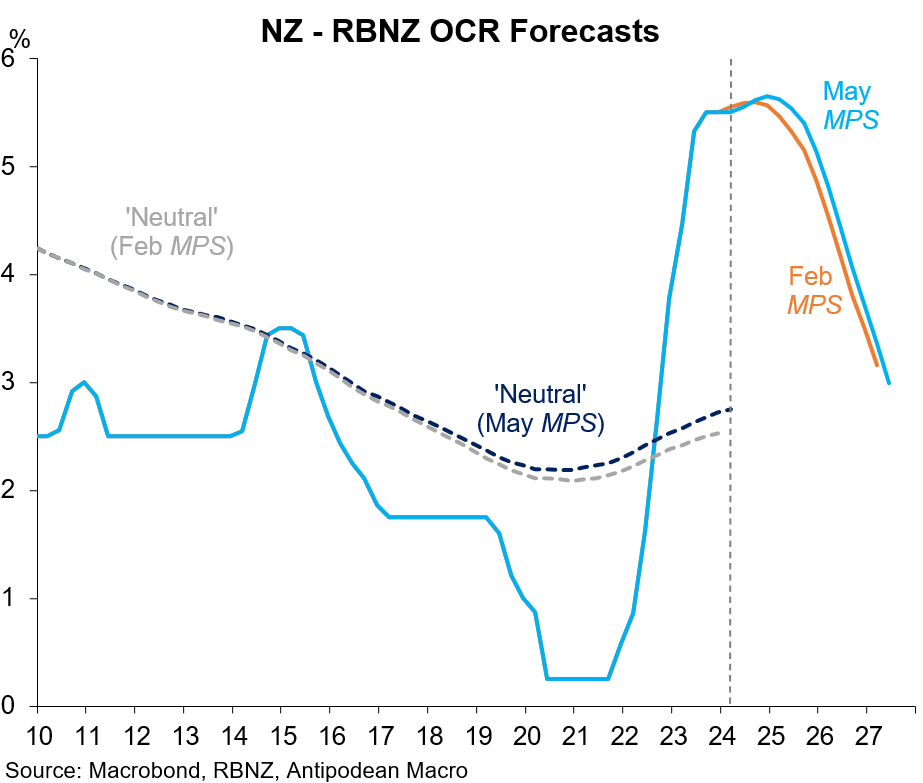

The biggest shift came from its overnight cash rate track with its profile pointing to 15 basis points of hikes by December, implying a greater risk than not that rates will increase to 5.75% before the end of 2024. Three months ago, it had only seven basis points of hikes forecast over the year.

Source: Antipodean Macro

The bank also sees a later starting point for reducing the cash rate from its present level, pushing back the expected timing by three months to September 2025. It also increased its estimate for the neutral policy setting, lifting it by 25 basis points relative to three months earlier. That implies it sees rates needing to remain higher than in the past to reduce inflationary pressures.

With rates expected to remain unchanged or higher in the coming year, its forecasts for unemployment were increased a touch. However, it’s inflation forecasts was bumped higher following the uncomfortably high March quarter report. A return to the top of its 1-3% target is not expected until September.

Domestic inflation too hot to consider cuts

In the monetary policy statement, the RBNZ acknowledged it considered hiking rates in May, pointing to an expectation that it will take time for domestic inflationary pressures to subside.

“While weaker capacity pressures and an easing labour market are reducing domestic inflation, this decline is tempered by sectors of the economy that are less sensitive to interest rates,” it said. “These near-term factors include, for example, higher dwelling rents, insurance costs, council rates, and other domestic services price inflation. A slow decline in domestic inflation poses a risk to inflation expectations.”

In term of forward guidance, it said policy needs to “remain restrictive to ensure inflation returns to target within a reasonable timeframe”, again pointing to stickiness in domestic price pressures.

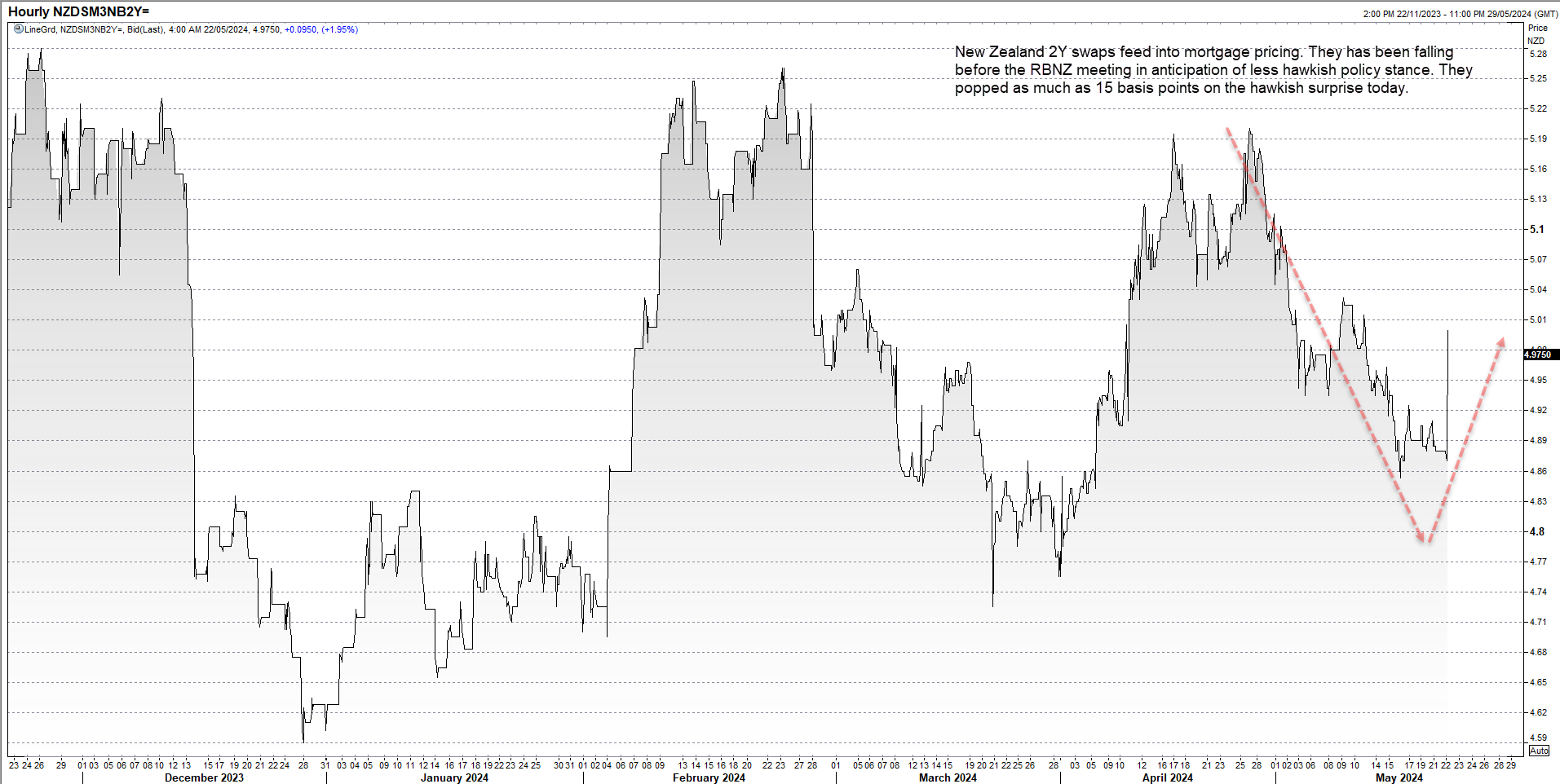

RBNZ November rate cut probability plunges

Prior to its May meeting, markets saw a greater than 80% chance that rates would be cut by November. Following today’s meeting, that’s now deemed a line-ball call. New Zealand two-year swaps surged 13 basis points following the update. That’s important as it’s what most fixed rate mortgages are priced off.

Source: Refinitiv

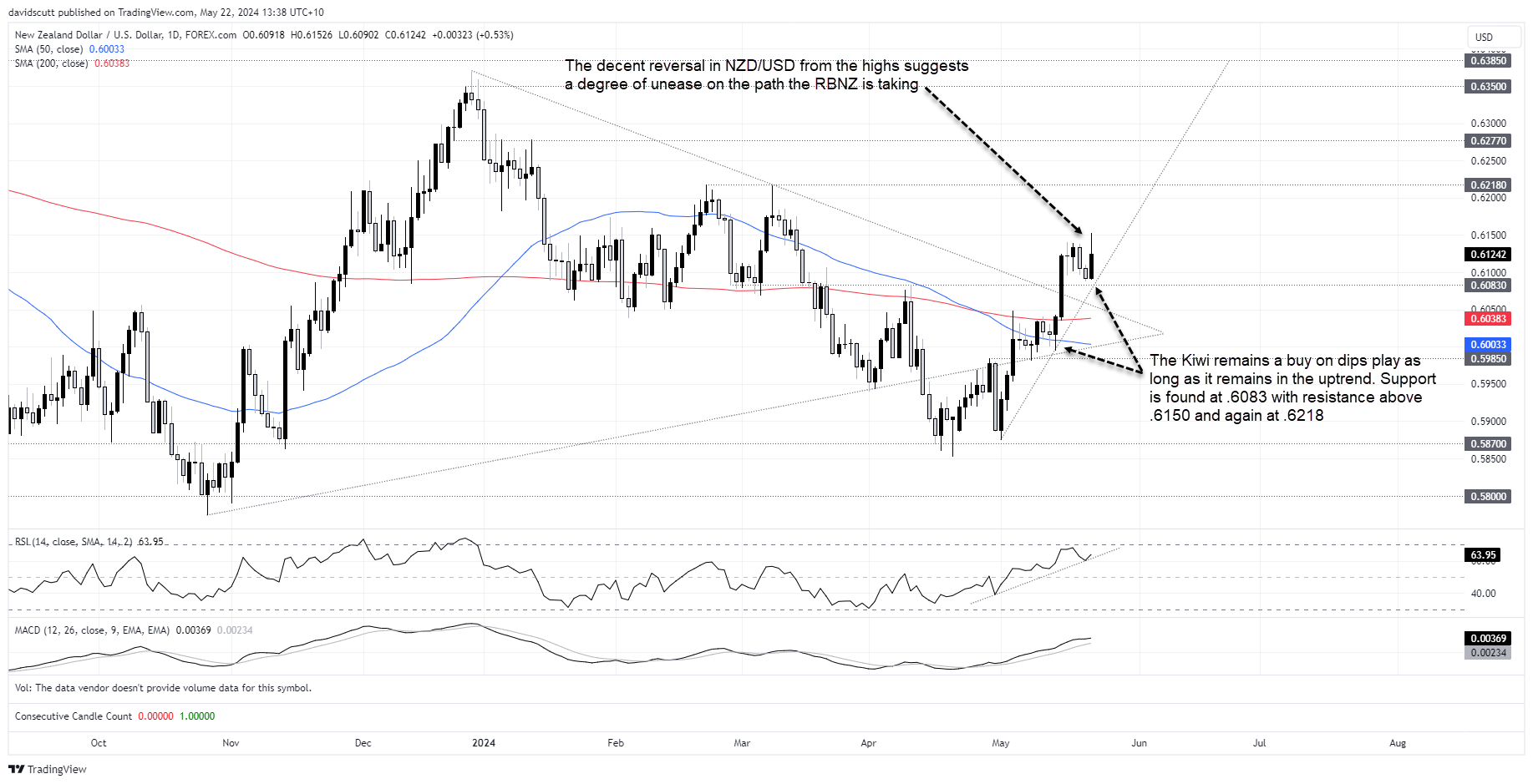

NZD/USD surges but will it last?

With the RBNZ far more hawkish than almost anyone expected, the New Zealand dollar took off like a rocket as soon as the hot headlines hit, sending NZD/USD to fresh multi-month highs above .6150. Zooming out, NZD/USD sits in a clear uptrend, adding to gains after clearing the 50 and 200-day moving averages earlier this month. With indicators such as RSI and MACD remaining bullish, the NZD/USD remains a buy on dips prospect for now.

However, with the RBNZ intent on defeating inflation at the expense of the economy, traders should be on the lookout for a potential break of the uptrend given amplified downside risks to the New Zealand economy. Interest rate differentials are one thing but hammering economic activity unnecessarily may not go down well globally.

Support is located at .6083 with resistance kicking in at the session high above .6150 and again at .6218.

-- Written by David Scutt

Follow David on Twitter @scutty