- New Zealand unemployment surged to 4.3% last quarter

- Employment fell, participation plunged while wage pressures eased

- Risks of RBNZ rate cuts in 2024 have grown

- NZD/USD remains pressured while AUD/NZD hits cycle highs

New Zealand’s unemployment rate jumped more than expected in the March quarter despite a sizeable decline in the number of Kiwis participating in the labour market, putting the Reserve Bank of New Zealand closer to cutting interest rates before the US Federal Reserve.

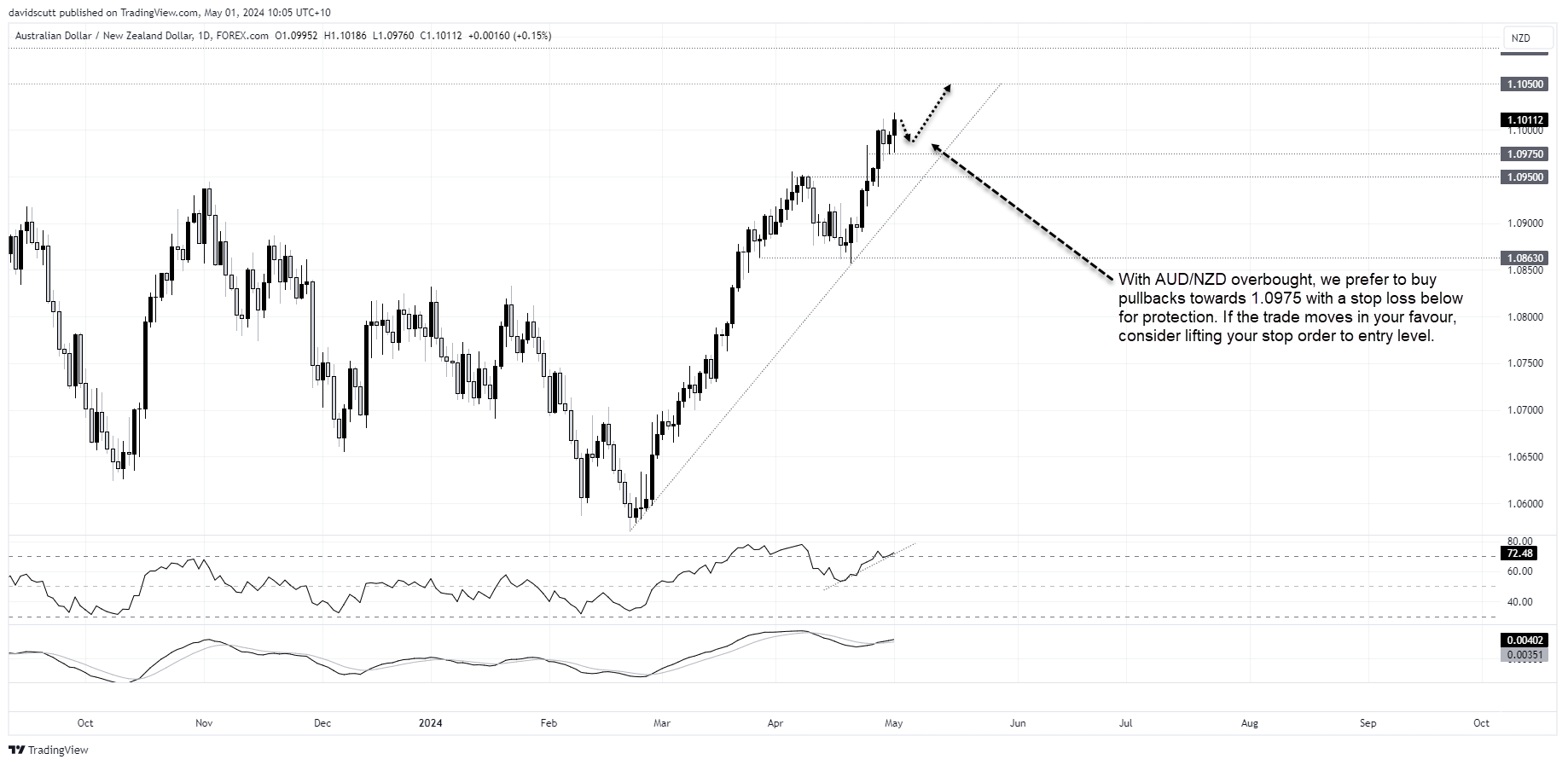

NZD/USD fell sharply while AUD/NZD rose to new cycle highs following the data.

Kiwi labour market softening fast

Unemployment rose sharply to 4.3%, above the 4.2% level expected and 4% rate reported three months earlier. Unemployment stood at 3.4% one year ago. Flattering the outcome, labour force participation tumbled four tenths to 71.5%, below the unchanged reading expected.

Statistics New Zealand reported a 0.2% decline in employment, again a significant undershoot on the 0.3% growth expected.

Over the year, the number of employed increased 36,000 to 2.9 million. Breaking down that figure, youth employment slumped by 24,900 while those aged 30 to 44 years increased by 50,800.

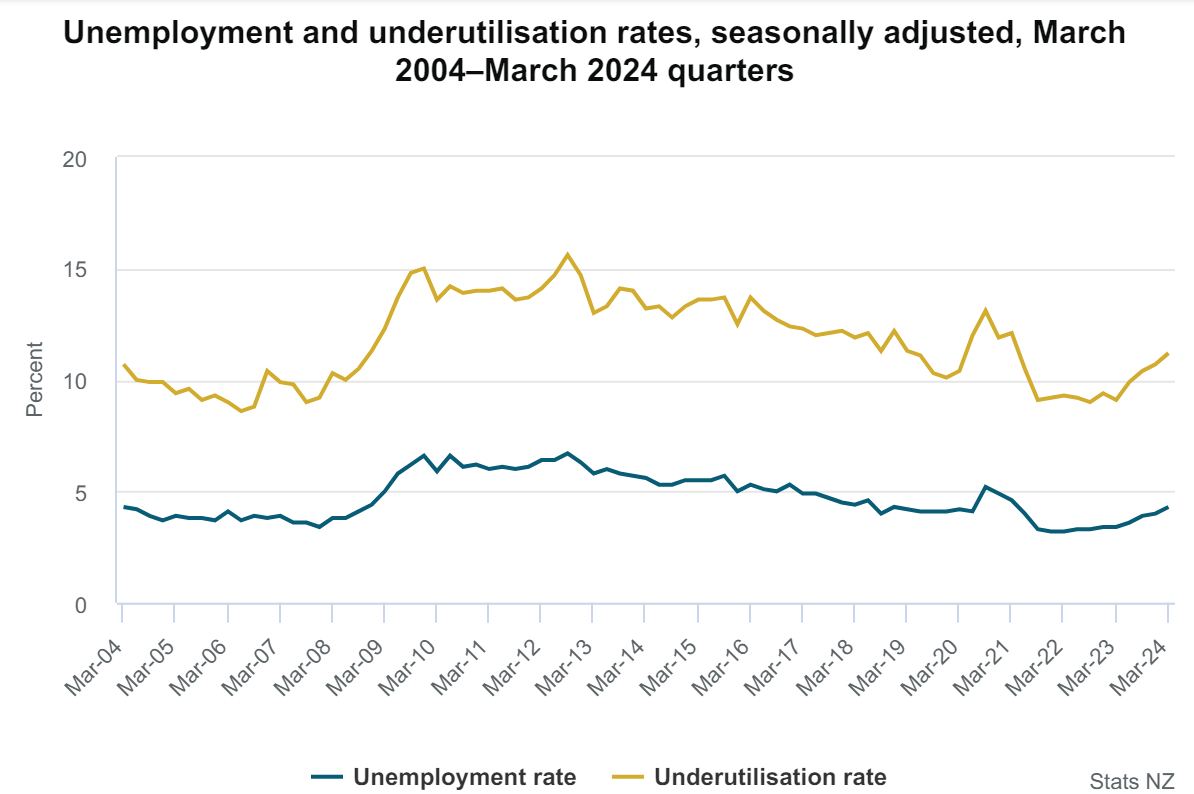

Including underemployed workers, the underutilisation rate surged to 11.2%, up from 10.7% in the December quarter and 9.1% level of a year ago. Over the year, unemployment rose by 31,000 while total underutilisation increased by 75,000.

With wage pressures subsiding

With underutilisation on the rise, wage pressures continued to ease with private sector pay lifting 0.8%, in line with expectations but below the 1% pace of Q4. From a year earlier, private sector wages growth eased a tenth of a percent to 3.8%.

Inflation will be next

The clean sweep of data weakness is reflective of an economy in recession as tight monetary policy works to reduce inflation pressures. While there is still work to be done on that front, with lagging labour market indicators already rolling over, it seems only a matter of when not if the RBNZ starts to prioritise economic activity over the threat of a reignition of price pressures.

Traders certainly think so, adding to the risk the RBNZ starts to cut rates this year, well ahead of the mid-2025 starting date currently forecast by the bank.

NZD/USD hammered, but a lot of bad news is now priced in

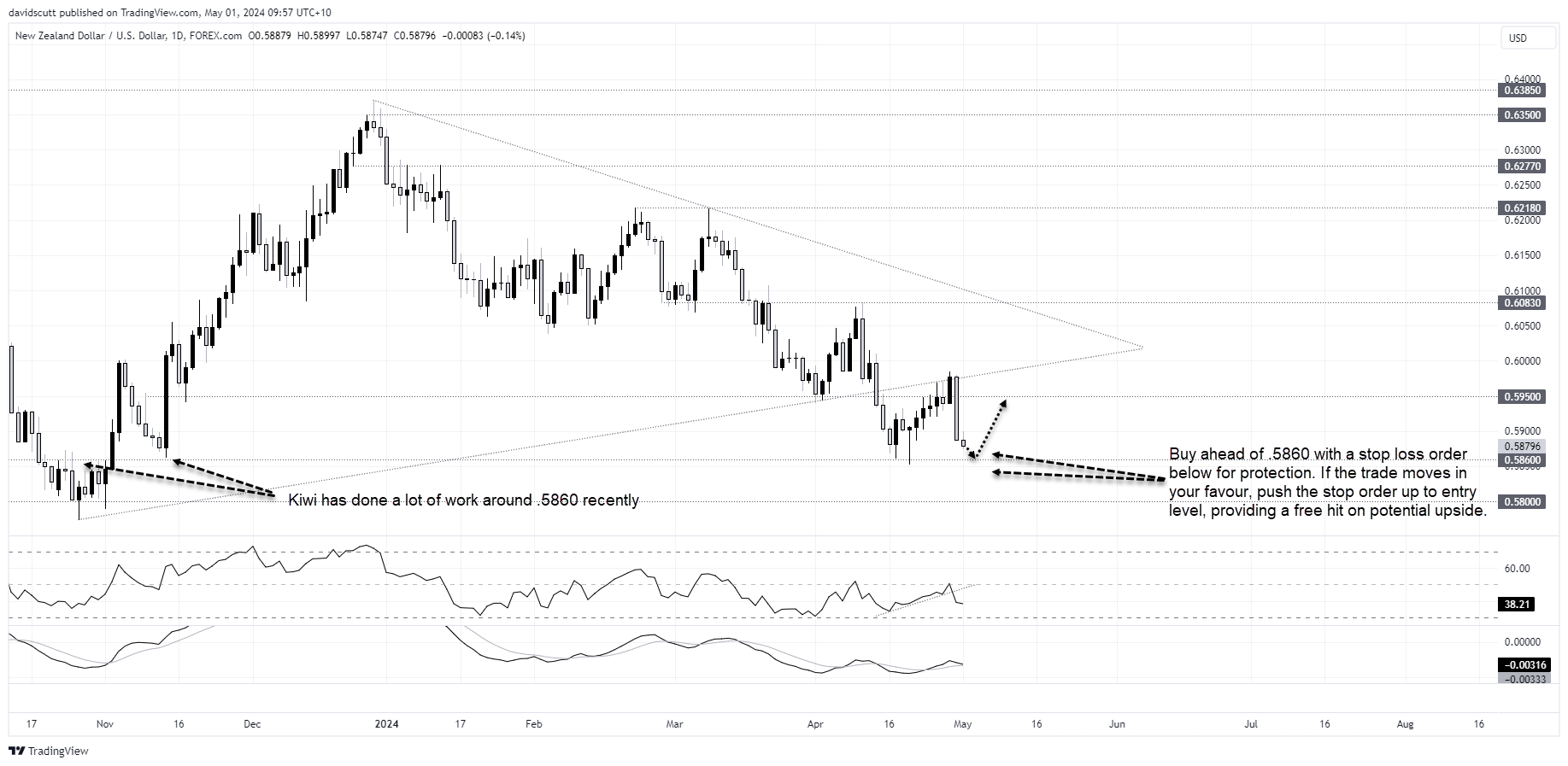

NZD/USD was hammered on the data, adding to hefty losses experienced on Tuesday as strong wages growth in the United States amplified fears of the Fed having to abandon rate cuts later this year.

While the tepid uptrend from the middle of April is now over, selling at these levels is not without its risks. Not only has NZD/USD struggled to break meaningfully below .5800 recently but there’s already plenty of bullish sentiment priced into the US dollar, meaning the Fed, US Treasury refunding details, PMIs and payrolls report will likely have to keep upward pressure on US bond yields to keep the greenback moving higher.

In the near-term, that may be hard to achieve, potentially providing a relief valve for the Kiwi.

Given the proximity to support at .5860, we favour buying dips on moves towards this level, allowing for a stop loss order to be placed below for protection. The initial upside target would be .5950 with former uptrend support around 25 pips higher the next level after that.

AUD/NZD dip buying preferred

The data helped push AUD/NZD to fresh cycle highs above 1.1000, seeing the pair move marginally into overbought territory on RSI. As such, we prefer to buy pullbacks towards 1.0975, allowing for a stop loss order to be placed below for protection. The initial trade target would be 1.1050. Buying above 1.1000 screens as a poor setup but we are not prepared to fade the move given the pair remains in a clear uptrend for now.

-- Written by David Scutt

Follow David on Twitter @scutty