US futures

Dow future 0.17% at 40,437

S&P futures 0.37% at 5657

Nasdaq futures 0.20% at 20470

In Europe

FTSE -0.7% at 8125

Dax -0.71% at 18470

- Retail sales ex-autos rise 0.4% MoM

- Fed Powell's speech & Trump trade remain in focus

- BAC & MS beat earnings and revenue forecasts

- Oil falls as China worries offset Fed rate cut hopes

Stronger retail sales fail to dampen the mood

U.S. stocks are set to rise modestly on the open as the Trump trade continues, and investors digest comments from Fed Powell, including the latest US retail sales and earnings.

US retail sales excluding autos rose by the most in three months in June, a sign that consumers are regaining their footing at the end of Q2. Retail sales less major vehicles rose +0.4% after an upwardly revised 0.1% increase in May. The data contrasts a recent trend, which had shown a gradual slowdown in consumption as Americans started to be squeezed amid high interest rates and a cooling labor market. Instead, the stronger data suggests that the economy is holding out better as the Federal Reserve considers a start to reducing interest rate cuts.

The data comes after Federal Reserve chair Jerome Powell yesterday said he was more confident that inflation was cooling towards the Fed's 2% target. Following his speech, the markets are now pricing in a 100% probability that the Fed will cut rates in September.

Powell’s comments, combined with expectations that Donald Trump could win a second term in the White House, have supported stocks. Trump's protectionist policies helped Wall Street higher on Monday and continue to fuel the Trump trade, which is buying the US over anything else.

As well as economic data attention is also on earning season as more earnings continue to drive in.

Corporate news

Bank of America is set to open 2% higher after reporting Q2 revenue and profits that beat expectations, thanks to rising investment banking and asset management fees.

Morgan Stanley is set to open over 2% lower despite reporting profits rising in Q2 with investment banking activity rewrite rebounding.

Apple is set to open at fresh all-time highs after Morgan Stanley called the stock a “top pack for AI.” Analysts cited the company's AI efforts, which are likely to boost device sales as Apple catches up with Alphabet, Google, and Microsoft, which have already benefited from AI gains.

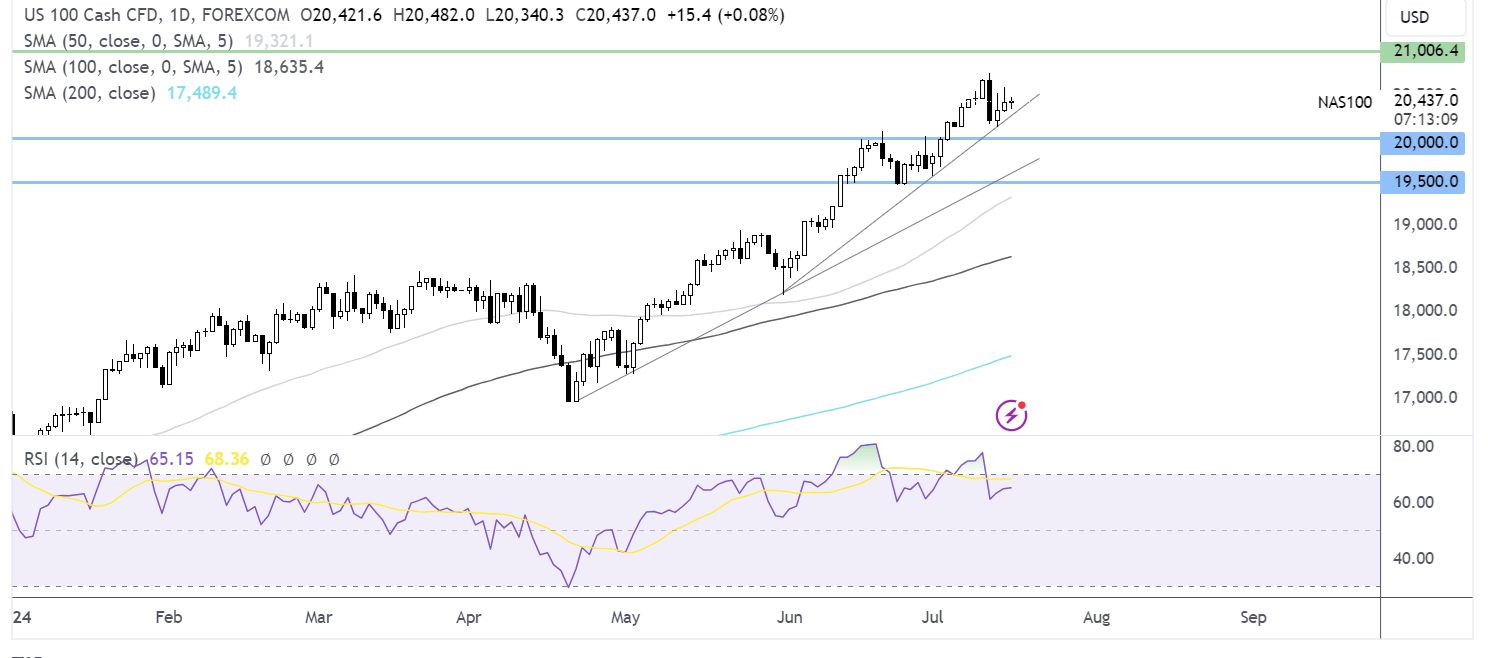

Nasdaq 100 forecast – technical analysis.

The Nasdaq holds above its near-term rising trendline, recovering from Friday’s selloff. Buyers will look to push the price above 20,600, the weekly high, ahead of 20,760 for fresh all-time highs. Support can be seen at 20,250, the rising trendline support. Below here is 20,130, last week’s low, ahead of 20,000. A fall below 19,500 is needed for sellers to take control.

FX markets – USD rising, GBP/USD falls

The USD is rising after retail sales data was stronger than expected. The USD continues to weigh up the Trump trade against expectations that the Fed could cut rates soon.

EUR/USD is falling after German ZEW economic sentiment fell more than expected in June. German economic morale fell to 41.8, down from 47.5. The data raises concerns over a slowdown in the eurozone’s largest economy. Attention will turn to the ECB meeting on Thursday, where the central bank is expected to leave rates unchanged.

GBP/USD is falling after data from Kantar showed that UK grocery inflation cooled the most in almost three years. Grocery inflation is 1.6%, a level last seen in September 2021 and coincides with an increase in footfall. UK inflation data is due tomorrow and jobs data on Thursday.

Oil falls further on China worries.

Oil prices continue falling on Tuesday, extending the selloff from yesterday amid ongoing concerns over the health of the Chinese economy and despite expectations that the Federal Reserve is looking to cut interest rates as soon as September potentially.

Data yesterday showed that the Chinese economy grew at 4.7% in Q2, its lowest rate since Q1 2023, while also missing forecasts. Slowing growth in China, the world's largest importer, hurts the oil demand outlook, adding pressure on oil prices.

Meanwhile, increased confidence that US inflation is cooling towards the 2% target supports the view that the Fed could cut interest rates soon. A lower interest rate environment is more beneficial for oil demand, helping to cap some of the losses fueled by China concerns.