US futures

Dow future 0.06% at 39166

S&P futures 0.01% at 5474

Nasdaq futures 0.23% at 19770

In Europe

FTSE -0.48% at 8229

Dax -0.40% at 18165

- Nvidia falls from record high

- PMI is set to ease slightly after weaker retail sales & higher jobless claims this week

- Oil is set to rise across the week

Nvidia falls, PMI data in focus

U.S. stocks are heading for a quiet open as Nvidia looses ground and investors look cautiously ahead to PMI data.

While AI stocks have helped the NASDAQ and S&P 500 reach new record highs this week, investors are booking profits, pulling the sector lower amid questions about the rally's sustainability. The move is dragging on the major indices.

Meanwhile, attention will be on US PMI readings, which are expected to fall slightly but remain above the key 50 level, which separates expansion from contraction.

While the US markets have previously considered bad news as good news because it means the Fed will cut rates sooner, there is always a risk that signs of a slowdown could spark recession jitters.

Other data this week have pointed to a softening in the US economy, with retail sales falling more than expected and jobless claims remaining near last week's nine-month high.

While the market is pricing in a 70% probability of a September rate cut, Fed speakers this week have supported the view that the Fed will cut rates and that rate cut could be as late as December.

Corporate news

Nvidia is falling, extending losses of 3.5% in the previous session in profit-taking after the stock rallied sharply following its stock split. Nvidia trades at 165% so far this year; however, recent declines mean it lost its crown as the world's most valuable company, which it briefly took from Microsoft earlier this week.

Amazon will be in focus after a report that the tech giant is planning a major revamp of its decade-old, money-losing Alexa service. This could include conversational generative AI and two levels of service costing $5 or $10.

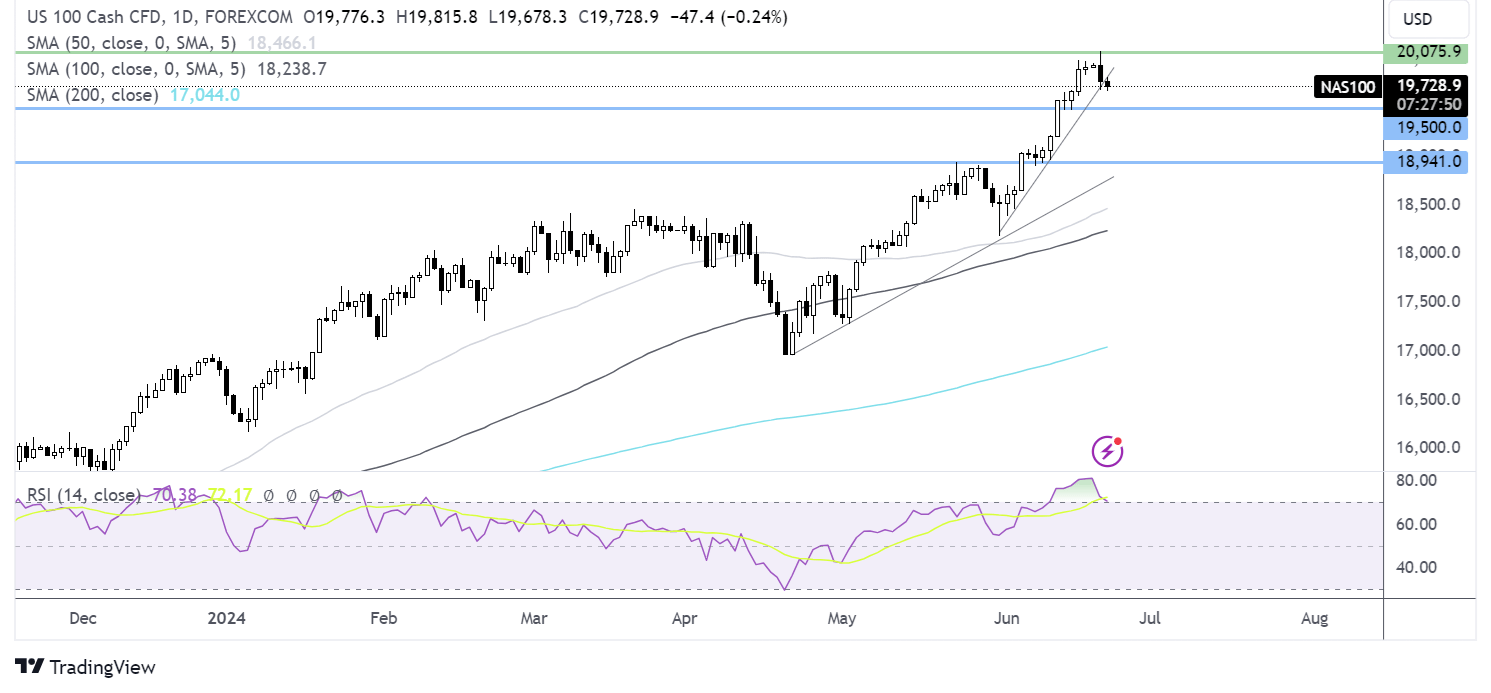

Nasdaq 100 forecast – technical analysis.

The Nasdaq 100 has eased back from yesterday's ATH of 20,085. The price has slipped below the rising trendline, helping to bring the index closer to coming out of overbought territory. The buyers will look to rise above 20,085 for fresh ATHs. There is little in the way of support, with 19,500 in focus ahead of 19,000.

FX markets – USD rises, GBP/USD falls

The USD is rising after hawkish Fed comments and ahead of more clear data from business surveys. The Fed, being the least dovish of major central banks, is driving the USD higher.

EUR/USD is under pressure below 1.07 after weaker-than-expected PMI data suggesting that the economic recovery in the region slowed. The manufacturing PMI fell to 45.6 in June versus the 47.9 expected, while the services PMI fell to 52.6, defying forecasts of 53. rise to 53.5. Delving deeper into the numbers, eurozone business growth slowed sharply as demand fell for the first time since February.

GBP/USD is falling as investors digest stronger than expected retail sales and weaker-than-expected service sector activity. Retail sales jumped 2.9% year on year after falling 1.8% in the previous month, highlighting the volatile nature of this monthly report. Meanwhile, the UK preliminary services PMI edged lower to 51.2 in June, defying expectations of a rise to 53 and falling to a seven-month low as the election nerves appeared to hit the economy.

Oil set for a weekly rise

Oil prices are rising and are set to book a second straight week of gains amid signs of improving demand, falling inventories, and ongoing political tensions.

Data from the US Energy Information Administration showed a drawdown in US crude stockpiles by 2.5 million barrels more than the 2.2 million draw that analysts expected.

Inventories also fell by 2.3 million barrels compared with expectations of a 600K build.

Meanwhile, signs of stronger demand in Asia have also lifted sentiment, with oil refineries in the region reviving some capacity after maintenance.

Finally, Ukraine's geopolitical tensions keep oil high after Ukraine's military it's junk for refineries in Russia and after Hezbollah pledged to a long contract with conflict with Israel.