At its biannual meeting, the MAS said it would raise the slope of its currency band slightly from zero previously while maintaining the width of the currency band at which it is centred.

The currency is a primary tool of MAS monetary policy. Increasing the slope of the band has allowed the currency to appreciate, thereby reducing the price of imports and easing inflationary pressures.

Of the thirteen economists polled by Reuters ahead of the event, eleven predicted that the central bank would keep its monetary settings on hold.

After the announcement, USDSGD fell -0.30% to 1.3475, although it has since recovered to be back trading near 1.3500 at the time of writing.

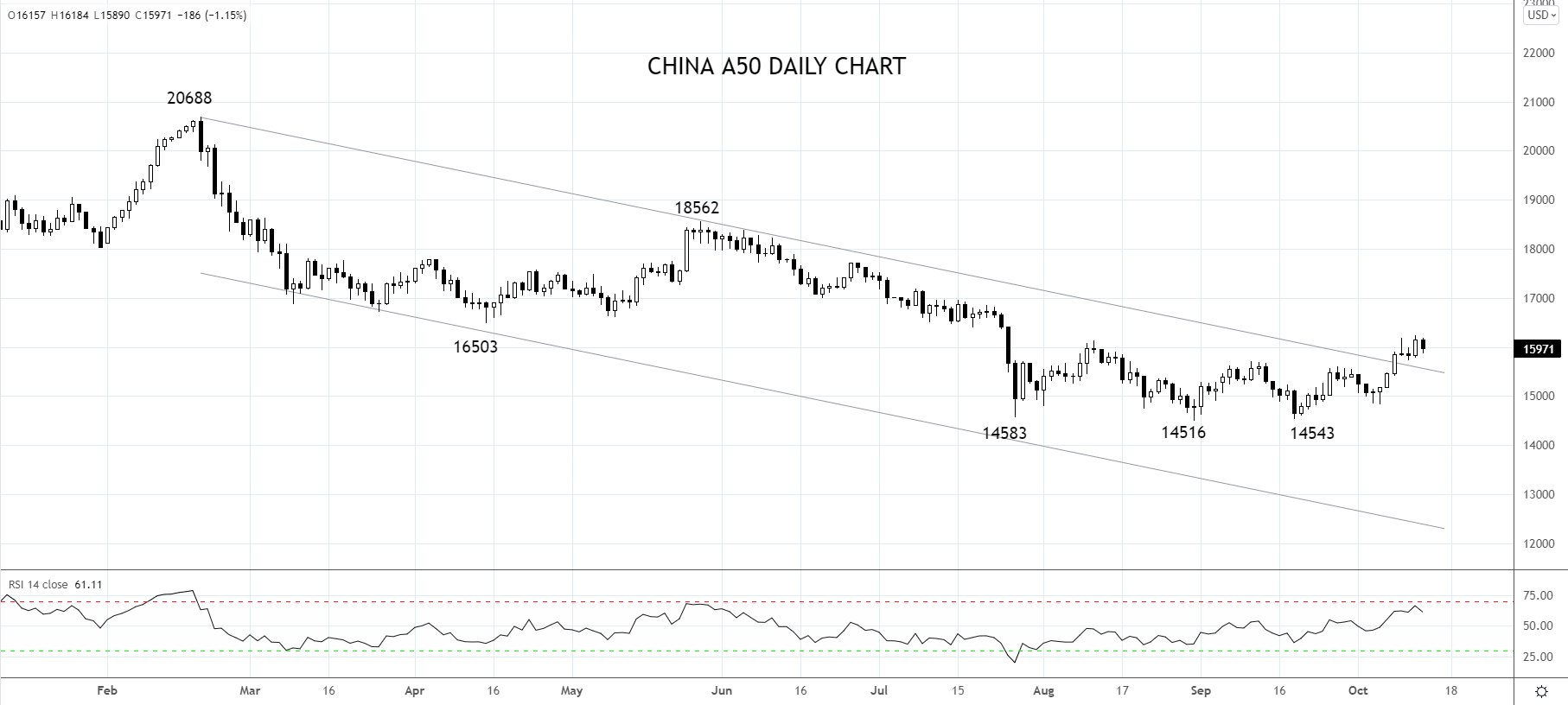

Turning now to the China A50. JP Morgan this week downgraded China's growth to 8.3% in 2021 and 5.2% in 2022, based on a property sector slowdown and production constraints to meet energy targets. Despite this, the China A50 has made good gains since our last update.

As noted last week, the China A50 tested and held the August 14516 low during the commotion of the Evergrande incident during September, providing preliminary evidence of basing.

The index has since broken above downtrend resistance at 15650, coming from the February 20688 high and horizontal resistance from the September 15715 high. This development indicates that a multi-month correction is complete at the 14,516 low and sets up a test of resistance, formerly support at 16,500/17,000.

We would stay with the positive view unless the China A50 was to fall back below support 15,600.

Source Tradingview. The figures stated areas of October 14th, 2021. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation