US futures

Dow futures +0.50% at 33836

S&P futures +0.3% at 4340

Nasdaq futures +0.16% at 15017

In Europe

FTSE +0.4% at 7629

Dax +0.02% at 15180

- The market mood remains cautious on concerns of a wider conflict

- Earnings season ramps up this week with 11% of the S&P500 reporting

- Chip stocks in focus as US reportedly will tighten restrictions to China

- Oil holds onto Friday’s gains

Banks beat earnings estimates

US stocks are pointing to a mildly stronger open after losses on Friday. The market mood remains cautious and trading could be choppy as investors fret over the potential of escalating violence in the Middle East and look ahead to the US earnings season ramping up.

US Secretary of State Anthony Blinken is due to return to Israel in a diplomatic effort to ensure that the conflict with Hamas does not spill over into the wider Middle East region. This comes as Iran, which backs Hamas warned Israel of consequences if the conflict escalates.

Domestically, this week sees earning season ramp up, with 11% of the S&P 500 expected to report earnings. While Monday is a quiet day with just Charles Schwab reporting, tomorrow sees Bank of America and Goldman Sachs continuing the bank earnings after JP Morgan and Wells Fargo posted upbeat numbers on Friday.

The US economic calendar is relatively quiet, and the main release will be the New York Empire State manufacturing index, which is expected to fall -1.5% in October after rising 1.9% in September.

Looking ahead across the week, tomorrow sees the release of US retail sales figures which will provide some insight into the strength of consumer spending ahead of Federal Reserve chair Jerome Powell's speech at the Economic Club in New York on Thursday.

Corporate news

Pfizer drops after lowering its revenue and earning forecasts for the year. The drug maker now expects EPS at $1.55, down from $3.35, and full-year revenue is expected at $59.5 billion, down from $68.5 billion. The downward revision is owing to a decline in demand for its COVID-19 treatments.

Apple is falling pre-market as it faces challenges in the Chinese market with sales of the iPhone 15 lagging behind sales of its predecessor, the iPhone 14. Meanwhile, Huawei has now taken the top spot in the market from Apple in China, according to Jefferies analysts.

US chip stocks such as Nvidia and Advanced Micro Devices will be under the spotlight on reports that the US will strengthen restrictions on China's access to its advanced chip technology.

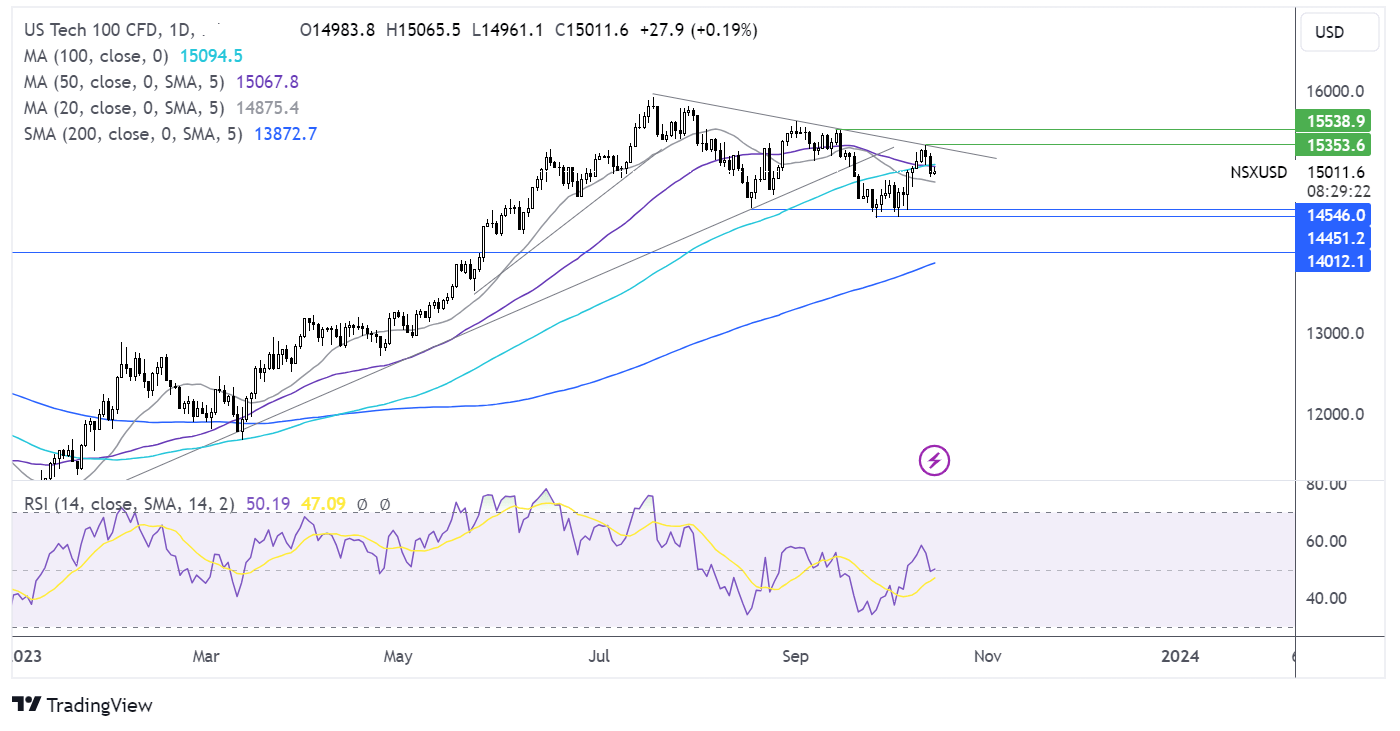

Nasdaq 100 forecast – technical analysis.

After falling below the 100 sma on Friday, the Nasdaq 100 dropped to a low of 14940 on Friday, which is offering a floor for now. Buyers will look to rise above the 50 sma at 15100 and 15340, last week’s high and the falling trendline resistance to create a higher high. Meanwhile, sellers will look for a break below 14940 to test the 20 sma support at 14900. A break below here opens the door to 14535 the August low and 14445 the October low.

FX markets –USD falls, EUR rises

The USD is falling at the start of the week but remains near the weekly high as the greenback is supported by safe-haven flows amid the ongoing conflict in the Middle East. The US dollar reached a 10-month high last week after hotter-than-expected inflation boosted the prospect of the Federal Reserve keeping interest rates high for longer. Federal Reserve chair Jerome Powell is due to speak later this week.

EUR/USD is rising, taking advantage of the softer U.S. dollar after the eurozone posted a trade surplus of €6.7 billion after booking a trade deficit of €54.4 billion in August 2022. Exports across the block rose 1.6% in August however, the eurozone's largest economy, Germany, saw exports tick down 0.7% amid the ongoing sluggishness in the manufacturing industry. German wholesale prices also fell 4.1% annually, marking the sixth straight monthly decline.

GBP/USD is rising thanks to a slightly softer dollar and as investors digest the latest Rightmove house data, which showed that prices rose at the slowest pace in the month of October since 2008. Weaker house prices can have a damaging effect on consumer confidence.

EUR/USD +0.22% at 1.0534

GBP/USD +0.16% at 1.2160

Oil holds most of Friday’s gains

Oil Prices are holding onto most of Friday's gains as investors continue to watch developments in the Middle East to see if the Israel-Hamas conflict draws in oil-rich countries.

Both the Brent crude and West Texas Intermediate rallied almost 6% on Friday as the market priced in a higher geopolitical risk premium amid the possibility of a wider Middle East conflict.

The war between Israel and Hamas is the most significant risk to oil markets since Russia's invasion of Ukraine last year, particularly amid concerns over an escalation involving Iran.

Oil markets will be watching developments closely, particularly comments from Iran or from the US.

For now, the tensions are keeping oil prices well supported, and it would take a de-escalation of tensions for oil prices to fall significantly lower.

WTI crude trades -0.2% at $86.39

Brent trades -0.2% at $89.84

Looking ahead

15:30 Fed Harker Speech