- NZD/USD was the best performing G10 FX name on Tuesday

- Big gains in Chinese markets, a softer US dollar and a better-than-expected New Zealand jobs report underpinned the move

- NZD/USD is likely to be driven by the performance of Chinese financial markets on Wednesday

A late flurry of buying after New Zealand’s jobs report sent NZD/USD to the top of the G10 FX leaderboard on Tuesday, leaving in on track for another retest of the downtrend it’s been stuck in throughout the entirety of 2024.

Already bid on a decline on a decline in US bond yields and massive gains in Chinese equities and yuan earlier in the session, the Kiwi extended its rally against the greenback to over 0.7% on the back of the jobs data which provided no smoking gun for an early rate cut from the Reserve Bank of New Zealand (RBNZ).

New Zealand jobs market slowly softening

Statistics New Zealand said unemployment ticked up a tenth to 4% in the December quarter, well below the 4.3% level expected by economists. The increase in unemployment was capped by a marginal reduction in the estimated labour force participation rate to 71.9%. Labour market underutilisation – which includes both unemployed and underemployed workers – rose by a larger 0.3 percentage points to 10.7%.

Employment growth was a touch firmer than consensus, rising 0.4% from Q3, while private sector wages growth printed at 1%, up two tenths on economist forecasts. From a year earlier, private sector wages grew 3.9%, down from 4.1% in the 12 months to September.

While the New Zealand labour force survey is notoriously volatile at times, at face value, the details of the Q4 report suggests job market conditions were cooling rather than collapsing entering 2024, eroding the case for the RBNZ to start easing policy rates as soon as May.

RBNZ events calendar perking up

RBNZ Governor Adrian Orr has an opportunity to guide markets on what he’s thinking when he delivers a speech on ‘The monetary policy remit and 2% inflation’ in a speech on February 16. The RBNZ’s next monetary policy decision arrives on February 28.

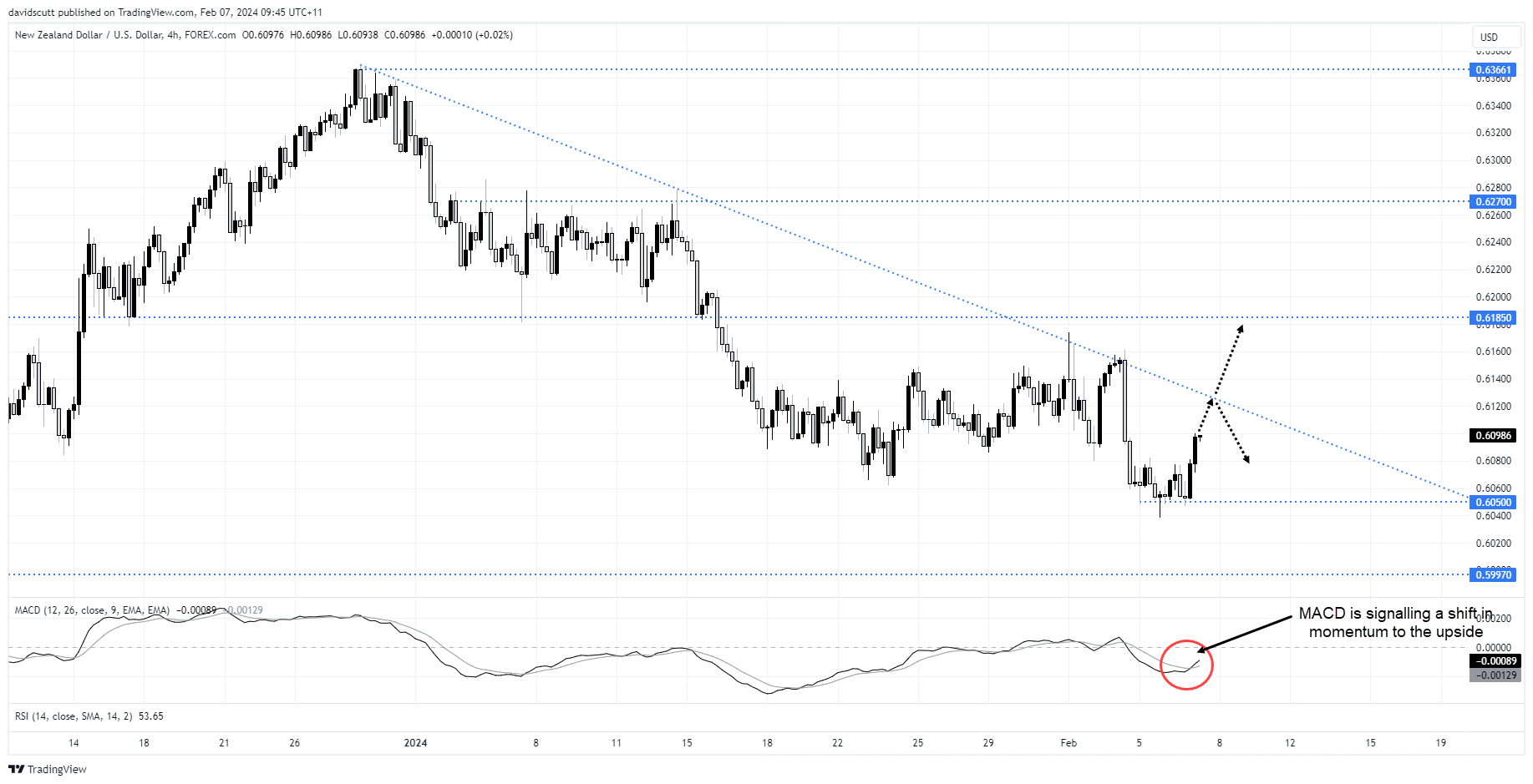

NZD/USD eyes downtrend test

Combined with the lower global bond yields, a softer US dollar and big gains in Chinese markets, the jobs data has brought NZD/USD back to within sight of the downtrend it’s been thwarted at on multiple occasions so far this year.

Given the strong bounce off support around .6050 earlier in the session, the path of least resistance may be higher for the Kiwi, especially should Chinese markets extend their rally today. Even though the basis of that rally is a financial markets ‘rescue’, muscle memory among traders typically aids NZD, AUD and commodities given we’ve become so accustomed to authorities stimulating the real economy since the GFC. At the margin, a higher wealth effect may help boost real world activity should it last beyond a fleeting moment. But that’s a long very bow.

On the topside, downtrend resistance is located at .6130, making that a potential target for longs in the near-term. Should it get there, traders can see how the price interacts at the level before deciding whether to cut, add or reverse their trade. Above, .6160 and .6185 are the levels to watch. Below, support kicks in from .6050. Remember to place a stop below your entry level that fits with an appropriate risk-reward for the trade.

-- Written by David Scutt

Follow David on Twitter @scutty