T

he fall in the commodity currencies started after the dovish RBA outcome yesterday afternoon, accentuated by sharp falls in key commodity prices on Chinese futures exchanges.

To put some of the recent moves in the commodity space in context, coal has now fallen around 45% from its October highs, and iron ore has lost approximately 55% from its May highs.

Saving further blushes, the commodity currency complex has found some support this morning after another stonking New Zealand labour market report.

Total employment rose 2.0% q/q vs 0.4% expected. The unemployment rate fell from 4.0% to 3.4%, equal to the previous record low set 14 years ago in Q4 2007. While private-sector wage growth rose by 0.7% q/q, slightly lower than the 0.8% q/q expected.

All in all, another strong report that highlights the impressive underlying strength of the New Zealand economy despite having spent half the September quarter in lockdown.

As the current lockdown has extended into the December quarter, it remains unknown if the New Zealand economy has weathered the 2021 lockdowns unscathed. For this reason, the RBNZ may choose to resist calls for a 50 bp tightening at its November meeting and deliver a more cautious 25 bp hike.

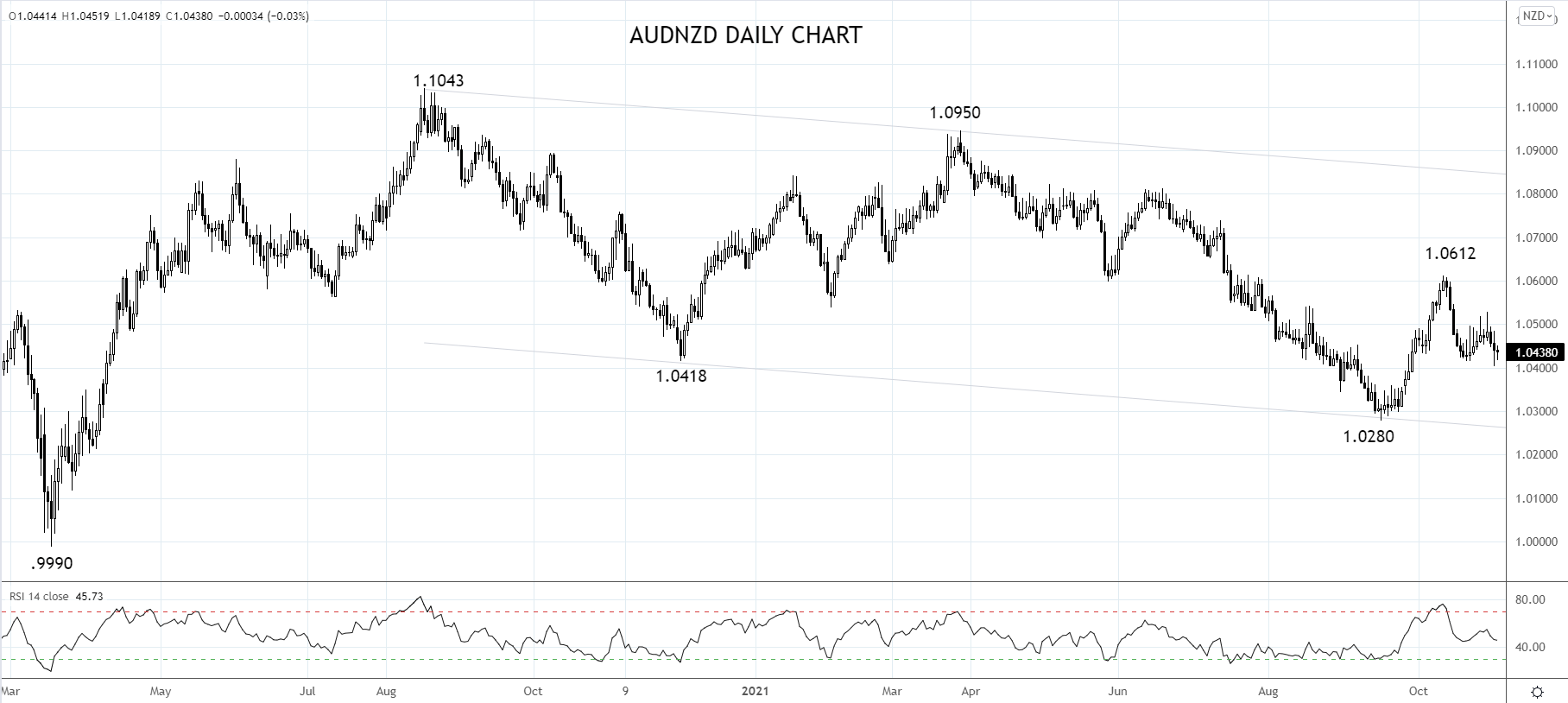

Nonetheless, the events of the past 24 hours have reinforced the divergent monetary policy path that the RBA and the RBNZ are walking and why the AUDNZD cross rate is on our radar

Technically, AUDNZD has spent the past 14 months trading lower in a descending trend channel. The preference is to sell bounces into the 1.0470/1.0530 resistance area looking for the cross to decline towards the bottom of the trend channel near 1.0250 in the coming weeks.

Source Tradingview. The figures stated areas of November 3rd, 2021. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

- Open a Forex.com account, or log in if you’re already a customer.

- Search for the pair you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.