- New Zealand’s PSI slipped further into contractionary territory in April

- Already in recession, the result suggests the economic downturn is worsening

- An influential inflation survey will be released by the RBNZ later Monday

- NZD/USD volatility could spike, although expectations for the Fed interest rate outlook remain in the driving seat

Economic downturn looks to be getting worse

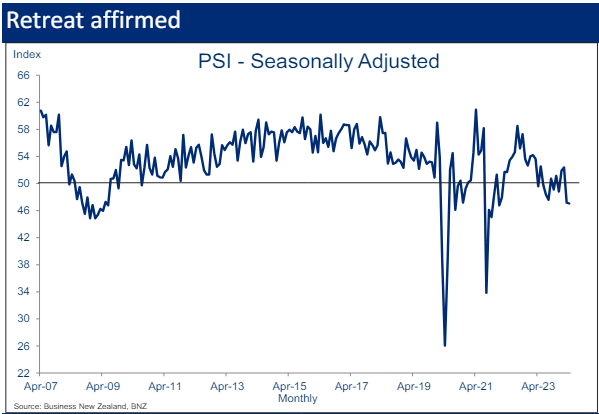

The latest dour report card on the New Zealand economy came from the BNZ Performance of Services Index (PSI) for April which slumped to levels not seen since January 2021 when the nation was isolated from the rest of the world due to pandemic travel restrictions.

Source: BNZ

“The Performance of Services Index (PSI) failed to bounce in April. At 47.1, it was marginally lower than the 47.2 it had slumped to in March,” said BNZ economists. “We thought last month’s drop reflected more than just the timing of Easter. Evidence of this is much stronger now with another poor PSI reading in April. It is disconcerting.”

All bar two services subcategories saw activity decline from a month earlier with particularly acute contractions in household-facing sectors.

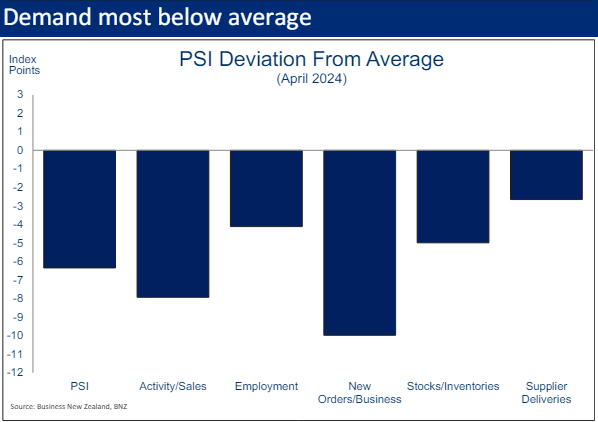

“Weak demand was most obvious in April’s PSI new orders index at 47.1. This is well below 50, a bit lower than March’s already weak 47.9, and now 10 full percentage points below its long-term average,” BNZ said. “Current sales are weak too, with the PSI sales/activity index remaining well below 50, at 46.5.”

Source: BNZ

RBNZ focus could shift depending on key inflation survey

The weak result adds to mounting evidence that tighter monetary policy, combined with renewed fiscal restraint, is hammering New Zealand’s economy, resulting in jobs losses and rising unemployment. In normal circumstances, this would be enough for central bank to begin lowering interest rates but with domestic inflationary pressures remaining elevated, the RBNZ is showing little public inclination to switch focus away from fighting inflation to supporting economic activity.

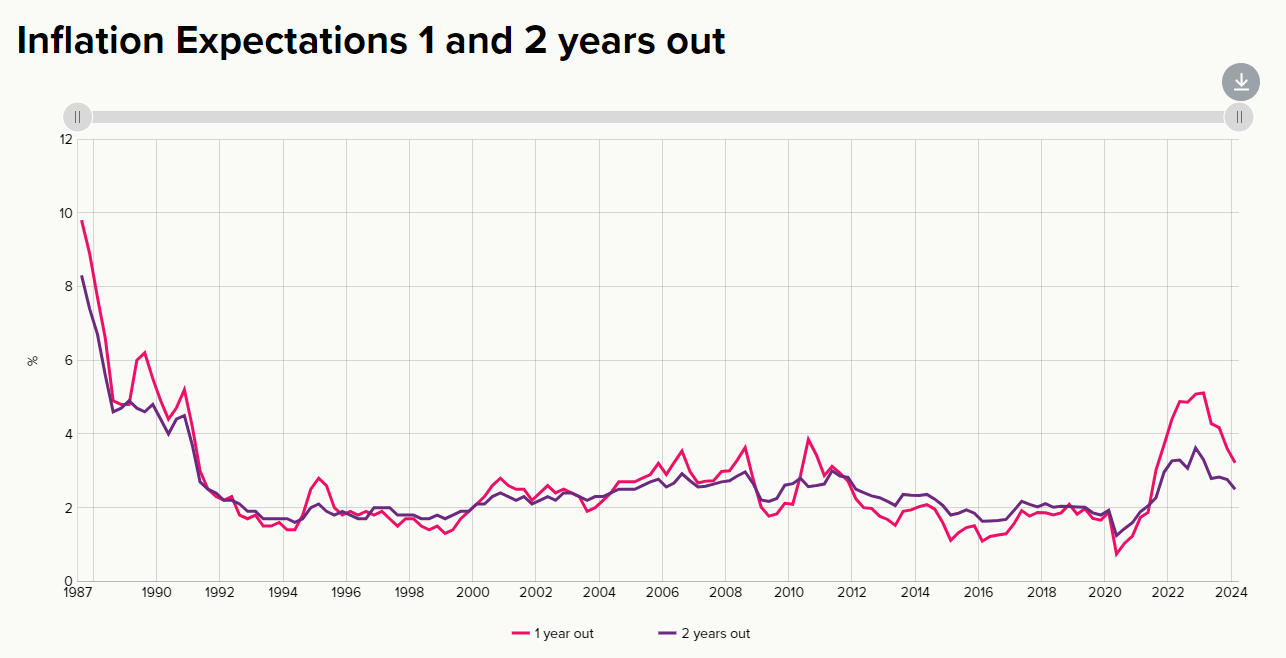

However, with the RBNZ’s influential quarterly survey of expectations survey released later Monday, including inflation expectations, markets have a potential catalyst that may be enough to alter the bank’s focus.

This release can and has delivered significant New Zealand market movements previously, meaning traders should be on alert for volatility when the results drop at 3pm in Wellington.

Source: RBNZ

In the last survey, economists and business leaders saw inflation one and two years out sitting at 3.22% and 2.5% respectively, down from 3.6% and 2.76% in the prior three-month period. While both remain above the midpoint of the RBNZ’s 1-3% inflation target, another sharp decline in these readings to or below the midpoint may be enough for the RBNZ to contemplate bringing forward the expected timing of rate cuts, currently flagged for the middle of 2025.

Big week for US economic data

Outside New Zealand, it will also be an important week for the US dollar with not only US consumer price inflation released on Wednesday but also PPI, retail sales along with a raft of Federal Reserve speakers scheduled, including Jerome Powell on Tuesday.

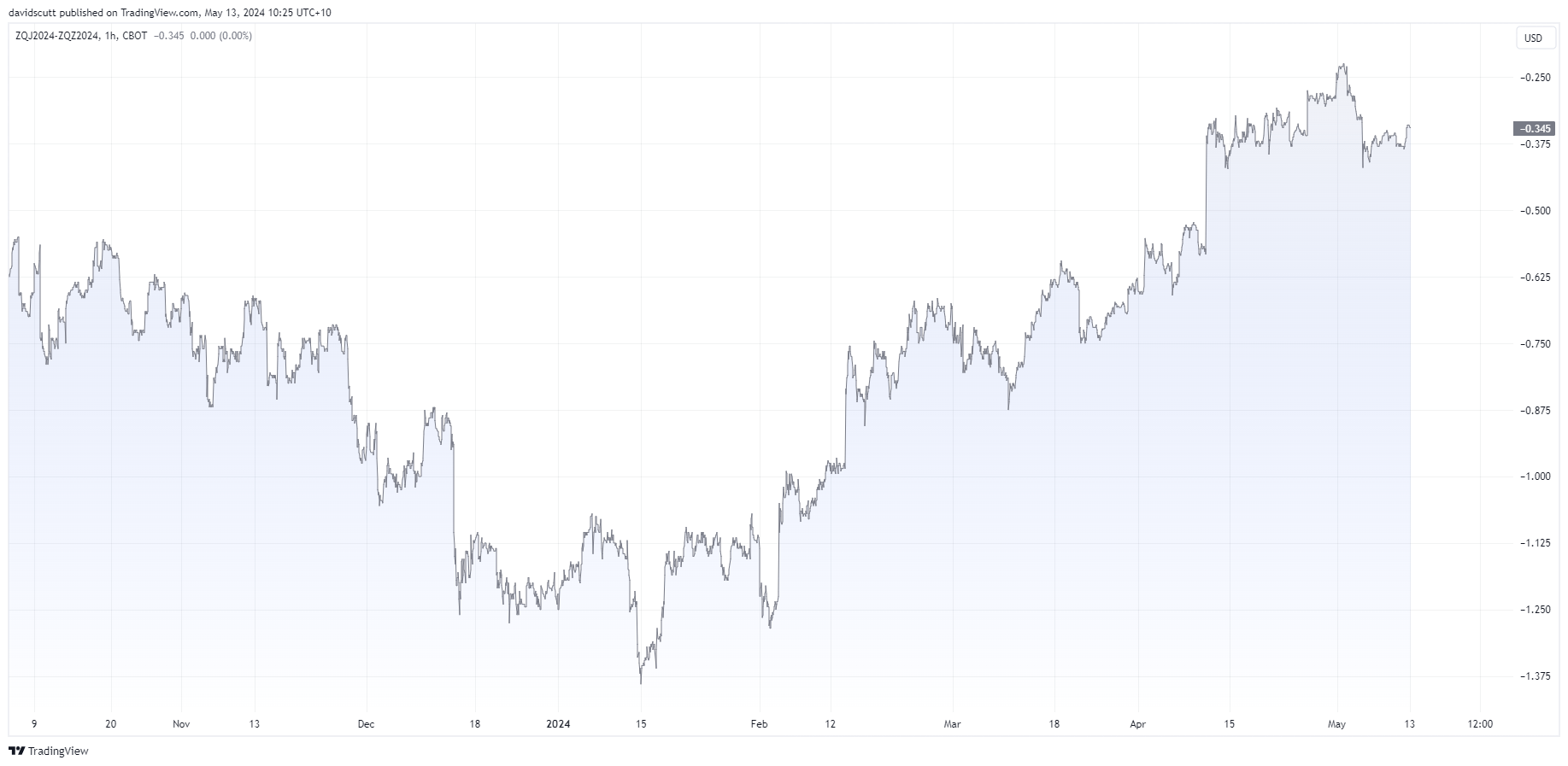

Before the data deluge, Fed funds futures have around 35 basis points of rate cuts priced in 2024, How this evolves will likely determine how the NZD/USD fares this week, with increased expectations for rate cuts likely to weigh on the greenback, and vice versus if they decline.

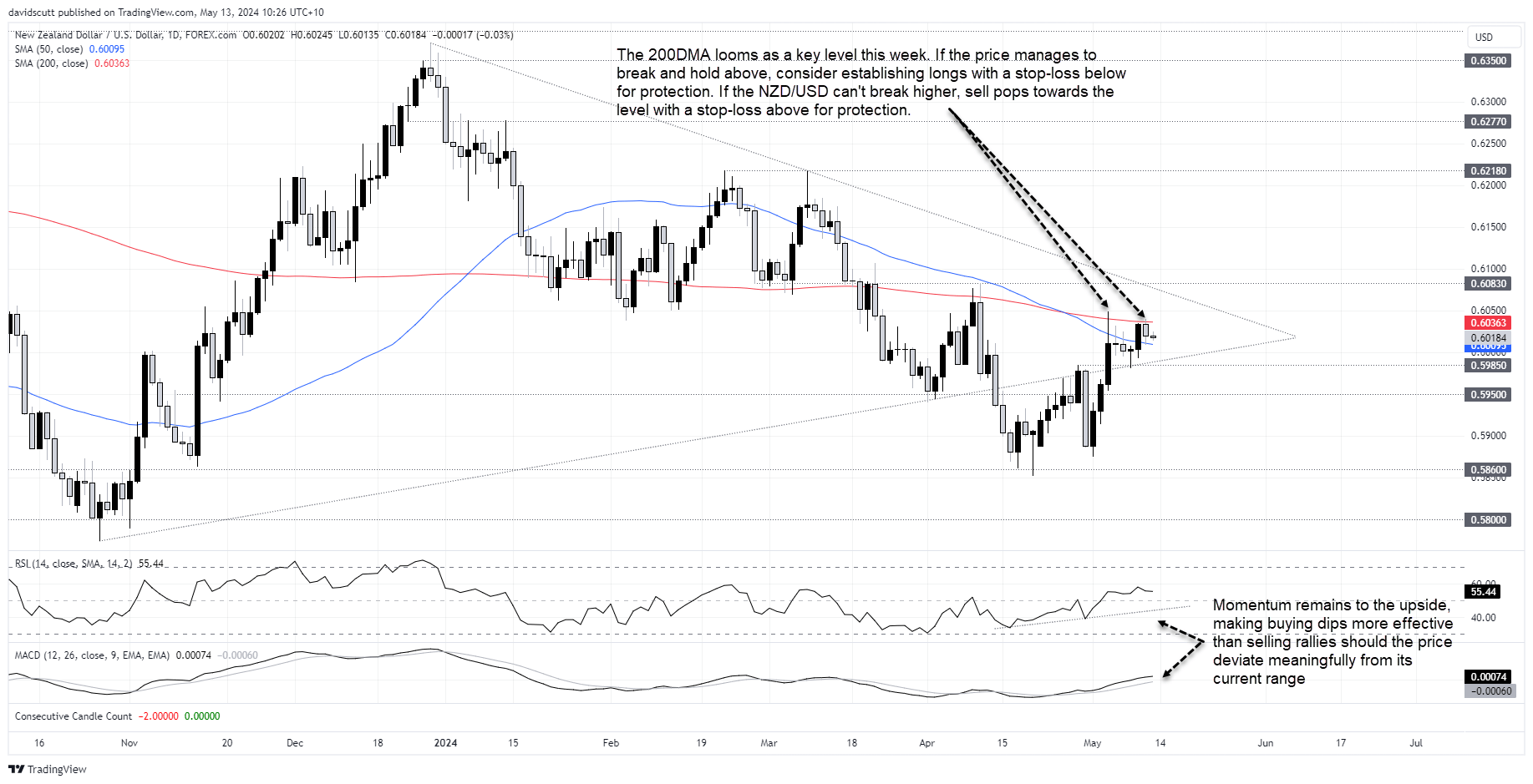

NZD/USD rebound stalls at 200DMA

Looking at NZD/USD on the charts, the advance from the YTD lows struck in April stalled last week with unable to break and hold above the 200-day moving average. That level has now thwarted bulls on two separate occasions in May, suggesting it may be a suitable level to build trade ideas around depending on how the price action evolves.

On the downside, bids were noted at the 50-day moving average last Friday with further near-term support located between .6000 and .59854. Below, there’s not a lot of visible support evident until you get back towards .5870.

Above the 200-day moving average, the intersection of the downtrend running from late December with horizontal resistance at .6083 looms as a decent test for bulls. Should it give way, other than around .6150, there’s not a lot to note until you get towards .6218, the double-top hit in February and March.

From a momentum perspective, we favour buying dips rather than selling rallies right now.

-- Written by David Scutt

Follow David on Twitter @scutty