- The RBNZ’s chief economist doesn’t sound in a rush to cut rates

- In November, the RBNZ saw the risk of a further hike in 2024 with cuts not expected to begin until 2025 at the earliest

- Weakness in New Zealand GDP may have been overstated due to one-off methodological changes

Hold off on your imminent RBNZ rate cut bets, because if the tone of the bank’s chief economist on Tuesday is anything to go by, it appears to have little interest in pivoting towards rate cuts as other major central banks have.

RBNZ chief economist anything but dovish

In a speech titled ‘The importance of quality research and data’, RBNZ chief economist Paul Conway conveyed a decisively hawkish tone, suggesting recent weakness in New Zealand’s national accounts, including a shock contraction in the third quarter, may have been driven by one-off methodological changes rather than an abrupt decline in activity.

The remark could be interpreted as an attempt to push back against forecasters and markets who have been moving to price rate cuts by the September quarter this year, in part due to reported weakness in the economy. When the RBNZ released its forecast track for the cash rate, it had the risk of a further increase in borrowing costs built into its 2024 profile with rate cuts only expected to begin from 2025 at the earliest.

Questioning the messaging received from the national accounts, Conway also cautioned that while monetary policy was working to bring inflation back to the RBNZ’s 1-3% target, non-tradable prices, or domestic inflation, remained higher than what the bank had been expecting.

“Monetary policy is working, with the economy slowing and inflation falling. But we still have a way to go to get inflation back to the target midpoint,” Conway said. “We will have much more to say on this in the February Statement, which will be based on an assessment of all incoming data.”

NZD/USD adding to earlier gains

The NZD/USD added to earlier gains following the speech, reflecting the hawkish tone which suggests the RBNZ is in no rush to join other central banks in signalling an imminent easing in monetary policy settings.

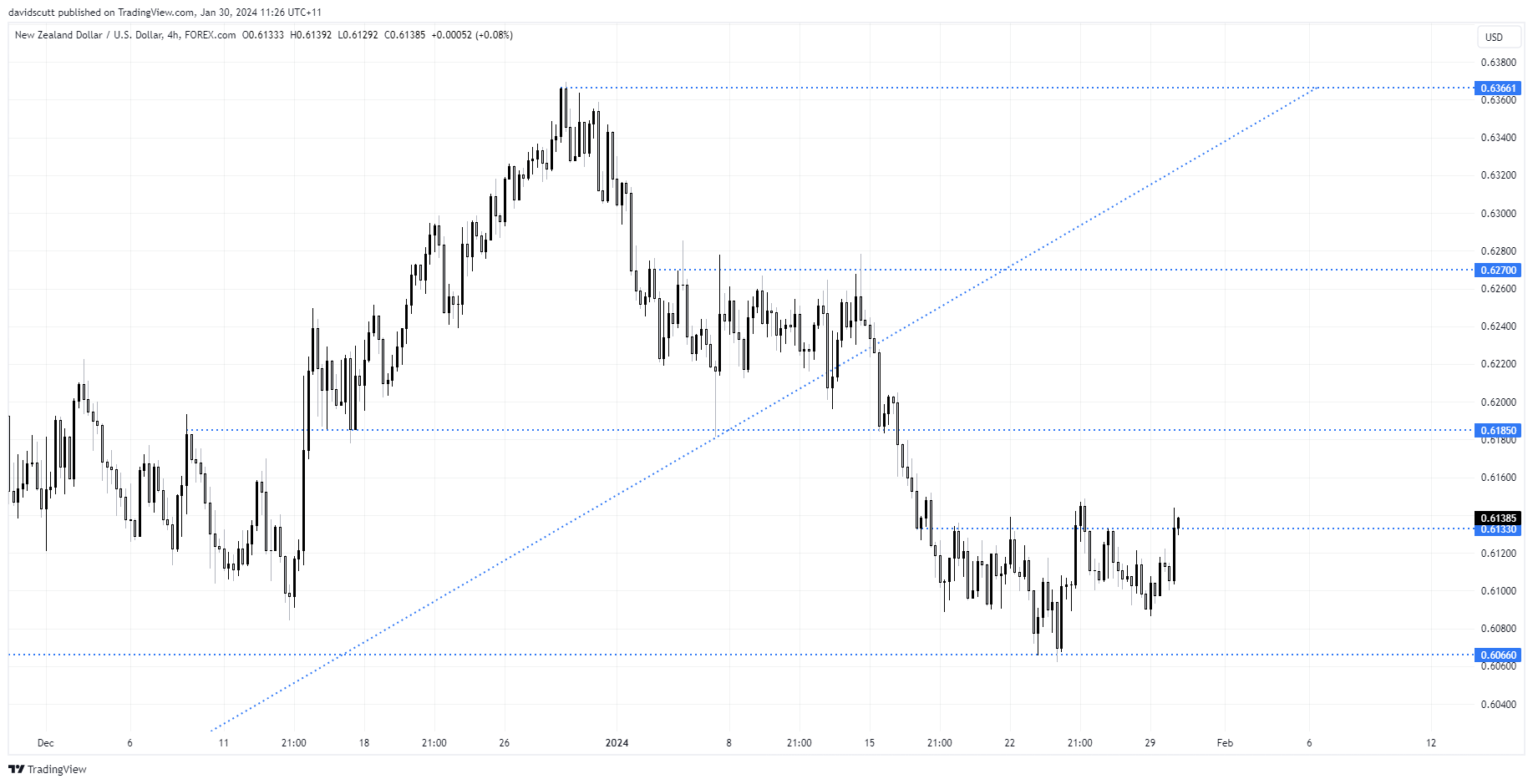

After a false break of resistance around .6133 last week, NZD/USD is having another attempt to break higher on Tuesday. If it manages to clear .6150, it may encourage fresh longs to join in looking for a move back to resistance at .6185. On the downside, bids have been noted below .6100 with further support kicking in around .6066.

-- Written by David Scutt

Follow David on Twitter @scutty