- US interest rate expectations remain influential over USD/JPY, Nikkei 225 movements

- Hard to determine longer-term directional risks as these are day trading markets

- US jobless claims data out later today is likely to be important

US interest rate expectations are becoming increasingly influential on Japan’s Nikkei 225, both through the FX channel impacting forecasts for exporter earnings and sentiment towards the outlook for global economic growth. Other factors, such as commentary from Bank of Japan (BOJ) officials which fuelled substantial gains in USD/JPY and Nikkei 225 on Wednesday, come across as secondary factors for now.

US rates, Nikkei, USD/JPY the same trade?

The Nikkei 225 chart tells the story.

It’s a daily timeframe with price at the top and rolling four-week correlation with USD/JPY in blue and US two-year yields in red at the bottom. The relationship with both these markets has been very strong and positive over the past month, reflecting the role interest rate differentials have on the FX side and the role the FX side has on Japanese export earnings.

US rates look to be leading

But what’s leading what?

That question is up for debate, but the rapid strengthening of the correlation between two-year US Treasury yields and Nikkei suggests it’s US rates in the driving seat. Before looking at anything else that happened overnight, the first market I glanced at today was US two-year yields. They were lower than where I looked last night, implying USD/JPY and Nikkei 225 futures would be lower. They were. Substantially.

For traders, it suggests US short-end rates can be used as a filter when evaluating trade setups, along as the relationship holds.

Jobless claims unusually important

In a week where we’ve seen almost no new data on the health of the US economy outside corporate earnings results, the sensitivity of short-end US rates to perceptions about the economic outlook suggests we may see an outsized reaction to weekly jobless claims data released later in the session.

It’s summer in the States, filled with holidays and temporary business closures – it could spit out absolutely anything which we know is likely to influence the Nikkei and USD/JPY. A 240,000 figure is expected, down from 249,000 last week. Remember those numbers.

Nikkei 225 futures technical setup

In terms of trade setups in Nikkei 225 futures, I’m agnostic on short-term directional risks given how sensitive markets are to US rate expectations. We’re dealing with day trading markets here, so adjust accordingly until things settle down.

Having broken several uptrend supports during the recent rout, selling rallies comes across as easier than buying dips, but I’m not wed to the idea. What’s clear is the price is finding it difficult to break the intersection of former uptrend and horizontal support around 35,700, rejected twice here over the past two days. That’s your first topside level to watch. Above, 37,000 and 200-day moving average await.

On the downside, 33,750 was respected for large parts of last year but has been decimated over the course of this week. I’ll leave it on the chart, but don’t put faith in it unless the price does first. 30,400 looms as a more reliable level, respected on numerous occasions last year with the rout stalling just ahead of it on Monday.

USD/JPY tied at the hip with US rates

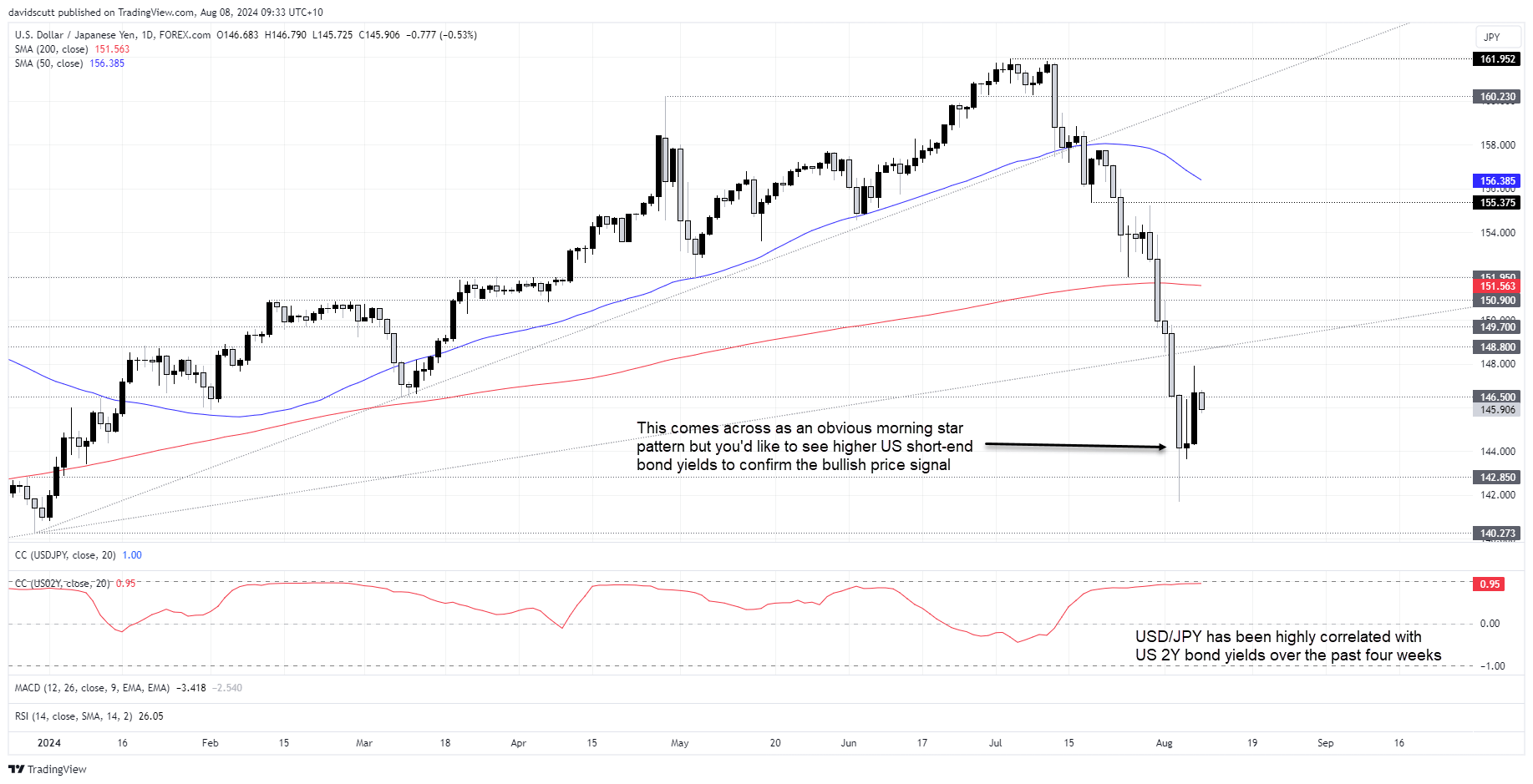

My view towards directional risks for USD/JPY is much the same as Nikkei in the near-term, simply evaluating moves on the charts against known levels and gyrations in US short-end bond yields. As shown by the red line below, dollar-yen has been moving basically in lockstep with the latter over the past four weeks, sitting with a correlation of 0.95 on a daily timeframe.

USD/JPY has tended to gravitate towards 146.50 in recent days, so that’s an immediate reference point on the chart. The three-candle pattern on the daily resembles a morning star that’s often seen around market bottoms, but I’m not going to get excited about it unless US yield provide the green light by pushing higher.

Wednesday’s rally stalled just below 148, so that’s your first target on the topside. Above, the intersection of the former uptrend and horizontal support at 148.80 looms as potentially tough test for bulls.

On the downside, the price bottomed Tuesday at 143.60, a level the price respected last year before being obliterated earlier this week. That’s the first level of note. 142.85 may find some buyers but Monday’s low of 141.70 looms as a more important level. A break there would bring the December 2023 low into play at 140.27

-- Written by David Scutt

Follow David on Twitter @scutty