New Zealand inflationary pressures continued to ease in the March quarter, although domestic prices remained uncomfortably sticky, likely keeping the prospect of rate cuts from the Reserve Bank of New Zealand a distant prospect.

No CPI surprises but higher than RBNZ forecasts

Statistics New Zealand reported consumer price inflation increased 0.6% over the quarter, in line with expectations but higher than the 0.5% lift in Q4 2023. The rate from a year earlier slowed to 4%, the softest outcome since Q2 2021. That too was in line with expectations but above the 3.7% pace forecast by the RBNZ two months ago.

“Housing and household utilities was the largest contributor to the annual inflation rate. This was due to rising prices for rent, construction of new houses, and rates,” Statistics New Zealand said. “Rent prices are increasing at the highest rate since the series was introduced in September 1999.”

But underlying, domestic prices remain sticky

Fitting with that assessment, non-tradeable inflation barely budged, rising 5.8% over the year compared to 5.9% previously. In contrast, tradable prices – which are impacted by global factors – eased to an annual rate of 1.6% from 3.0% in the December quarter.

With monetary policy targeting domestic supply and demand factors, the ongoing stickiness of domestic price pressures may delay rate cuts from the RBNZ that economists expect will begin from the September quarter.

Adding to the case for the RBNZ to stay on the sidelines, core inflation – an average of underlying inflation measures that remove volatile price swings – rose 4.1% over the year, unchanged from the December quarter.

And that means reduced risk of RBNZ rate cuts

In response to the data, markets now deem a rate cut from the RBNZ in August as a coin flip. By November, 39 basis points of easing is expected, so 1.5 cuts. It stood at 2.5 cuts only a fortnight ago.

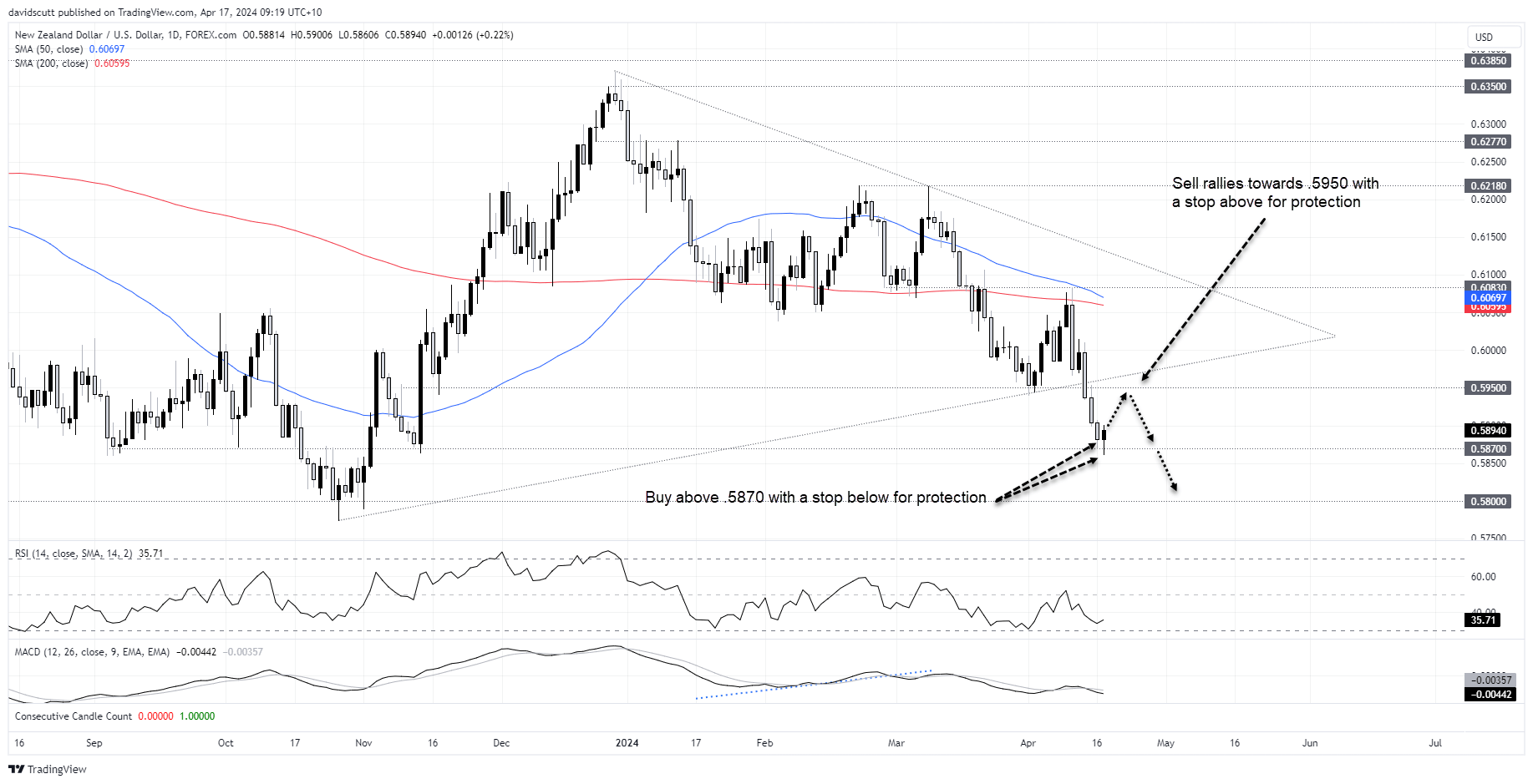

Reflecting the diminished risk of early rate cuts, NZD/USD popped higher on the data, helping the kiwi crawl off the mat after being pummelled by a stronger US dollar over the past week. However, even with sticky domestic inflation limiting the risk of near-term rate cuts, NZD/USD remains a sell-on-rallies play.

However, some near-term upside may be seen in the wake of the report, especially if the RBNZ’s sectoral factor inflation model doesn’t deliver a dovish surprise when released at 2pm Wellington time. It’s the RBNZ’s preferred underlying inflation measure and has moved the Kiwi abruptly in the past.

NZD/USD may see a short-term bounce, selling rallies preferred

Having bounced from support at .5870 on Tuesday and earlier today, those considering longs could enter trades around these levels, looking for a squeeze higher to former support at .5950. A stop could be placed below .5870 for protection.

If the pair were to get to .5950, it would present a decent level for those considering longer-term shorts, allowing for traders to place stops above the level for protection. Aside from .5870, there’s not a lot of visible support evident until the mid-50 cent region.

-- Written by David Scutt

Follow David on Twitter @scutty