US futures

Dow future -0.17% at 41,110

S&P futures 0.97% at 5608

Nasdaq futures 0.85% at 19966

In Europe

FTSE 0.80% at 8253

Dax 0.31% at 18500

- Chip stocks and mega caps recover

- Markers jittery ahead of tech earnings

- US jobless claims rise 243k vs 222k forecast

- Oil steadies after strong gains yesterday

Chip stocks and mega caps recover from blistering selloff

U.S. stocks are pointing to a broadly positive start following upbeat forecasts from Taiwan Semiconductor Manufacturing, which helped lift chip stocks and mega caps following a sharp sell-off yesterday.

The Philadelphia Semiconductor Index logged its worst day in four years on Wednesday amid a rout in chip stocks, which also pressurised mega caps and amid rotation out of growth into cyclical and small caps.

There are some signs of nerves as attention turns to earnings from these high-valued mega caps, which have rallied hard across the year. Investors question whether the fundamentals will be able to support the high valuations.

The bar for earnings is set high for the tech sector, beating profits may no longer be enough to spur further gains.

While tech stocks have struggled, the Dow Jones and small-cap Russell 200 have enjoyed impressive rallies over the past few days thanks to Fed rate cut expectations. Despite the recent slump in tech stock, sentiment remains upbeat for U.S. stocks on expectations that the Federal Reserve will start to cut rates in September.

On the data front, US jobless claims were higher than expected at 243k, up from 222k previously and ahead of the 230k forecast. This points to a slight softening in the labour market.

Attention will also be on Fed speakers with Lorie Logan and Mary Daly scheduled to speak.

Corporate news

Netflix is set to open modestly higher ahead of its quarterly results, which come after the close. Netflix has already guided for lower net subscriber additions in Q2 compared to three months earlier.

Taiwan Semiconductor Manufacturing is set to open over 1% higher after the world's largest contract chipmaker posted a 36% rise in Q2 net profits, fueled by a surge in demand for semiconductors used in AI.

Domino's is set to slump 12% after the pizza chain missed quarterly same-store sales estimates. Inflation worries dampened US demand.

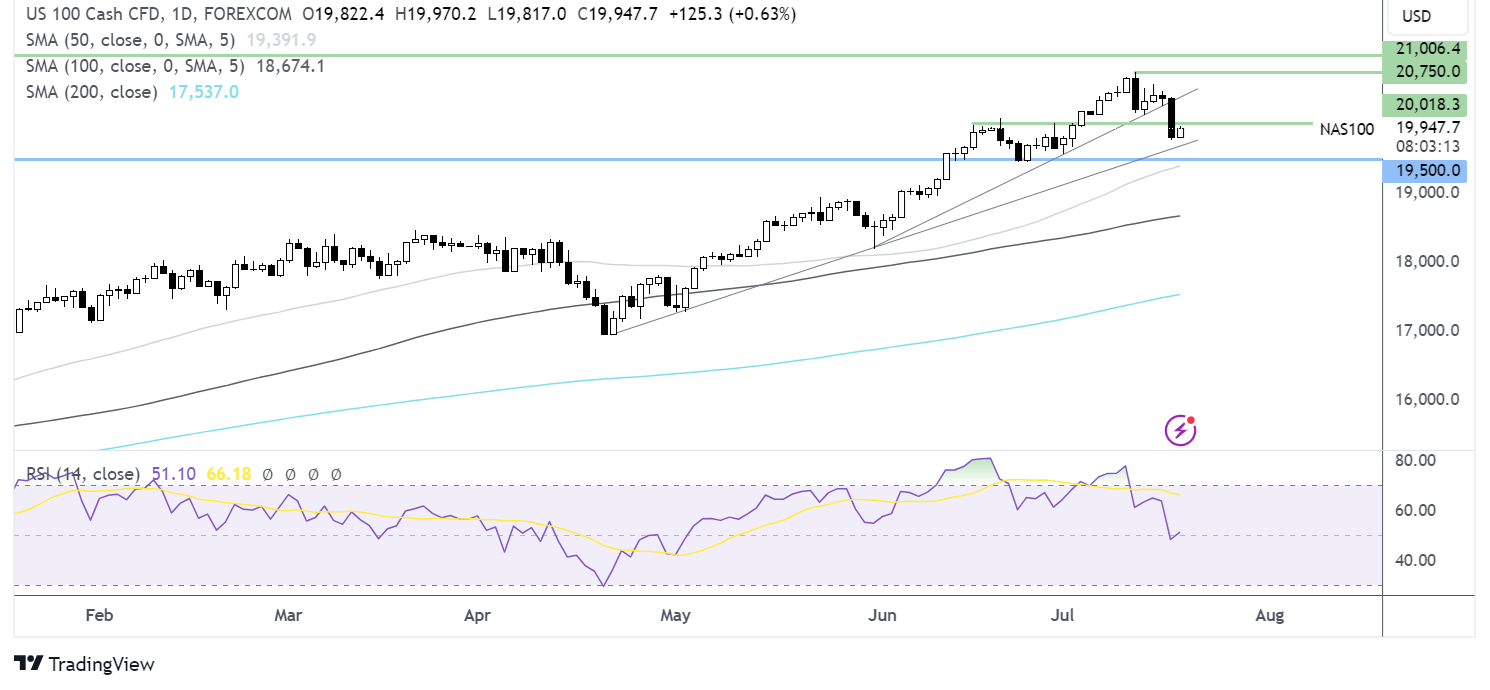

Nasdaq 100 forecast – technical analysis.

The Nasdaq broke below its near-term rising trendline and 20k before finding support at 19771. Buyers are attempting to stage a recovery but must retake 20,000, the psychological level, and 20,400 yesterday’s high, to extend to 20,759 and fresh all-time highs. Meanwhile, sellers will look to take out 19.770, yesterday’s low, and 19700, the rising trendline support, to bring 19,500, the late June low, into play.

FX markets – USD rising, GBP/USD falls

The USD is rising, recovering from a 3-month low, as treasury yields tick higher despite higher-than-expected jobless claims.

EUR/USD left interest rates unchanged at 3.75%, which is in line with expectations. The decision comes as inflation sits at 2.5% and wage growth remains strong. Attention is now on ECB Christine Lagarde’s press conference.

GBP/USD is falling modestly, but after UK jobs data revived some hope, the August rate cut was still possible. Unemployment remained unchanged at a 2.5-year high of 4.4%, and wage growth eased to a two-year low of 5.7%. The market lifted rate cut expectations to 40%, up from 30% at the close yesterday.

Oil steadies after strong gains yesterday

Oil prices are Holding steady after rebounding 2% in the previous session following a larger-than-expected draw in US inventories.

According to data from the Energy Information Administration, crude oil inventories fell by 4.9 million barrels last week. This was well ahead of the forecast decline of 30,000 barrels and was greater than the drop of 4.4 million barrels seen in the API report.

Meanwhile, optimism that the Federal Reserve could start easing interest rates soon, which would boost economic growth and lift the oil demand outlook, is also supporting oil prices.

However, Chinese economic growth remains a point of concern. Chinese leaders on Thursday signaled that Beijing would stay the course with the economic policy, although few concrete details were disclosed. Data at the start of the week showed that Chinese GDP was weaker than expected in Q2.